flyExclusive SPAC

V. FINANCIAL OVERVIEW

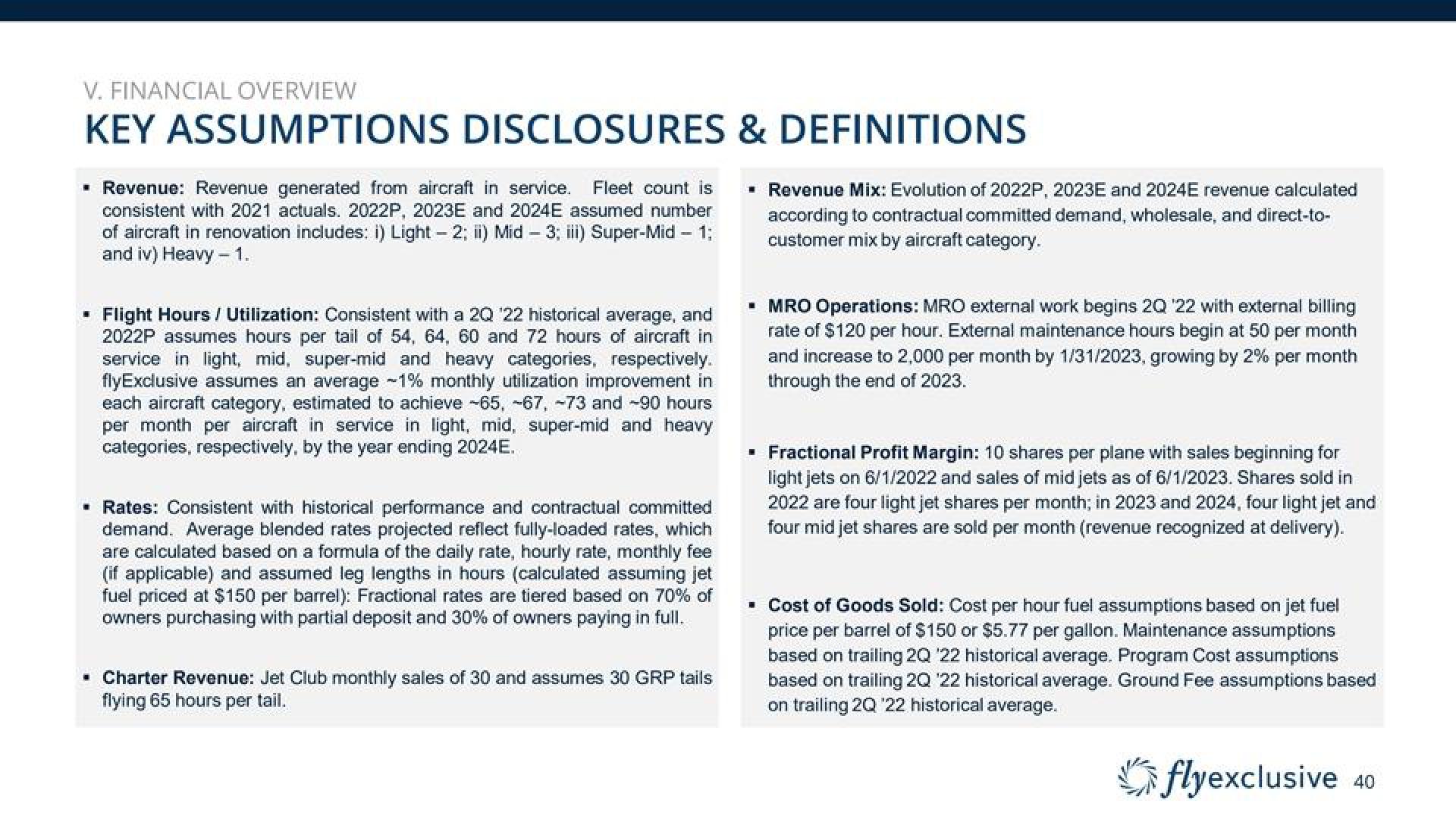

KEY ASSUMPTIONS DISCLOSURES & DEFINITIONS

▪ Revenue: Revenue generated from aircraft in service. Fleet count is

consistent with 2021 actuals. 2022P, 2023E and 2024E assumed number

of aircraft in renovation includes: i) Light -2; ii) Mid - 3; iii) Super-Mid - 1;

and iv) Heavy - 1.

i

Flight Hours / Utilization: Consistent with a 2Q '22 historical average, and

2022P assumes hours per tail of 54, 64, 60 and 72 hours of aircraft in

service in light, mid, super-mid and heavy categories, respectively.

flyExclusive assumes an average -1% monthly utilization improvement in

each aircraft category, estimated to achieve -65, -67, -73 and -90 hours

per month per aircraft in service in light, mid, super-mid and heavy

categories, respectively, by the year ending 2024E.

▪ Rates: Consistent with historical performance and contractual committed

demand. Average blended rates projected reflect fully-loaded rates, which

are calculated based on a formula of the daily rate, hourly rate, monthly fee

(if applicable) and assumed leg lengths in hours (calculated assuming jet

fuel priced at $150 per barrel): Fractional rates are tiered based on 70% of

owners purchasing with partial deposit and 30% of owners paying in full.

▪ Charter Revenue: Jet Club monthly sales of 30 and assumes 30 GRP tails

flying 65 hours per tail.

▪ Revenue Mix: Evolution of 2022P, 2023E and 2024E revenue calculated

according to contractual committed demand, wholesale, and direct-to-

customer mix by aircraft category.

▪ MRO Operations: MRO external work begins 2Q '22 with external billing

rate of $120 per hour. External maintenance hours begin at 50 per month

and increase to 2,000 per month by 1/31/2023, growing by 2% per month

through the end of 2023.

▪ Fractional Profit Margin: 10 shares per plane with sales beginning for

light jets on 6/1/2022 and sales of mid jets as of 6/1/2023. Shares sold in

2022 are four light jet shares per month; in 2023 and 2024, four light jet and

four mid jet shares are sold per month (revenue recognized at delivery).

• Cost of Goods Sold: Cost per hour fuel assumptions based on jet fuel

price per barrel of $150 or $5.77 per gallon. Maintenance assumptions

based on trailing 2Q '22 historical average. Program Cost assumptions

based on trailing 2Q '22 historical average. Ground Fee assumptions based

on trailing 2Q '22 historical average.

flyexclusive 40View entire presentation