Deutsche Bank Results Presentation Deck

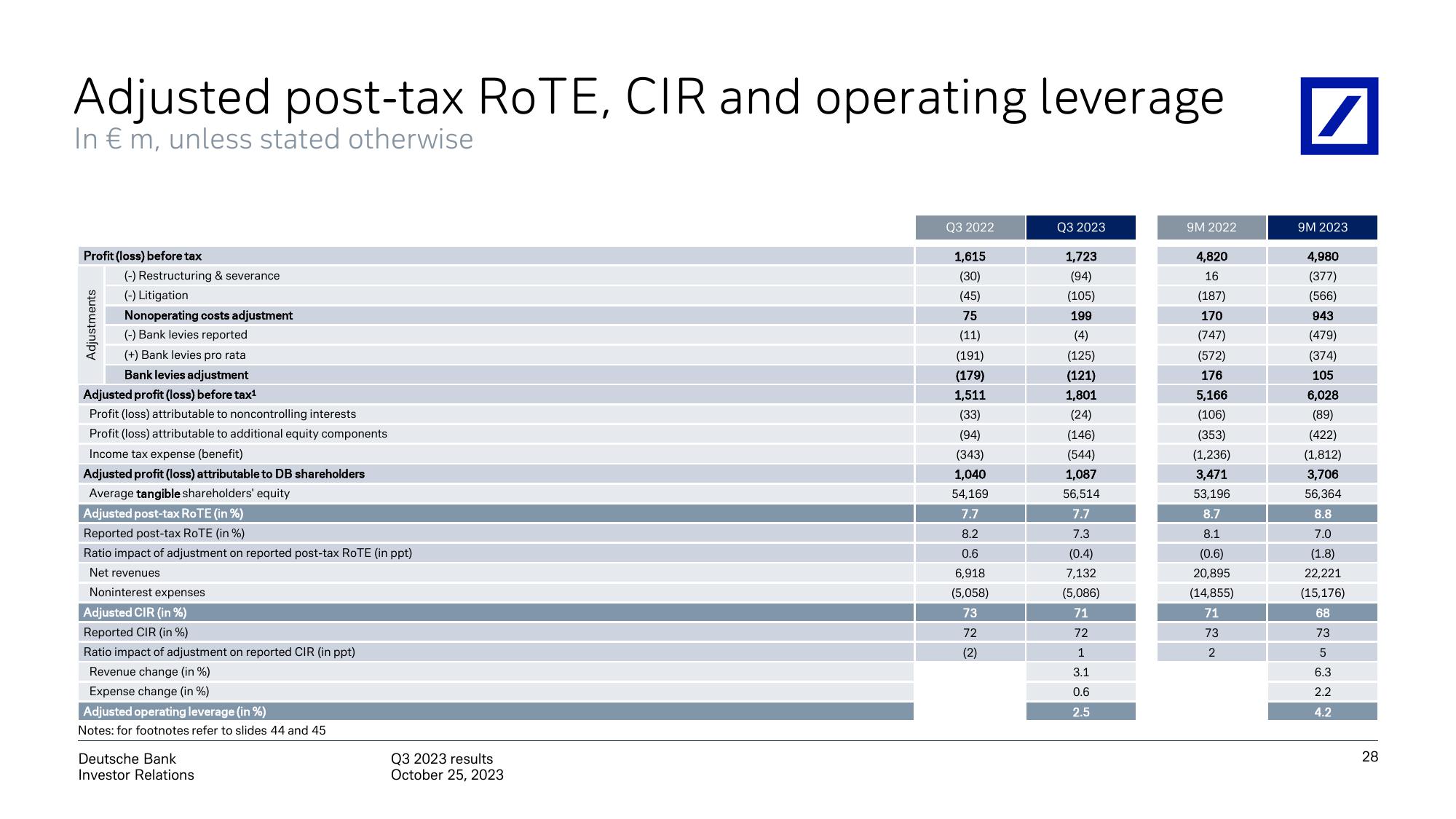

Adjusted post-tax RoTE, CIR and operating leverage

In € m, unless stated otherwise

Profit (loss) before tax

(-) Restructuring & severance

(-) Litigation

Nonoperating costs adjustment

(-) Bank levies reported

(+) Bank levies pro rata

Bank levies adjustment

Adjusted profit (loss) before tax¹

Profit (loss) attributable to noncontrolling interests

Profit (loss) attributable to additional equity components

Income tax expense (benefit)

Adjusted profit (loss) attributable to DB shareholders

Average tangible shareholders' equity

Adjustments

Adjusted post-tax ROTE (in %)

Reported post-tax ROTE (in %)

Ratio impact of adjustment on reported post-tax ROTE (in ppt)

Net revenues

Noninterest expenses

Adjusted CIR (in %)

Reported CIR (in %)

Ratio impact of adjustment on reported CIR (in ppt)

Revenue change (in %)

Expense change (in %)

Adjusted operating leverage (in %)

Notes: for footnotes refer to slides 44 and 45

Deutsche Bank

Investor Relations

Q3 2023 results

October 25, 2023

Q3 2022

1,615

(30)

(45)

75

(11)

(191)

(179)

1,511

(33)

(94)

(343)

1,040

54,169

7.7

8.2

0.6

6,918

(5,058)

73

72

(2)

Q3 2023

1,723

(94)

(105)

199

(4)

(125)

(121)

1,801

(24)

(146)

(544)

1,087

56,514

7.7

7.3

(0.4)

7,132

(5,086)

71

72

1

3.1

0.6

2.5

9M 2022

4,820

16

(187)

170

(747)

(572)

176

5,166

(106)

(353)

(1,236)

3,471

53,196

8.7

8.1

(0.6)

20,895

(14,855)

71

73

2

/

9M 2023

4,980

(377)

(566)

943

(479)

(374)

105

6,028

(89)

(422)

(1,812)

3,706

56,364

8.8

7.0

(1.8)

22,221

(15,176)

68

73

5

6.3

2.2

4.2

28View entire presentation