Azerion SPAC Presentation Deck

Trading update

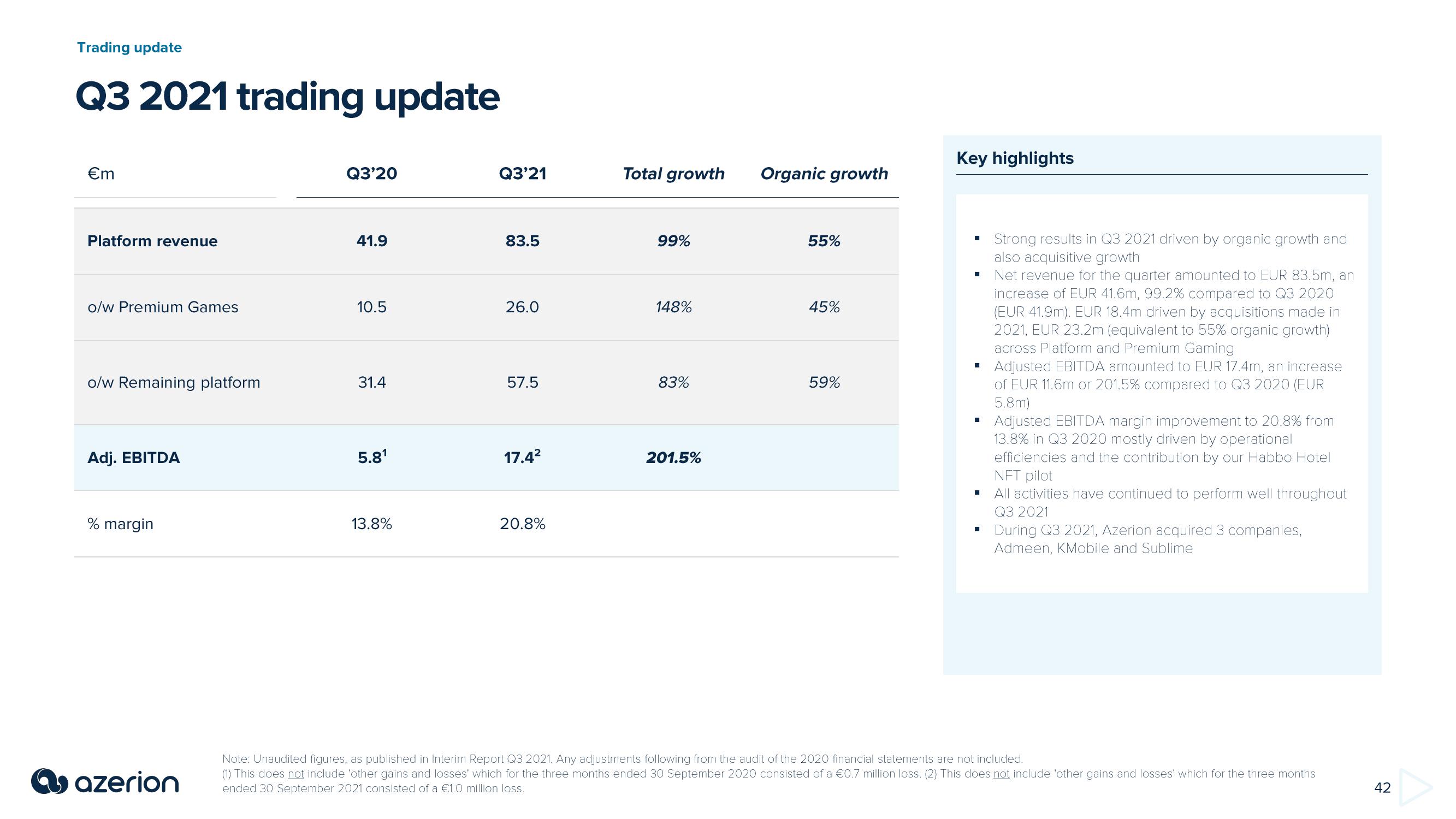

Q3 2021 trading update

€m

Platform revenue

o/w Premium Games

o/w Remaining platform

Adj. EBITDA

% margin

azerion

Q3'20

41.9

10.5

31.4

5.8¹

13.8%

Q3'21

83.5

26.0

57.5

17.4²

20.8%

Total growth

99%

148%

83%

201.5%

Organic growth

55%

45%

59%

Key highlights

■

■

Strong results in Q3 2021 driven by organic growth and

also acquisitive growth

Net revenue for the quarter amounted to EUR 83.5m, an

increase of EUR 41.6m, 99.2% compared to Q3 2020

(EUR 41.9m). EUR 18.4m driven by acquisitions made in

2021, EUR 23.2m (equivalent to 55% organic growth)

across Platform and Premium Gaming

Adjusted EBITDA amounted to EUR 17.4m, an increase

of EUR 11.6m or 201.5% compared to Q3 2020 (EUR

5.8m)

Adjusted EBITDA margin improvement to 20.8% from

13.8% in Q3 2020 mostly driven by operational

efficiencies and the contribution by our Habbo Hotel

NFT pilot

All activities have continued to perform well throughout

Q3 2021

During Q3 2021, Azerion acquired 3 companies,

Admeen, KMobile and Sublime

Note: Unaudited figures, as published in Interim Report Q3 2021. Any adjustments following from the audit of the 2020 financial statements are not included.

(1) This does not include 'other gains and losses' which for the three months ended 30 September 2020 consisted of a €0.7 million loss. (2) This does not include 'other gains and losses' which for the three months

ended 30 September 2021 consisted of a €1.0 million loss.

42View entire presentation