Maersk Results Presentation Deck

A.P. Moller Maersk Group

- Interim Report 02 2015

MAERSK LINE

Contents

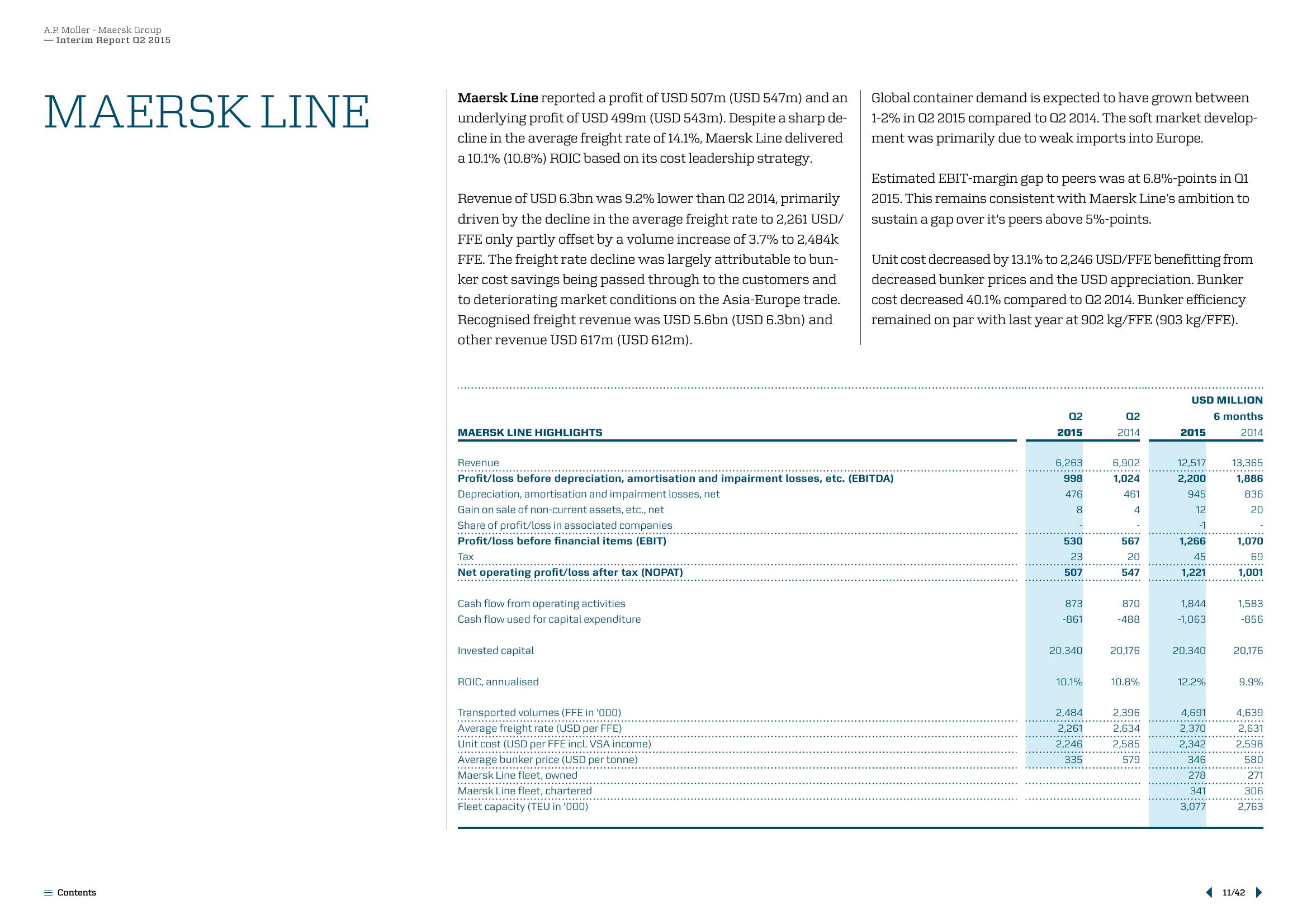

Maersk Line reported a profit of USD 507m (USD 547m) and an

underlying profit of USD 499m (USD 543m). Despite a sharp de-

cline in the average freight rate of 14.1%, Maersk Line delivered

a 10.1% (10.8%) ROIC based on its cost leadership strategy.

Revenue of USD 6.3bn was 9.2% lower than 02 2014, primarily

driven by the decline in the average freight rate to 2,261 USD/

FFE only partly offset by a volume increase of 3.7% to 2,484k

FFE. The freight rate decline was largely attributable to bun-

ker cost savings being passed through to the customers and

to deteriorating market conditions on the Asia-Europe trade.

Recognised freight revenue was USD 5.6bn (USD 6.3bn) and

other revenue USD 617m (USD 612m).

MAERSK LINE HIGHLIGHTS

Tax

Net operating profit/loss after tax (NOPAT)

Cash flow from operating activities

Cash flow used for capital expenditure

Revenue

Profit/loss before depreciation, amortisation and impairment losses, etc. (EBITDA)

Depreciation, amortisation and impairment losses, net

Gain on sale of non-current assets, etc., net

Share of profit/loss in associated companies

Profit/loss before financial items (EBIT)

Invested capital

ROIC, annualised.

Global container demand is expected to have grown between

1-2% in 02 2015 compared to Q2 2014. The soft market develop-

ment was primarily due to weak imports into Europe.

Transported volumes (FFE in '000)

Average freight rate (USD per FFE)

Unit cost (USD per FFE incl. VSA income)

********.

Average bunker price (USD per tonne)

Maersk Line fleet, owned

Maersk Line fleet, chartered

Fleet capacity (TEU in '000)

Estimated EBIT-margin gap to peers was at 6.8%-points in 01

2015. This remains consistent with Maersk Line's ambition to

sustain a gap over it's peers above 5%-points.

Unit cost decreased by 13.1% to 2,246 USD/FFE benefitting from

decreased bunker prices and the USD appreciation. Bunker

cost decreased 40.1% compared to 02 2014. Bunker efficiency

remained on par with last year at 902 kg/FFE (903 kg/FFE).

02

2015

6,263

998

476

8

530

23

507

873

-861

20,340

10.1%

2,484

2,261

2,246

335

02

2014

6,902

1,024

461

4

567

20

547

870

-488

20,176

10.8%

2,396

2,634

2,585

579

USD MILLION

6 months

2014

2015

12,517

2,200

945

12

-1

1,266

45

1,221

1,844

-1,063

20,340

12.2%

4,691

2,370

2,342

346

278

341

3,077

13,365

1,886

836

20

1,070

69

1,001

1,583

-856

20,176

9.9%

4,639

2,631

2,598

580

271

306

2,763

11/42View entire presentation