Barclays Credit Presentation Deck

STRATEGY, TARGETS

& GUIDANCE

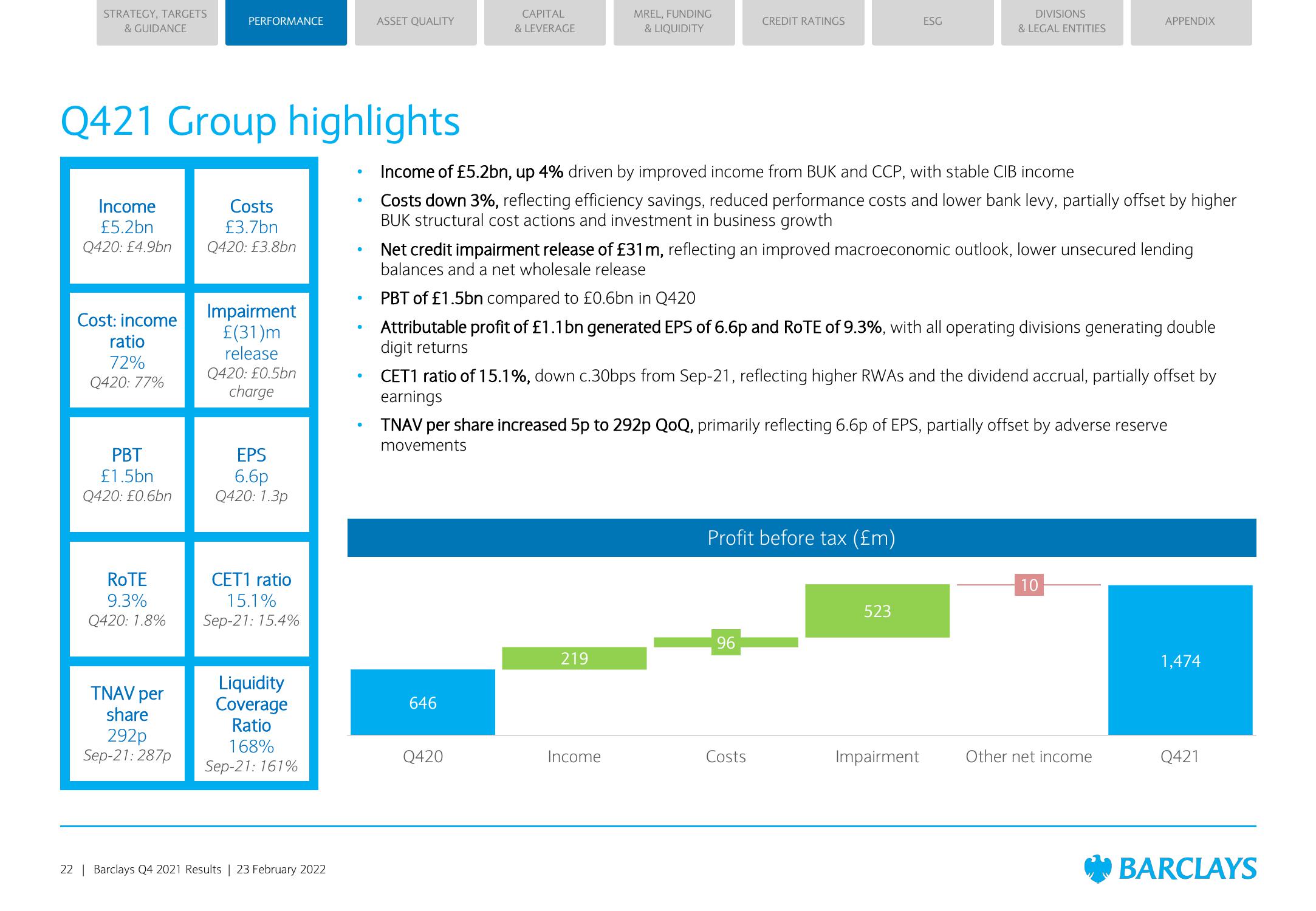

Income

£5.2bn

Q420: £4.9bn

Q421 Group highlights

Cost: income

ratio

72%

Q420: 77%

PBT

£1.5bn

Q420: £0.6bn

ROTE

9.3%

Q420: 1.8%

PERFORMANCE

TNAV per

share

292p

Sep-21:287p

Costs

£3.7bn

Q420: £3.8bn

Impairment

£(31)m

release

Q420: £0.5bn

charge

EPS

6.6p

Q420: 1.3p

CET1 ratio

15.1%

Sep-21: 15.4%

Liquidity

Coverage

Ratio

168%

Sep-21: 161%

22 | Barclays Q4 2021 Results | 23 February 2022

●

●

●

●

.

●

ASSET QUALITY

.

CAPITAL

& LEVERAGE

MREL, FUNDING

& LIQUIDITY

646

Income of £5.2bn, up 4% driven by improved income from BUK and CCP, with stable CIB income

Costs down 3%, reflecting efficiency savings, reduced performance costs and lower bank levy, partially offset by higher

BUK structural cost actions and investment in business growth

Q420

Net credit impairment release of £31 m, reflecting an improved macroeconomic outlook, lower unsecured lending

balances and a net wholesale release

CREDIT RATINGS

PBT of £1.5bn compared to £0.6bn in Q420

Attributable profit of £1.1 bn generated EPS of 6.6p and ROTE of 9.3%, with all operating divisions generating double

digit returns

219

CET1 ratio of 15.1%, down c.30bps from Sep-21, reflecting higher RWAS and the dividend accrual, partially offset by

earnings

Income

TNAV per share increased 5p to 292p QoQ, primarily reflecting 6.6p of EPS, partially offset by adverse reserve

movements

ESG

Profit before tax (£m)

96

DIVISIONS

& LEGAL ENTITIES

Costs

523

APPENDIX

Impairment

10

Other net income

1,474

Q421

BARCLAYSView entire presentation