UBS Mergers and Acquisitions Presentation Deck

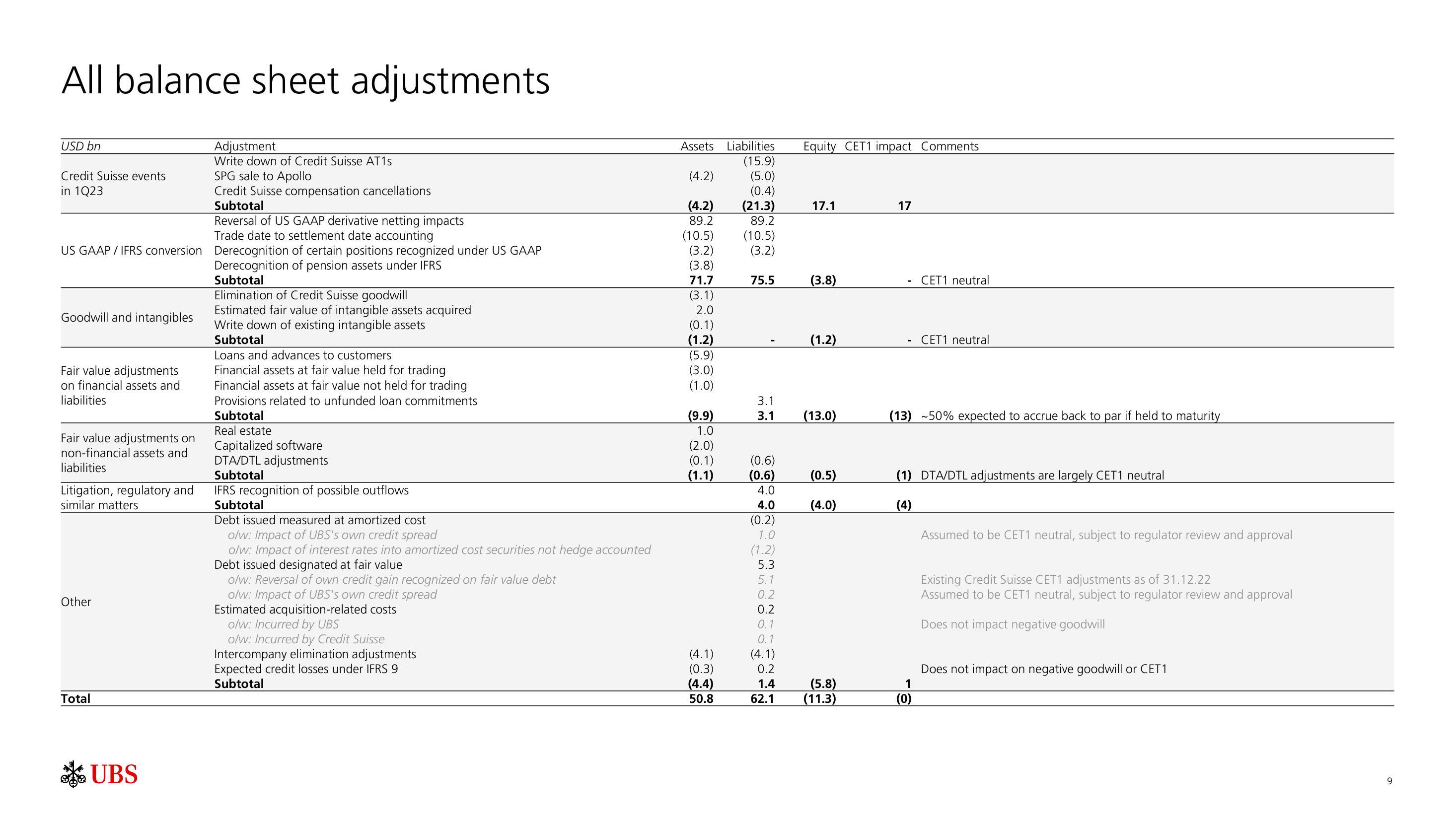

All balance sheet adjustments

USD bn

Credit Suisse events

in 1Q23

US GAAP / IFRS conversion Derecognition of certain positions recognized under US GAAP

Derecognition of pension assets under IFRS

Subtotal

Elimination of Credit Suisse goodwill

Estimated fair value of intangible assets acquired

Write down of existing intangible assets

Subtotal

Goodwill and intangibles

Fair value adjustments

on financial assets and

liabilities

Fair value adjustments on

non-financial assets and

liabilities

Litigation, regulatory and

similar matters

Other

Total

Adjustment

Write down of Credit Suisse AT1s

SPG sale to Apollo

Credit Suisse compensation cancellations

Subtotal

Reversal of US GAAP derivative netting impacts

Trade date to settlement date accounting

UBS

Loans and advances to customers

Financial assets at fair value held for trading

Financial assets at fair value not held for trading

Provisions related to unfunded loan commitments

Subtotal

Real estate

Capitalized software

DTA/DTL adjustments

Subtotal

IFRS recognition of possible outflows

Subtotal

Debt issued measured at amortized cost

o/w: Impact of UBS's own credit spread

o/w: Impact of interest rates into amortized cost securities not hedge accounted

Debt issued designated at fair value

o/w: Reversal of own credit gain recognized on fair value debt

o/w: Impact of UBS's own credit spread

Estimated acquisition-related costs

o/w: Incurred by UBS

o/w: Incurred by Credit se

Intercompany elimination adjustments

Expected credit losses under IFRS 9

Subtotal

Assets Liabilities

(15.9)

(5.0)

(0.4)

(21.3)

89.2

(4.2)

(4.2)

89.2

(10.5)

(3.2)

(3.8)

71.7

(3.1)

2.0

(0.1)

(1.2)

(5.9)

(3.0)

(1.0)

(9.9)

1.0

(2.0)

(0.1)

(1.1)

(4.1)

(0.3)

(4.4)

50.8

(10.5)

(3.2)

75.5

(0.6)

(0.6)

4.0

4.0

(0.2)

1.0

(1.2)

5.3

5.1

0.2

0.2

0.1

0.1

(4.1)

0.2

1.4

62.1

Equity CET1 impact Comments

600

17.1

3.1

3.1 (13.0)

(3.8)

(1.2)

(0.5)

(4.0)

(5.8)

(11.3)

17

CET1 neutral

CET1 neutral

(13) -50% expected to accrue back to par if held to maturity

1

(0)

(1) DTA/DTL adjustments are largely CET1 neutral

(4)

Assumed to be CET1 neutral, subject to regulator review and approval

Existing Credit Suisse CET1 adjustments as of 31.12.22

Assumed to be CET1 neutral, subject to regulator review and approval

Does not impact negative goodwill

Does not impact on negative goodwill or CET1

9View entire presentation