J.P.Morgan Results Presentation Deck

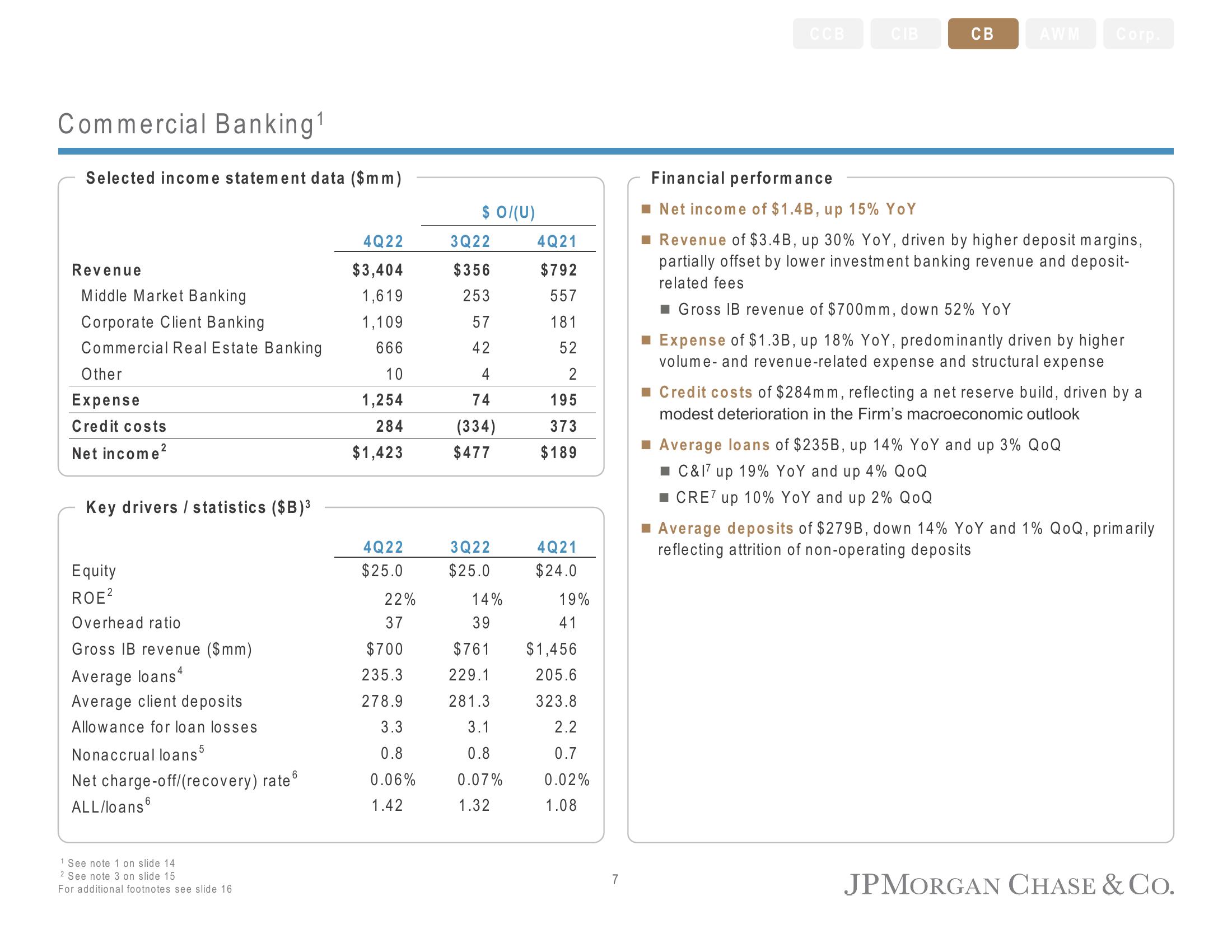

Commercial Banking¹

Selected income statement data ($mm)

Revenue

Middle Market Banking

Corporate Client Banking

Commercial Real Estate Banking

Other

Expense

Credit costs

Net income²

Key drivers / statistics ($B)³

Equity

ROE²

Overhead ratio

Gross IB revenue ($mm)

Average loans4

Average client deposits

Allowance for loan losses

Nonaccrual loans 5

6

Net charge-off/(recovery) rate

ALL/loans6

1 See note 1 on slide 14

2 See note 3 on slide 15

For additional footnotes see slide 16

4Q22

$3,404

1,619

1,109

666

10

1,254

284

$1,423

4Q22

$25.0

22%

37

$700

235.3

278.9

3.3

0.8

0.06%

1.42

$ 0/(U)

3Q22

$356

253

57

42

74

(334)

$477

3Q22

$25.0

14%

39

$761

229.1

281.3

3.1

0.8

0.07%

1.32

4Q21

$792

557

181

52

2

195

373

$189

4Q21

$24.0

19%

41

$1,456

205.6

323.8

2.2

0.7

0.02%

1.08

7

CIB

CB

AWM Corp.

Financial performance

■ Net income of $1.4B, up 15% YoY

■ Revenue of $3.4B, up 30% YoY, driven by higher deposit margins,

partially offset by lower investment banking revenue and deposit-

related fees

Gross IB revenue of $700mm, down 52% YoY

■ Expense of $1.3B, up 18% YoY, predominantly driven by higher

volume- and revenue-related expense and structural expense

■ Credit costs of $284mm, reflecting a net reserve build, driven by a

modest deterioration in the Firm's macroeconomic outlook

■ Average loans of $235B, up 14% YoY and up 3% QoQ

■ C&17 up 19% YoY and up 4% QOQ

CRE7 up 10% YoY and up 2% QOQ

■ Average deposits of $279B, down 14% YoY and 1% QoQ, primarily

reflecting attrition of non-operating deposits

JPMORGAN CHASE & Co.View entire presentation