WeWork SPAC Presentation Deck

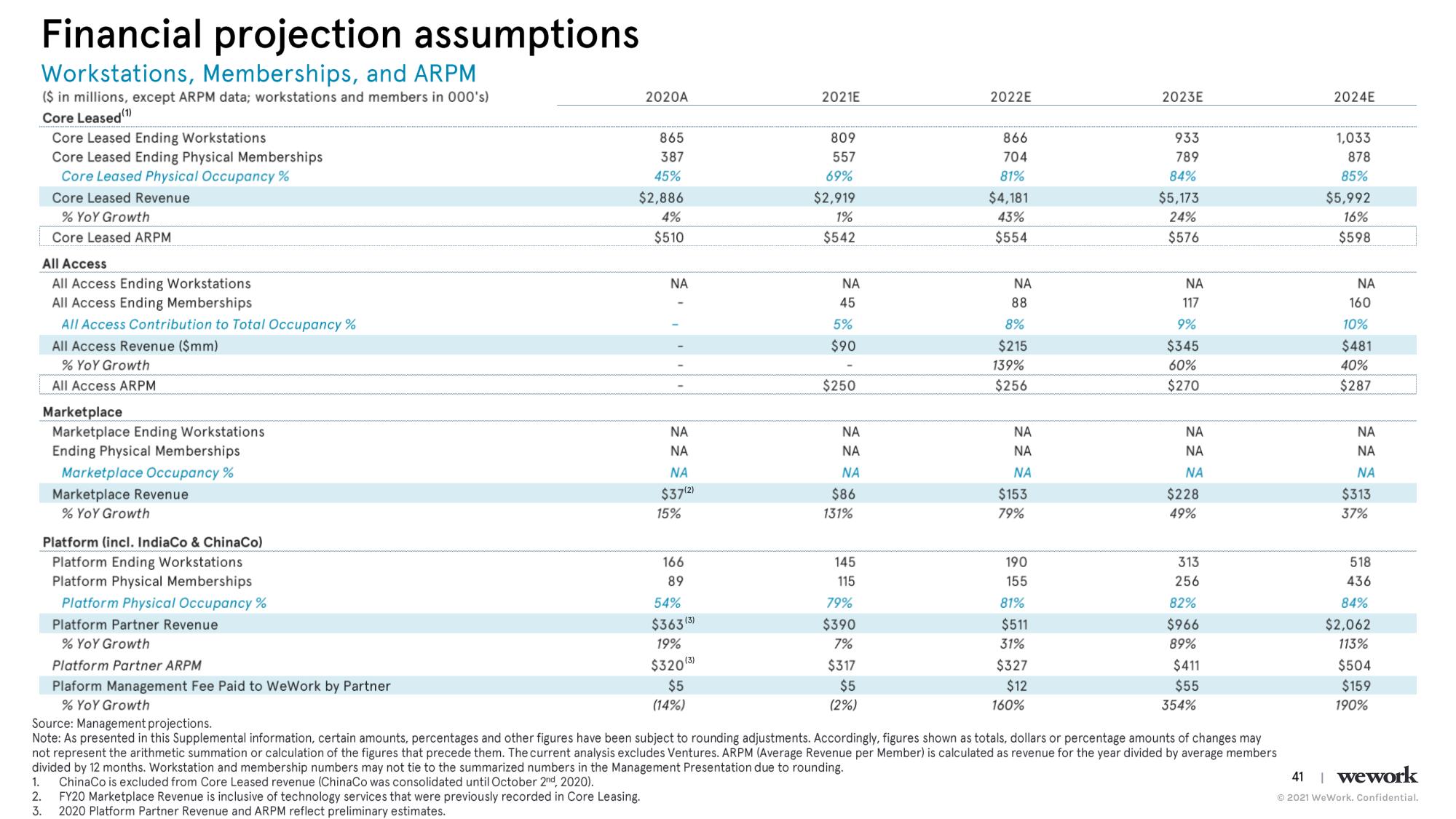

Financial projection assumptions

Workstations, Memberships, and ARPM

($ in millions, except ARPM data; workstations and members in 000's)

Core Leased (1)

Core Leased Ending Workstations

Core Leased Ending Physical Memberships

Core Leased Physical Occupancy %

Core Leased Revenue

% YoY Growth

Core Leased ARPM

All Access

All Access Ending Workstations

All Access Ending Memberships

All Access Contribution to Total Occupancy %

1.

2.

3.

All Access Revenue ($mm)

% YoY Growth

All Access ARPM

Marketplace

Marketplace Ending Workstations

Ending Physical Memberships

Marketplace Occupancy %

Marketplace Revenue

% YoY Growth

Platform (incl. IndiaCo & ChinaCo)

Platform Ending Workstations

Platform Physical Memberships

Platform Physical Occupancy %

Platform Partner Revenue

% YoY Growth

Platform Partner ARPM

Plaform Management Fee Paid to WeWork by Partner

% YoY Growth

2020A

865

387

45%

$2,886

4%

$510

FY20 Marketplace Revenue is inclusive of technology services that were previously recorded in Core Leasing.

2020 Platform Partner Revenue and ARPM reflect preliminary estimates.

ΝΑ

ΝΑ

ΝΑ

ΝΑ

$37(2)

15%

166

89

54%

$363 (3)

19%

$320 (3)

$5

(14%)

2021E

809

557

69%

$2,919

1%

$542

ΝΑ

45

5%

$90

$250

ΝΑ

ΝΑ

ΝΑ

$86

131%

145

115

79%

$390

7%

$317

$5

(2%)

2022E

866

704

81%

$4,181

43%

$554

ΝΑ

88

8%

$215

139%

$256

ΝΑ

ΝΑ

ΝΑ

$153

79%

190

155

81%

$511

31%

$327

$12

160%

2023E

933

789

84%

$5,173

24%

$576

ΝΑ

117

9%

$345

60%

$270

ΝΑ

ΝΑ

ΝΑ

$228

49%

313

256

82%

$966

89%

$411

$55

Source: Management projections.

Note: As presented in this Supplemental information, certain amounts, percentages and other figures have been subject to rounding adjustments. Accordingly, figures shown as totals, dollars or percentage amounts of changes may

not represent the arithmetic summation or calculation of the figures that precede them. The current analysis excludes Ventures. ARPM (Average Revenue per Member) is calculated as revenue for the year divided by average members

divided by 12 months. Workstation and membership numbers may not tie to the summarized numbers in the Management Presentation due to rounding.

ChinaCo is excluded from Core Leased revenue (ChinaCo was consolidated until October 2nd, 2020).

354%

2024E

1,033

878

85%

$5,992

16%

$598

ΝΑ

160

10%

$481

40%

$287

ΝΑ

ΝΑ

ΝΑ

$313

37%

518

436

84%

$2,062

113%

$504

$159

190%

41

wework

Ⓒ2021 WeWork. Confidential.View entire presentation