Silicon Valley Bank Results Presentation Deck

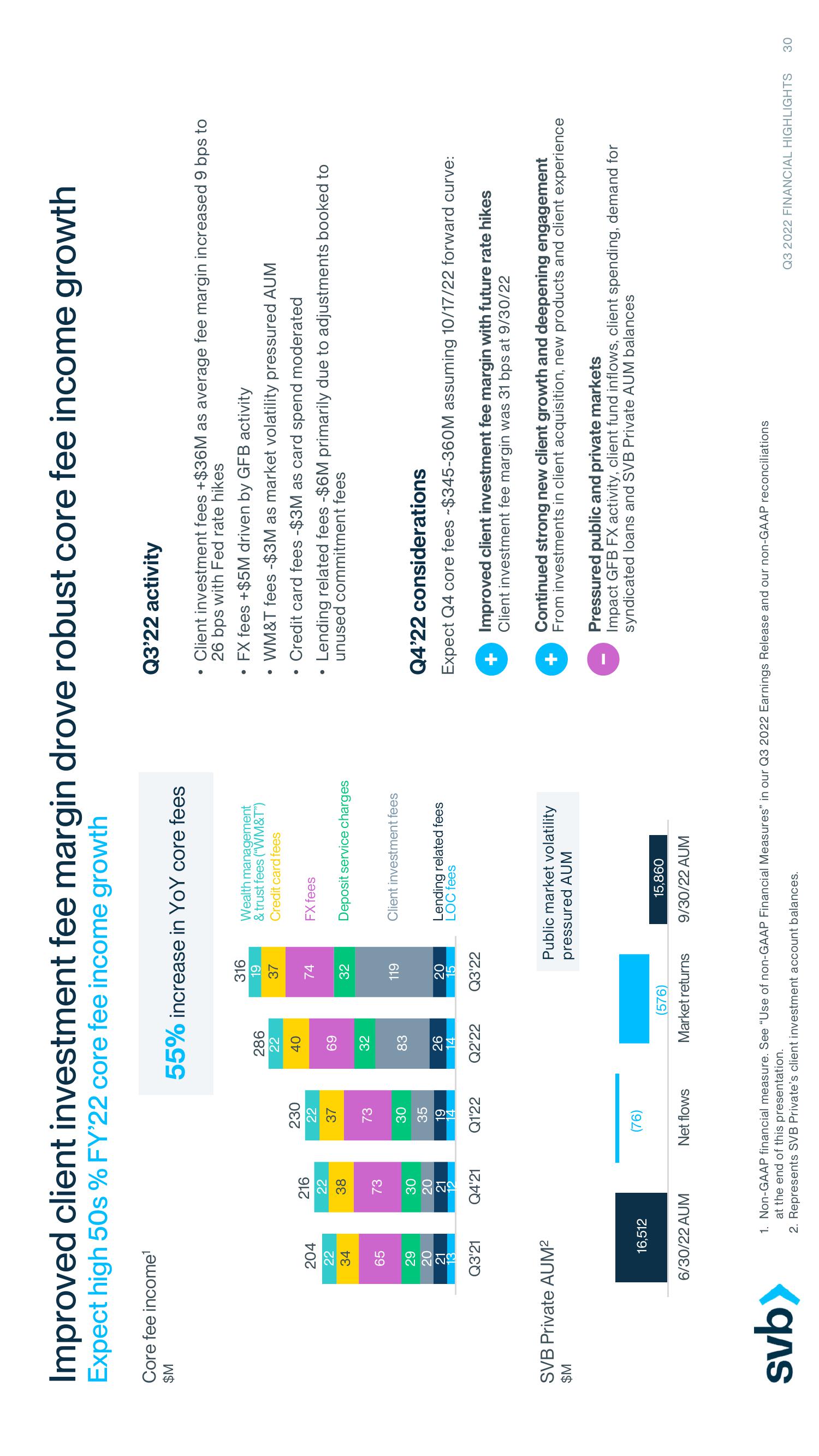

Improved client investment fee margin drove robust core fee income growth

Expect high 50s % FY'22 core fee income growth

Core fee income¹

$M

204

22

34

65

svb>

29

20

21

13

Q3'21

SVB Private AUM²

$M

16,512

216

22

38

73

30

20

21

12

Q4'21

6/30/22 AUM

230

22

37

73

30

35

19

14

Q1'22

(76)

Net flows

55% increase YoY core fees

286

22

40

69

32

83

26

14

Q2'22

316

19

37

74

32

119

20

15

Q3'22

Wealth management

& trust fees ("WM&T")

Credit card fees

(576)

Market returns

FX fees

Deposit service charges

Client investment fees

Lending related fees

LOC fees

Public market volatility

pressured AUM

15,860

9/30/22 AUM

Q3'22 activity

Client investment fees +$36M as average fee margin increased 9 bps to

26 bps with Fed rate hikes

FX fees +$5M driven by GFB activity

●

●

• WM&T fees -$3M as market volatility pressured AUM

• Credit card fees -$3M as card spend moderated

• Lending related fees -$6M primarily due to adjustments booked to

unused commitment fees

Q4'22 considerations

Expect Q4 core fees ~$345-360M assuming 10/17/22 forward curve:

Improved client investment fee margin with future rate hikes

Client investment fee margin was 31 bps at 9/30/22

Continued strong new client growth and deepening engagement

From investments in client acquisition, new products and client experience

Pressured public and private markets

Impact GFB FX activity, client fund inflows, client spending, demand for

syndicated loans and SVB Private AUM balances

1. Non-GAAP financial measure. See "Use of non-GAAP Financial Measures" in our Q3 2022 Earnings Release and our non-GAAP reconciliations

at the end of this presentation.

2. Represents SVB Private's client investment account balances.

Q3 2022 FINANCIAL HIGHLIGHTS

30View entire presentation