Blackwells Capital Activist Presentation Deck

■

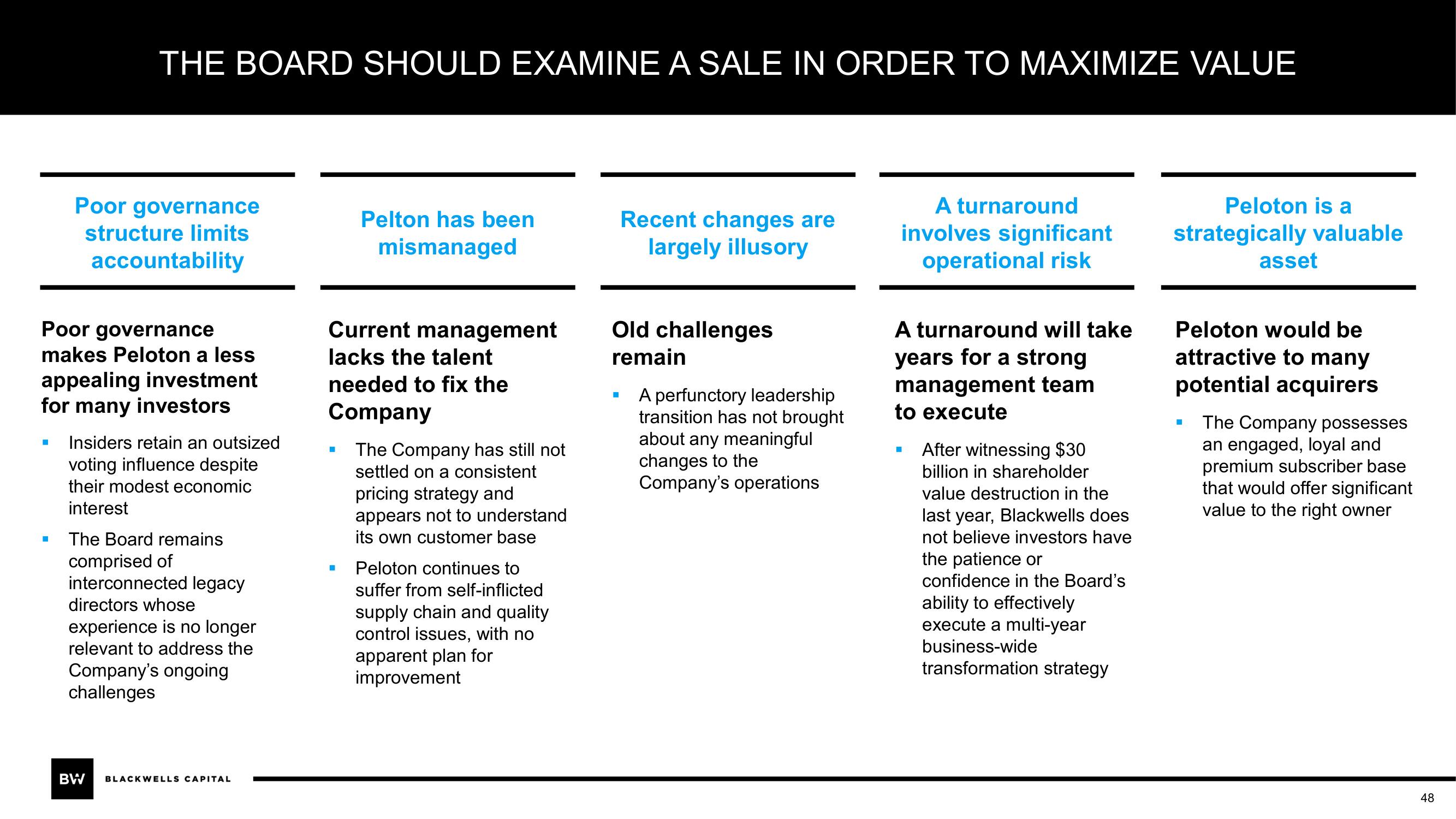

THE BOARD SHOULD EXAMINE A SALE IN ORDER TO MAXIMIZE VALUE

Poor governance

makes Peloton a less

appealing investment

for many investors

■

Poor governance

structure limits

accountability

Insiders retain an outsized

voting influence despite

their modest economic

interest

The Board remains

comprised of

interconnected legacy

directors whose

experience is no longer

relevant to address the

Company's ongoing

challenges

BW BLACKWELLS CAPITAL

Pelton has been

mismanaged

Current management

lacks the talent

needed to fix the

Company

■

The Company has still not

settled on a consistent

pricing strategy and

appears not to understand

its own customer base

■ Peloton continues to

suffer from self-inflicted

supply chain and quality

control issues, with no

apparent plan for

improvement

Recent changes are

largely illusory

Old challenges

remain

■

A perfunctory leadership

transition has not brought

about any meaningful

changes to the

Company's operations

A turnaround

involves significant

operational risk

A turnaround will take

years for a strong

management team

to execute

■

After witnessing $30

billion in shareholder

value destruction in the

last year, Blackwells does

not believe investors have

the patience or

confidence in the Board's

ability to effectively

execute a multi-year

business-wide

transformation strategy

Peloton is a

strategically valuable

asset

Peloton would be

attractive to many

potential acquirers

■

The Company possesses

an engaged, loyal and

premium subscriber base

that would offer significant

value to the right owner

48View entire presentation