J.P.Morgan 2Q23 Investor Results

JPMORGAN CHASE & CO.

CONSUMER & COMMUNITY BANKING

FINANCIAL HIGHLIGHTS, CONTINUED

(in millions, except ratio data)

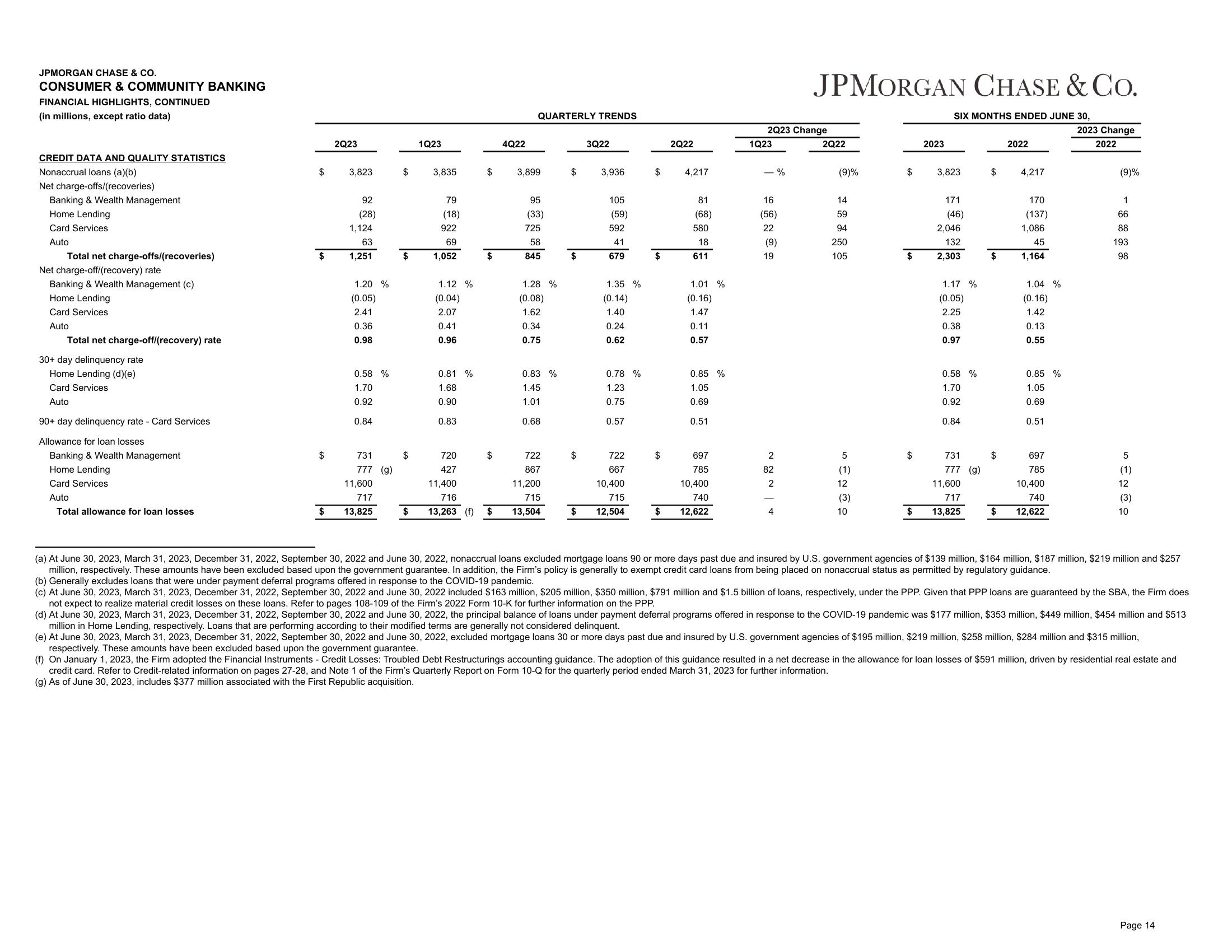

CREDIT DATA AND QUALITY STATISTICS

Nonaccrual loans (a)(b)

Net charge-offs/(recoveries)

Banking & Wealth Management

Home Lending

Card Services

Auto

Total net charge-offs/(recoveries)

Net charge-off/(recovery) rate

Banking & Wealth Management (c)

Home Lending

Card Services

Auto

Total net charge-off/(recovery) rate

30+ day delinquency rate

Home Lending (d)(e)

Card Services

Auto

90+ day delinquency rate - Card Services

Allowance for loan losses

Banking & Wealth Management

Home Lending

Card Services

Auto

Total allowance for loan losses

$

$

$

$

2Q23

3,823

92

(28)

1,124

63

1,251

1.20 %

(0.05)

2.41

0.36

0.98

0.58 %

1.70

0.92

0.84

731

777 (g)

11,600

717

13,825

$

$

$

1Q23

3,835

79

(18)

922

69

1,052

1.12 %

(0.04)

2.07

0.41

0.96

0.81 %

1.68

0.90

0.83

$

$

720

427

11,400

716

13,263 (f) $

4Q22

QUARTERLY TRENDS

3,899

95

(33)

725

58

845

1.28 %

(0.08)

1.62

0.34

0.75

0.83 %

1.45

1.01

0.68

722

867

11,200

715

13,504

$

$

$

3Q22

3,936

105

(59)

592

41

679

1.35 %

(0.14)

1.40

0.24

0.62

0.78 %

1.23

0.75

0.57

722

667

10,400

715

12,504

$

$

$

$

2Q22

4,217

81

(68)

580

18

611

1.01

(0.16)

1.47

0.11

0.57

0.85 %

1.05

0.69

0.51

697

785

10,400

740

12,622

2Q23 Change

1Q23

- %

16

(56)

22

(9)

19

2

82

2

JPMORGAN CHASE & CO.

4

2Q22

(9)%

14

59

94

250

105

ܗ ܚ ܘ

(1)

(3)

10

$

$

$

$

2023

SIX MONTHS ENDED JUNE 30,

3,823

171

(46)

2,046

132

2,303

1.17 %

(0.05)

2.25

0.38

0.97

0.58 %

1.70

0.92

0.84

731

777 (g)

11,600

717

13,825

$

$

$

$

2022

4,217

170

(137)

1,086

45

1,164

1.04 %

(0.16)

1.42

0.13

0.55

0.85 %

1.05

0.69

0.51

697

785

10,400

740

12,622

2023 Change

2022

(9)%

1

66

88

193

98

5

(1)

12

(3)

10

(a) At June 30, 2023, March 31, 2023, December 31, 2022, September 30, 2022 and June 30, 2022, nonaccrual loans excluded mortgage loans 90 or more days past due and insured by U.S. government agencies of $139 million, $164 million, $187 million, $219 million and $257

million, respectively. These amounts have been excluded based upon the government guarantee. In addition, the Firm's policy is generally to exempt credit card loans from being placed on nonaccrual status as permitted by regulatory guidance.

(b) Generally excludes loans that were under payment deferral programs offered in response to the COVID-19 pandemic.

(c) At June 30, 2023, March 31, 2023, December 31, 2022, September 30, 2022 and June 30, 2022 included $163 million, $205 million, $350 million, $791 million and $1.5 billion of loans, respectively, under the PPP. Given that PPP loans are guaranteed by the SBA, the Firm does

not expect to realize material credit losses on these loans. Refer to pages 108-109 of the Firm's 2022 Form 10-K for further information on the PPP.

(d) At June 30, 2023, March 31, 2023, December 31, 2022, September 30, 2022 and June 30, 2022, the principal balance of loans under payment deferral programs offered in response to the COVID-19 pandemic was $177 million, $353 million, $449 million, $454 million and $513

million in Home Lending, respectively. Loans that are performing according to their modified terms are generally not considered delinquent.

(e) At June 30, 2023, March 31, 2023, December 31, 2022, September 30, 2022 and June 30, 2022, excluded mortgage loans 30 or more days past due and insured by U.S. government agencies of $195 million, $219 million, $258 million, $284 million and $315 million,

respectively. These amounts have been excluded based upon the government guarantee.

(f) On January 1, 2023, the Firm adopted the Financial Instruments - Credit Losses: Troubled Debt Restructurings accounting guidance. The adoption of this guidance resulted in a net decrease in the allowance for loan losses of $591 million, driven by residential real estate and

credit card. Refer to Credit-related information on pages 27-28, and Note 1 of the Firm's Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2023 for further information.

(g) As of June 30, 2023, includes $377 million associated with the First Republic acquisition.

Page 14View entire presentation