Wallbox SPAC Presentation Deck

WALLBOX & KENSINGTON

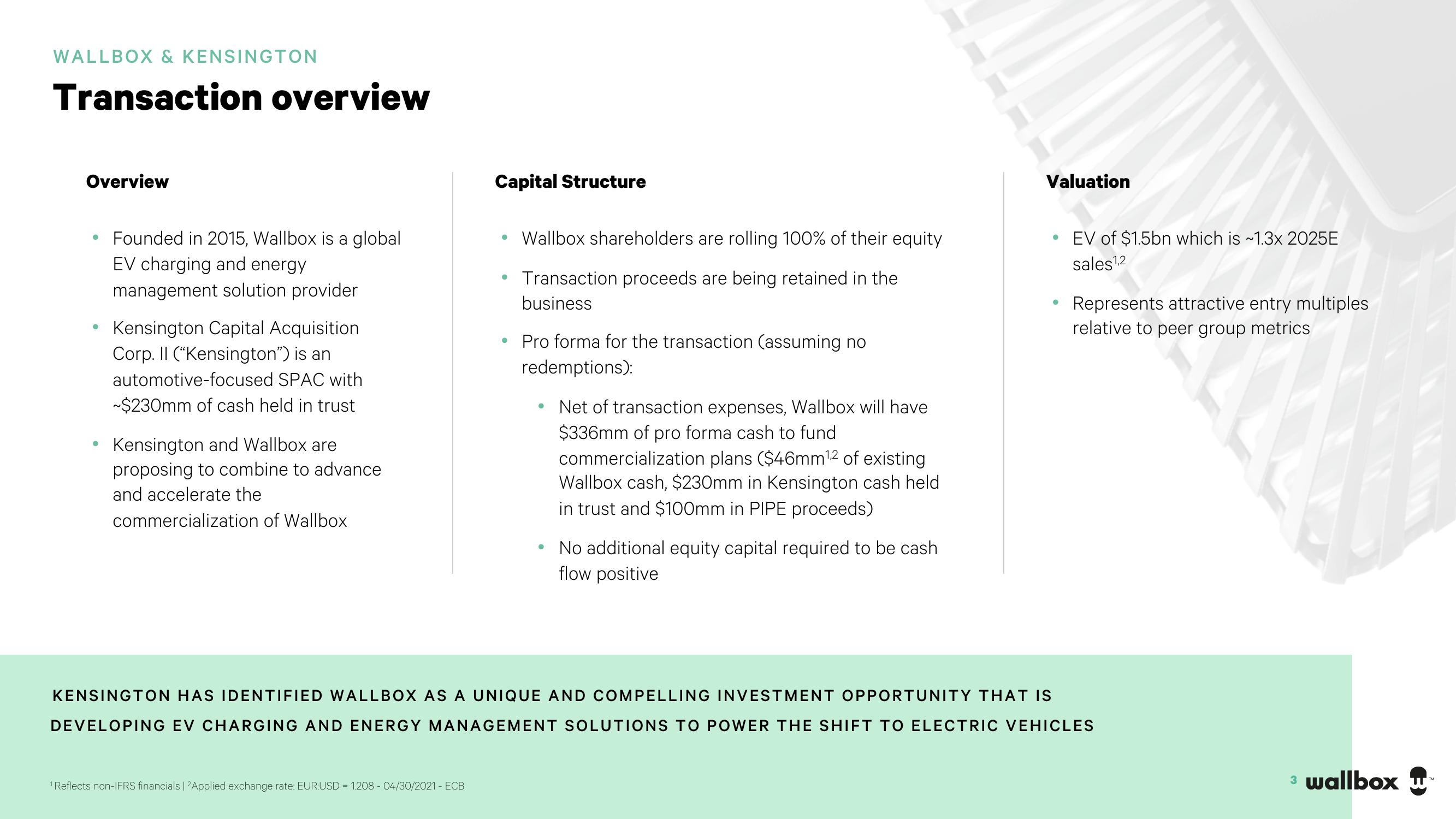

Transaction overview

Overview

●

Founded in 2015, Wallbox is a global

EV charging and energy

management solution provider

Kensington Capital Acquisition

Corp. Il ("Kensington") is an

automotive-focused SPAC with

~$230mm of cash held in trust

Kensington and Wallbox are

proposing to combine to advance

and accelerate the

commercialization of Wallbox

Capital Structure

¹Reflects non-IFRS financials | 2Applied exchange rate: EUR:USD = 1.208 - 04/30/2021 - ECB

●

Wallbox shareholders are rolling 100% of their equity

Transaction proceeds are being retained in the

business

Pro forma for the transaction (assuming no

redemptions):

●

Net of transaction expenses, Wallbox will have

$336mm of pro forma cash to fund

commercialization plans ($46mm ¹² of existing

Wallbox cash, $230mm in Kensington cash held

in trust and $100mm in PIPE proceeds)

No additional equity capital required to be cash

flow positive

Valuation

●

EV of $1.5bn which is ~1.3x 2025E

sales¹,2

Represents attractive entry multiples

relative to peer group metrics

KENSINGTON HAS IDENTIFIED WALLBOX AS A UNIQUE AND COMPELLING INVESTMENT OPPORTUNITY THAT IS

DEVELOPING EV CHARGING AND ENERGY MANAGEMENT SOLUTIONS TO POWER THE SHIFT TO ELECTRIC VEHICLES

3 wallbox

ΤΗView entire presentation