Bed Bath & Beyond Results Presentation Deck

FISCAL 2021 OUTLOOK

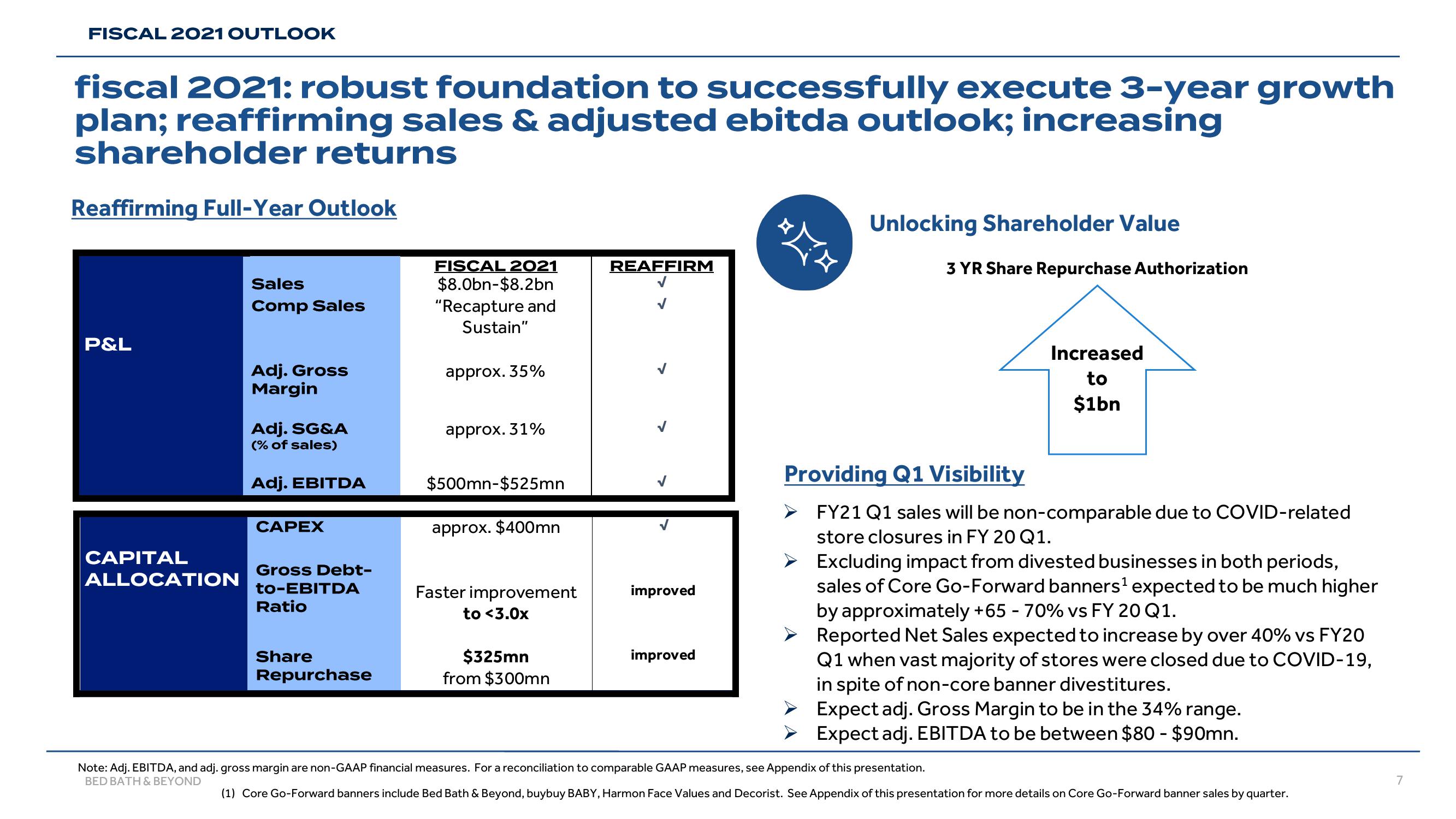

fiscal 2021: robust foundation to successfully execute 3-year growth

plan; reaffirming sales & adjusted ebitda outlook; increasing

shareholder returns

Reaffirming Full-Year Outlook

P&L

CAPITAL

ALLOCATION

Sales

Comp Sales

Adj. Gross

Margin

Adj. SG&A

(% of sales)

Adj. EBITDA

CAPEX

Gross Debt-

to-EBITDA

Ratio

Share

Repurchase

FISCAL 2021

$8.0bn-$8.2bn

"Recapture and

Sustain"

approx. 35%

approx. 31%

$500mn-$525mn

approx. $400mn

Faster improvement

to <3.0x

$325mn

from $300mn

REAFFIRM

improved

improved

¤¤

Unlocking Shareholder Value

3 YR Share Repurchase Authorization

Increased

to

$1bn

Providing Q1 Visibility

FY21 Q1 sales will be non-comparable due to COVID-related

store closures in FY 20 Q1.

Excluding impact from divested businesses in both periods,

sales of Core Go-Forward banners¹ expected to be much higher

by approximately +65 - 70% vs FY 20 Q1.

Reported Net Sales expected to increase by over 40% vs FY20

Q1 when vast majority of stores were closed due to COVID-19,

in spite of non-core banner divestitures.

Expect adj. Gross Margin to be in the 34% range.

➤ Expect adj. EBITDA to be between $80 - $90mn.

Note: Adj. EBITDA, and adj. gross margin are non-GAAP financial measures. For a reconciliation to comparable GAAP measures, see Appendix of this presentation.

BED BATH & BEYOND

(1) Core Go-Forward banners include Bed Bath & Beyond, buybuy BABY, Harmon Face Values and Decorist. See Appendix of this presentation for more details on Core Go-Forward banner sales by quarter.

7View entire presentation