AMD Investor Day Presentation Deck

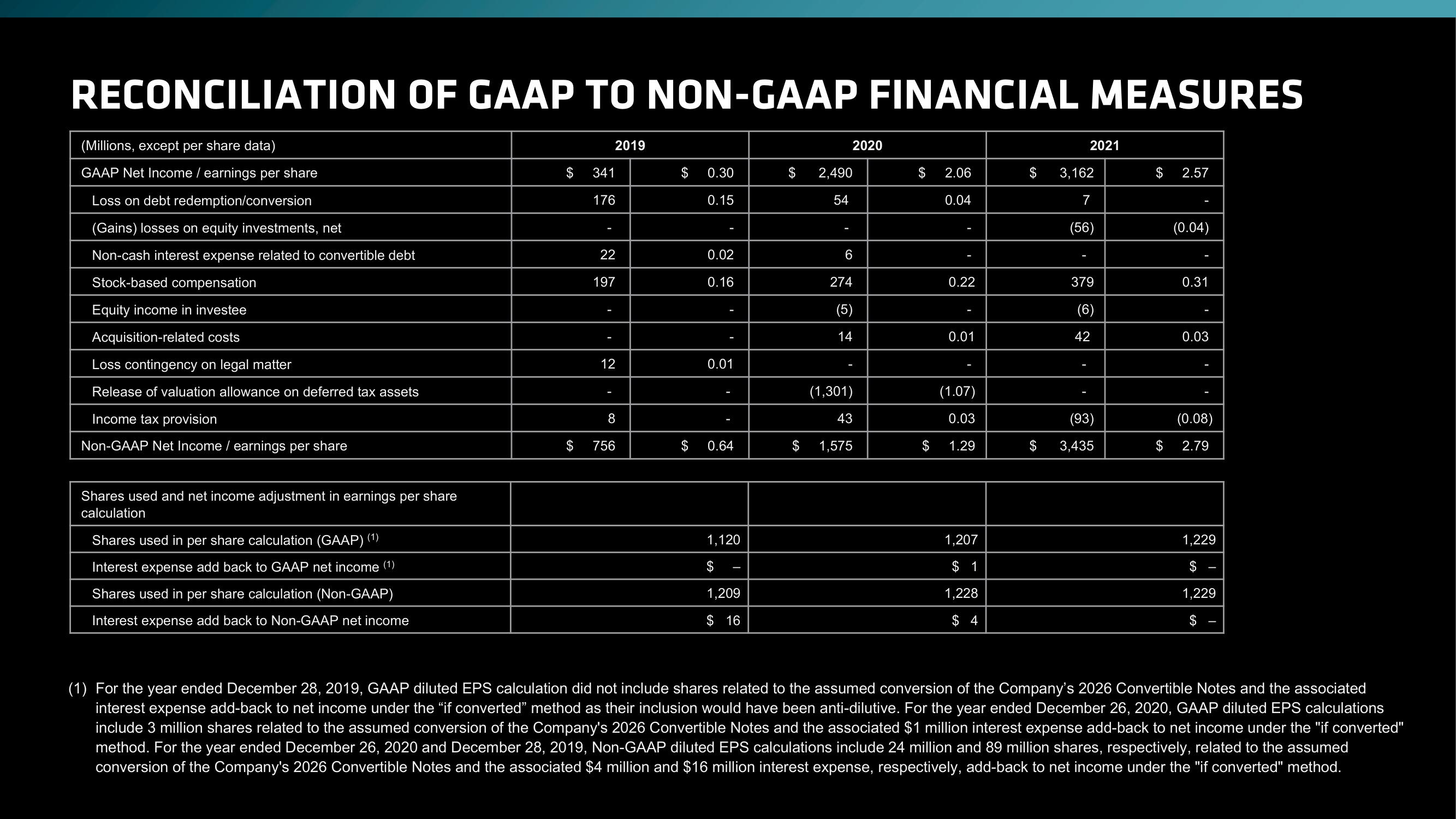

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(Millions, except per share data)

GAAP Net Income / earnings per share

Loss on debt redemption/conversion

(Gains) losses on equity investments, net

Non-cash interest expense related to convertible debt

Stock-based compensation

Equity income in investee

Acquisition-related costs

Loss contingency on legal matter

Release of valuation allowance on deferred tax assets

Income tax provision

Non-GAAP Net Income / earnings per share

Shares used and net income adjustment in earnings per share

calculation

Shares used in per share calculation (GAAP) (1)

Interest expense add back to GAAP net income (1)

Shares used in per share calculation (Non-GAAP)

Interest expense add back to Non-GAAP net income

2019

$ 341

176

22

197

-

12

8

$ 756

$

$

0.30

0.15

0.02

0.16

0.01

0.64

1,120

$

1,209

$ 16

2020

$ 2,490

54

$

6

274

(5)

14

(1,301)

43

1,575

$

$

2.06

0.04

0.22

0.01

(1.07)

0.03

1.29

1,207

$ 1

1,228

$ 4

$ 3,162

7

(56)

$

2021

379

(6)

42

I

I

(93)

3,435

$ 2.57

$

(0.04)

0.31

0.03

I

(0.08)

2.79

1,229

$

1,229

(1) For the year ended December 28, 2019, GAAP diluted EPS calculation did not include shares related to the assumed conversion of the Company's 2026 Convertible Notes and the associated

interest expense add-back to net income under the "if converted" method as their inclusion would have been anti-dilutive. For the year ended December 26, 2020, GAAP diluted EPS calculations

include 3 million shares related to the assumed conversion of the Company's 2026 Convertible Notes and the associated $1 million interest expense add-back to net income under the "if converted"

method. For the year ended December 26, 2020 and December 28, 2019, Non-GAAP diluted EPS calculations include 24 million and 89 million shares, respectively, related to the assumed

conversion of the Company's 2026 Convertible Notes and the associated $4 million and $16 million interest expense, respectively, add-back to net income under the "if converted" method.View entire presentation