Affirm Results Presentation Deck

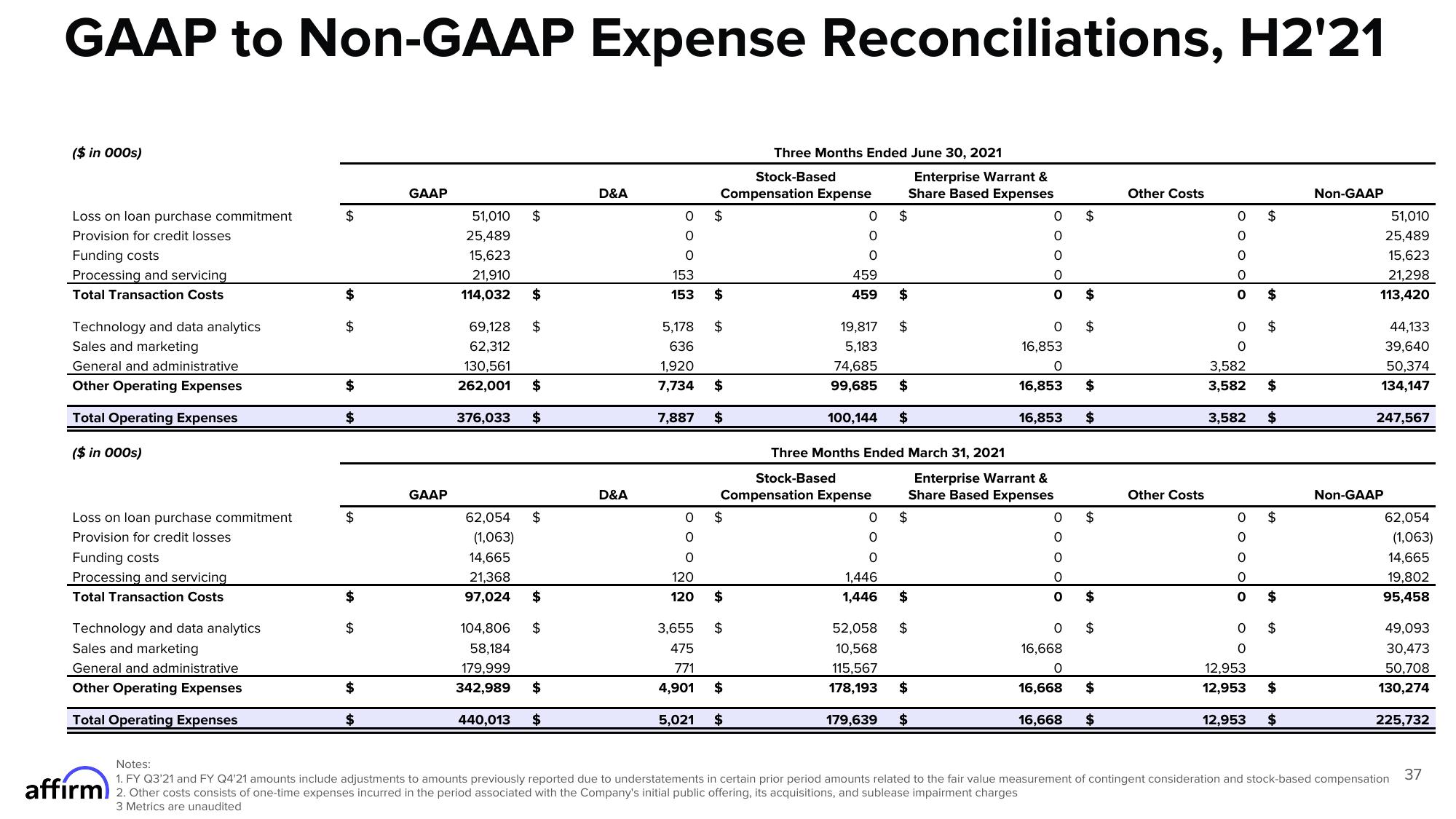

GAAP to Non-GAAP Expense Reconciliations, H2'21

($ in 000s)

Loss on loan purchase commitment

Provision for credit losses

Funding costs

Processing and servicing

Total Transaction Costs

Technology and data analytics

Sales and marketing

General and administrative

Other Operating Expenses

Total Operating Expenses

($ in 000s)

Loss on loan purchase commitment

Provision for credit losses

Funding costs

Processing and servicing

Total Transaction Costs

Technology and data analytics

Sales and marketing

General and administrative

Other Operating Expenses

Total Operating Expenses

$

$

$

$

$

$

$

$

$

$

GAAP

GAAP

51,010

25,489

15,623

21,910

114,032

$

$

69,128 $

62,312

130,561

262,001

$

376,033 $

62,054 $

(1,063)

14,665

21,368

97,024

$

104,806

58,184

179,999

342,989 $

440,013 $

$

D&A

D&A

O

O

O

153

153

5,178

636

1,920

7.734

7,887

O

O

O

120

120

Compensation Expense

$

$

$

$

$

$

$

Three Months Ended June 30, 2021

Stock-Based

3,655 $

475

771

4,901

5,021 $

$

0

0

O

Compensation Expense

459

459

$

Enterprise Warrant &

Share Based Expenses

$

$

19,817

5,183

74,685

99,685 $

100,144 $

Three Months Ended March 31, 2021

Stock-Based

0

0

0

1,446

1,446 $

52,058 $

10,568

115,567

178,193

179,639

O O O Oc

Enterprise Warrant &

Share Based Expenses

$

$

$

$

+A

0 $

16,853

0

16,853

16,853

lo

$

$

$

0 $

0

tA

$

O $

16,668

0

16,668 $

16,668 $

Other Costs

Other Costs

O O O O O

0 $

O O

OO

O o o o o

$

3,582

3,582

3,582 $

0

$

LA

$

$

LA

$

$

12,953

12,953 $

12,953 $

Non-GAAP

51,010

25,489

15,623

21,298

113,420

44,133

39,640

50,374

134,147

247,567

Non-GAAP

62,054

(1,063)

14,665

19,802

95,458

49,093

30,473

50,708

130,274

225,732

Notes:

1. FY Q3'21 and FY Q4'21 amounts include adjustments to amounts previously reported due to understatements in certain prior period amounts related to the fair value measurement of contingent consideration and stock-based compensation 37

affirm) 2. Other costs consists of one-time expenses incurred in the period associated with the Company's initial public offering, its acquisitions, and sublease impairment charges

3 Metrics are unauditedView entire presentation