Marti SPAC Presentation Deck

Detailed transaction overview

●

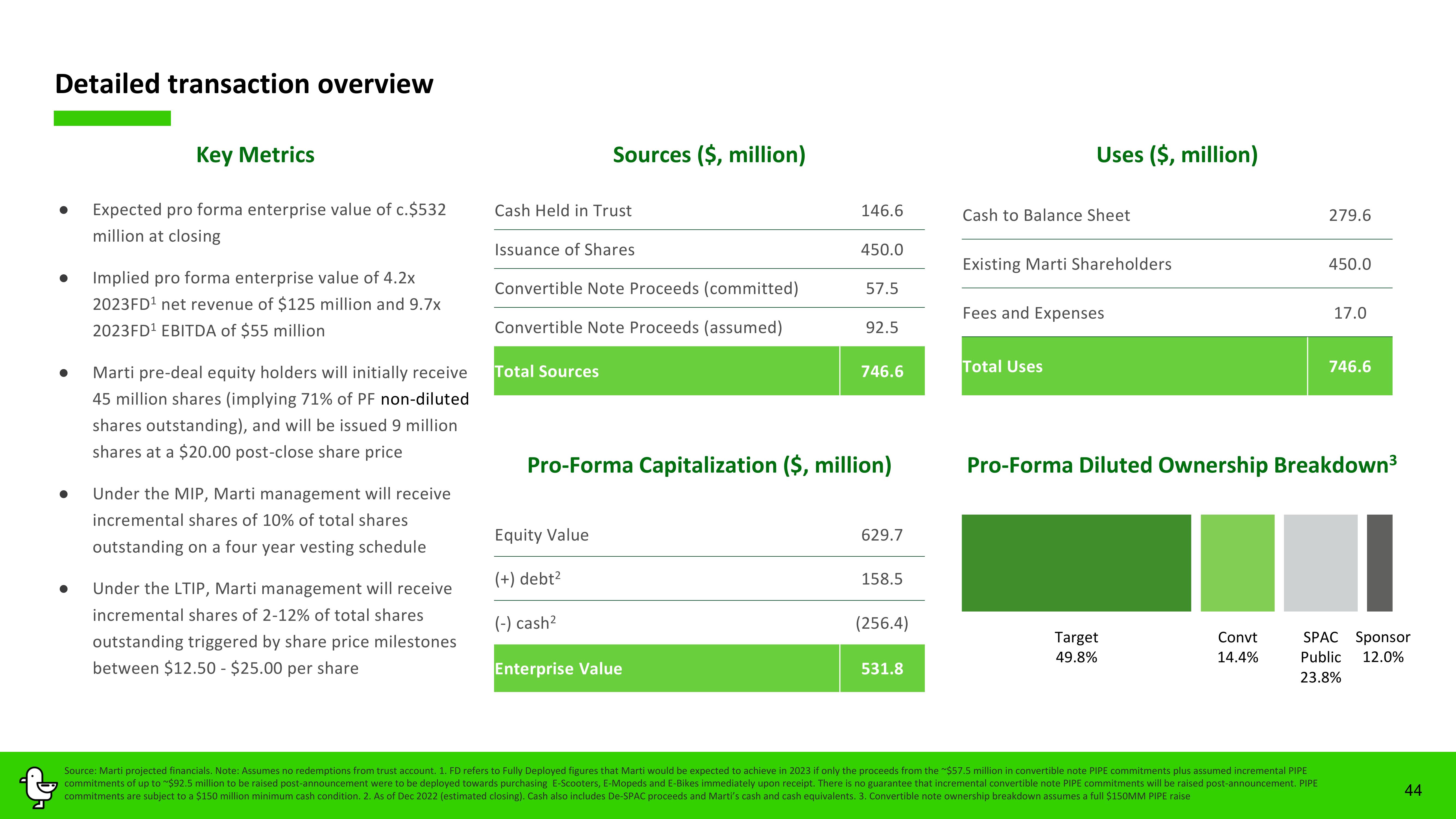

Key Metrics

Expected pro forma enterprise value of c.$532

million at closing

Implied pro forma enterprise value of 4.2x

2023FD¹ net revenue of $125 million and 9.7x

2023FD¹ EBITDA of $55 million

Marti pre-deal equity holders will initially receive

45 million shares (implying 71% of PF non-diluted

shares outstanding), and will be issued 9 million

shares at a $20.00 post-close share price

Under the MIP, Marti management will receive

incremental shares of 10% of total shares

outstanding on a four year vesting schedule

Under the LTIP, Marti management will receive

incremental shares of 2-12% of total shares

outstanding triggered by share price milestones

between $12.50 - $25.00 per share

Cash Held in Trust

Sources ($, million)

Issuance of Shares

Convertible Note Proceeds (committed)

Convertible Note Proceeds (assumed)

Total Sources

Equity Value

(+) debt²

(-) cash²

146.6

Enterprise Value

450.0

57.5

92.5

Pro-Forma Capitalization ($, million)

746.6

629.7

158.5

(256.4)

531.8

Uses ($, million)

Cash to Balance Sheet

Existing Marti Shareholders

Fees and Expenses

Total Uses

Target

49.8%

Convt

14.4%

279.6

450.0

Pro-Forma Diluted Ownership Breakdown³

Source: Marti projected financials. Note: Assumes no redemptions from trust account. 1. FD refers to Fully Deployed figures that Marti would be expected to achieve in 2023 if only the proceeds from the ~$57.5 million in convertible note PIPE commitments plus assumed incremental PIPE

commitments of up to $92.5 million to be raised post-announcement were to be deployed towards purchasing E-Scooters, E-Mopeds and E-Bikes immediately upon receipt. There is no guarantee that incremental convertible note PIPE commitments will be raised post-announcement. PIPE

commitments are subject to a $150 million minimum cash condition. 2. As of Dec 2022 (estimated closing). Cash also includes De-SPAC proceeds and Marti's cash and cash equivalents. 3. Convertible note ownership breakdown assumes a full $150MM PIPE raise

17.0

746.6

SPAC Sponsor

Public 12.0%

23.8%

44View entire presentation