Tradeweb Investor Presentation Deck

3. POWERFUL GROWTH THEMES

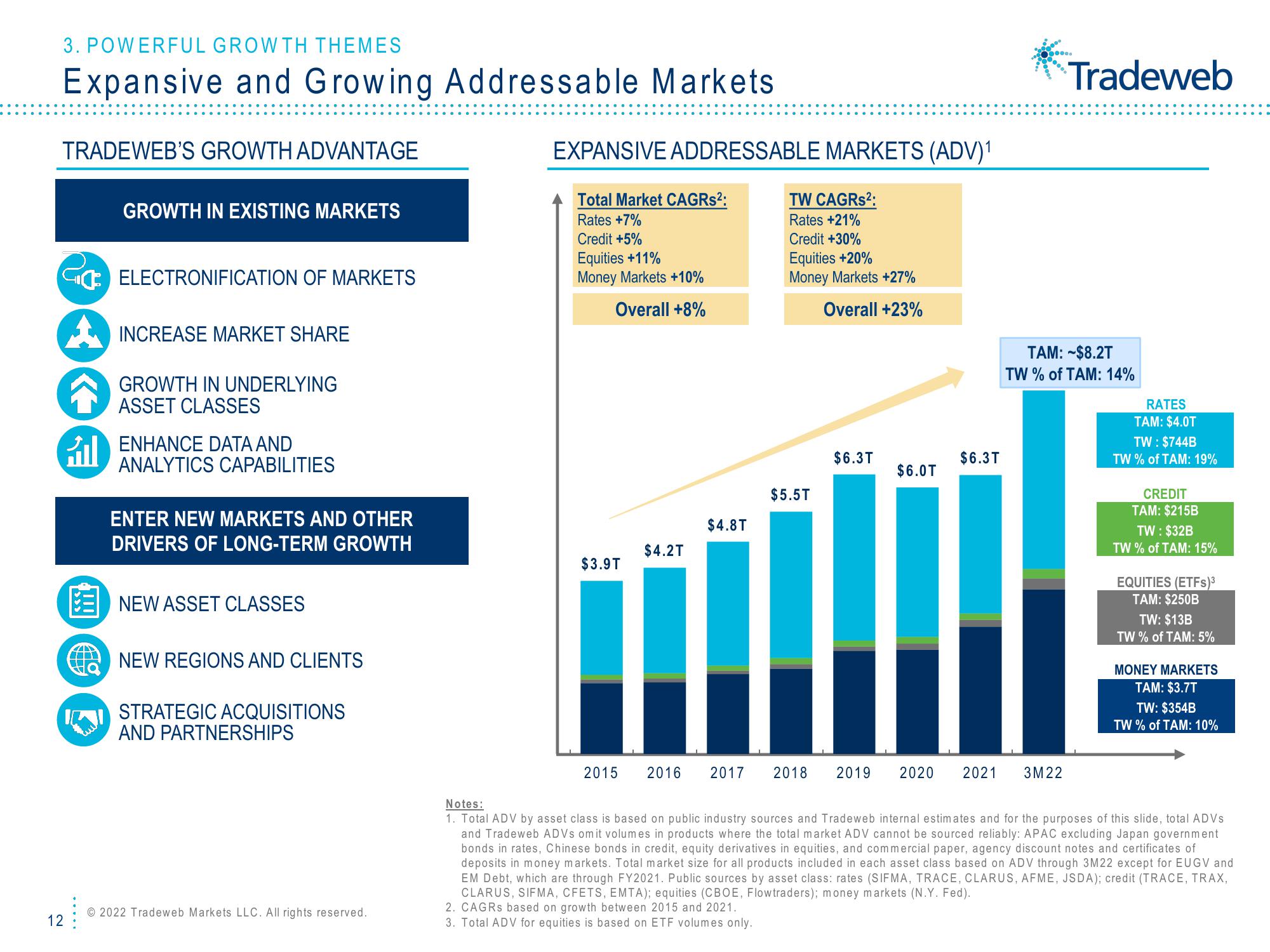

Expansive and Growing Addressable Markets

TRADEWEB'S GROWTH ADVANTAGE

सव

IN

12

GROWTH IN EXISTING MARKETS

ELECTRONIFICATION OF MARKETS

INCREASE MARKET SHARE

GROWTH IN UNDERLYING

ASSET CLASSES

ENHANCE DATA AND

ANALYTICS CAPABILITIES

ENTER NEW MARKETS AND OTHER

DRIVERS OF LONG-TERM GROWTH

NEW ASSET CLASSES

NEW REGIONS AND CLIENTS

STRATEGIC ACQUISITIONS

AND PARTNERSHIPS

Ⓒ2022 Tradeweb Markets LLC. All rights reserved.

EXPANSIVE ADDRESSABLE MARKETS (ADV)¹

Total Market CAGRs²:

Rates +7%

Credit +5%

Equities +11%

Money Markets +10%

Overall +8%

$3.9T

2015

$4.2T

$4.8T

TW CAGRs²:

Rates +21%

Credit +30%

Equities +20%

Money Markets +27%

Overall +23%

$5.5T

2016 2017 2018

$6.3T

$6.0T

$6.3T

....

Tradeweb

TAM:~$8.2T

TW% of TAM: 14%

2019 2020 2021 3M22

RATES

TAM: $4.0T

TW: $744B

TW% of TAM: 19%

CREDIT

TAM: $215B

TW: $32B

TW% of TAM: 15%

EQUITIES (ETFs)³

TAM: $250B

TW: $13B

TW% of TAM: 5%

MONEY MARKETS

TAM: $3.7T

TW: $354B

TW % of TAM: 10%

Notes:

1. Total ADV by asset class is based on public industry sources and Tradeweb internal estimates and for the purposes of this slide, total ADVS

and Tradeweb ADVs omit volumes in products where the total market ADV cannot be sourced reliably: APAC excluding Japan government

bonds in rates, Chinese bonds in credit, equity derivatives in equities, and commercial paper, agency discount notes and certificates of

deposits in money markets. Total market size for all products included in each asset class based on ADV through 3M22 except for EUGV and

EM Debt, which are through FY2021. Public sources by asset class: rates (SIFMA, TRACE, CLARUS, AFME, JSDA); credit (TRACE, TRAX,

CLARUS, SIFMA, CFETS, EMTA); equities (CBOE, Flowtraders); money markets (N.Y. Fed).

2. CAGRS based on growth between 2015 and 2021.

3. Total ADV for equities is based on ETF volumes only.View entire presentation