Ares US Real Estate Opportunity Fund III

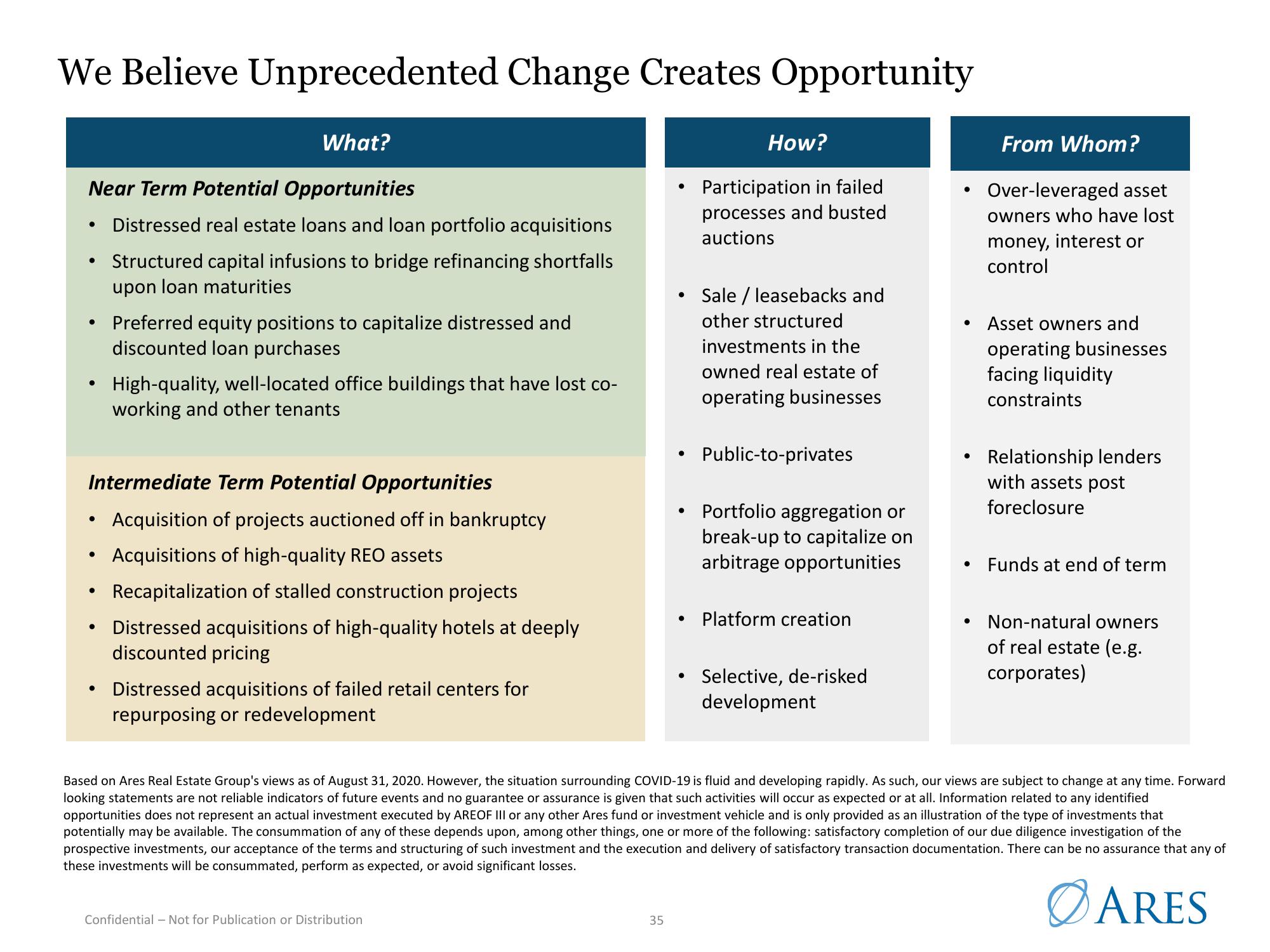

We Believe Unprecedented Change Creates Opportunity

What?

Near Term Potential Opportunities

Distressed real estate loans and loan portfolio acquisitions

Structured capital infusions to bridge refinancing shortfalls

upon loan maturities

●

●

●

Intermediate Term Potential Opportunities

Acquisition of projects auctioned off in bankruptcy

Acquisitions of high-quality REO assets

Recapitalization of stalled construction projects

Distressed acquisitions of high-quality hotels at deeply

discounted pricing

●

●

Preferred equity positions to capitalize distressed and

discounted loan purchases

●

High-quality, well-located office buildings that have lost co-

working and other tenants

Distressed acquisitions of failed retail centers for

repurposing or redevelopment

Confidential - Not for Publication or Distribution

●

35

How?

Participation in failed

processes and busted

auctions

Sale / leasebacks and

other structured

investments in the

owned real estate of

operating businesses

Public-to-privates

Portfolio aggregation or

break-up to capitalize on

arbitrage opportunities

Platform creation

Selective, de-risked

development

●

●

●

From Whom?

Over-leveraged asset

owners who have lost

money, interest or

control

Asset owners and

operating businesses

facing liquidity

constraints

Relationship lenders

with assets post

foreclosure

Funds at end of term

Based on Ares Real Estate Group's views as of August 31, 2020. However, the situation surrounding COVID-19 is fluid and developing rapidly. As such, our views are subject to change at any time. Forward

looking statements are not reliable indicators of future events and no guarantee or assurance is given that such activities will occur as expected or at all. Information related to any identified

opportunities does not represent an actual investment executed by AREOF III or any other Ares fund or investment vehicle and is only provided as an illustration of the type of investments that

potentially may be available. The consummation of any of these depends upon, among other things, one or more of the following: satisfactory completion of our due diligence investigation of the

prospective investments, our acceptance of the terms and structuring of such investment and the execution and delivery of satisfactory transaction documentation. There can be no assurance that any of

these investments will be consummated, perform as expected, or avoid significant losses.

ARES

• Non-natural owners

of real estate (e.g.

corporates)View entire presentation