Kymera IPO Presentation Deck

VERTEX

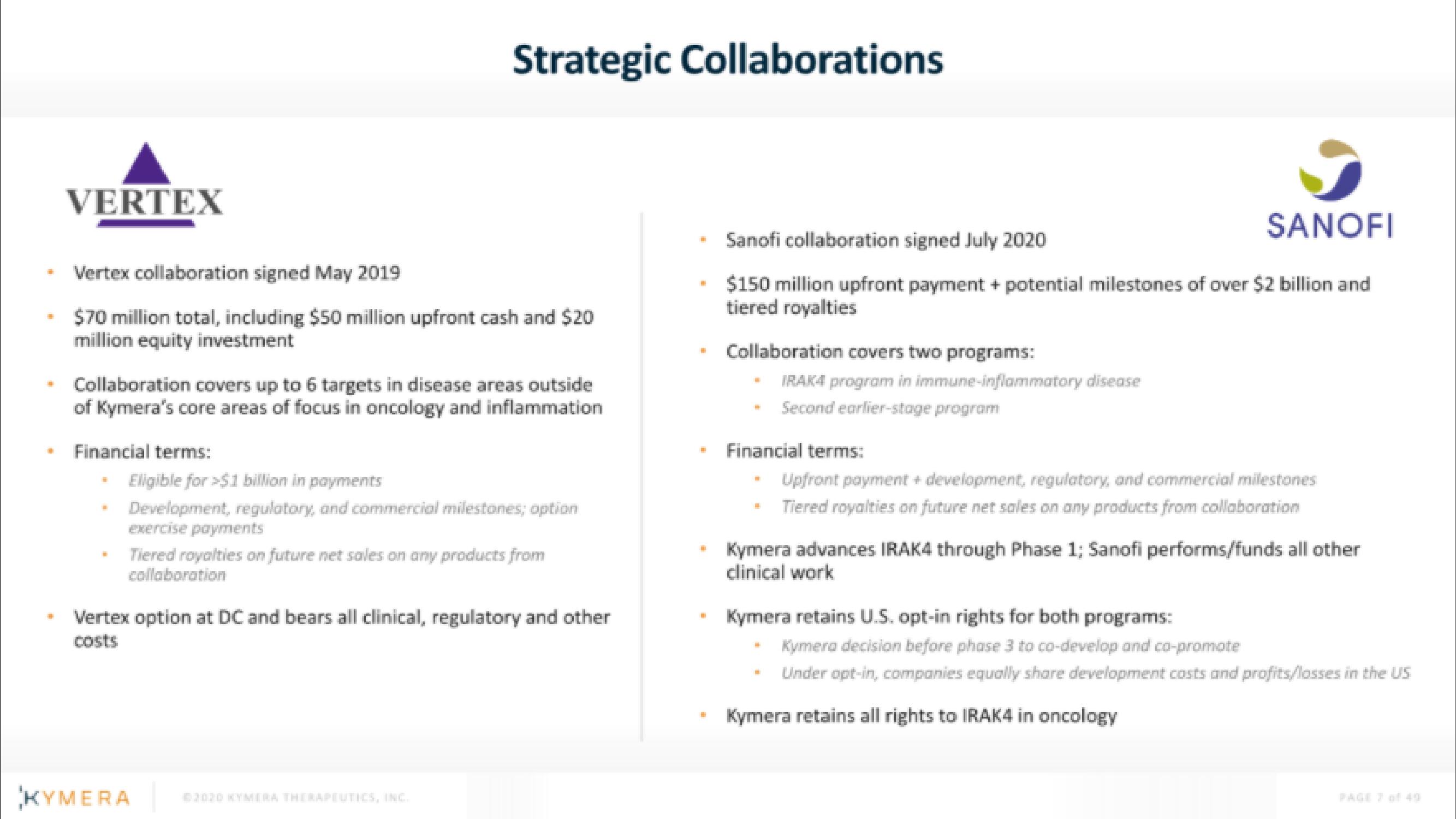

Vertex collaboration signed May 2019

- $70 million total, including $50 million upfront cash and $20

million equity investment

Collaboration covers up to 6 targets in disease areas outside

of Kymera's core areas of focus in oncology and inflammation.

Financial terms:

Strategic Collaborations

Eligible for >$1 billion in payments

Development, regulatory, and commercial milestones; option

exercise payments

Tiered royalties on future net sales on any products from

collaboration

Vertex option at DC and bears all clinical, regulatory and other

.

KYMERA

H

i

SANOFI

Sanofi collaboration signed July 2020

$150 million upfront payment + potential milestones of over $2 billion and

tiered royalties

Collaboration covers two programs:

IRAK4 program in immune-inflammatory disease

Second earlier-stage program

Financial terms:

Upfront payment + development, regulatory, and commercial milestones

Tiered royalties on future net sales on any products from collaboration

Kymera advances IRAK4 through Phase 1; Sanofi performs/funds all other

clinical work

Kymera retains U.S. opt-in rights for both programs:

-

Kymera decision before phase 3 to co-develop and co-promote

Under opt-in, companies equally share development costs and profits/losses in the US

Kymera retains all rights to IRAK4 in oncologyView entire presentation