Allwyn Investor Conference Presentation Deck

Q3 2022 highlights

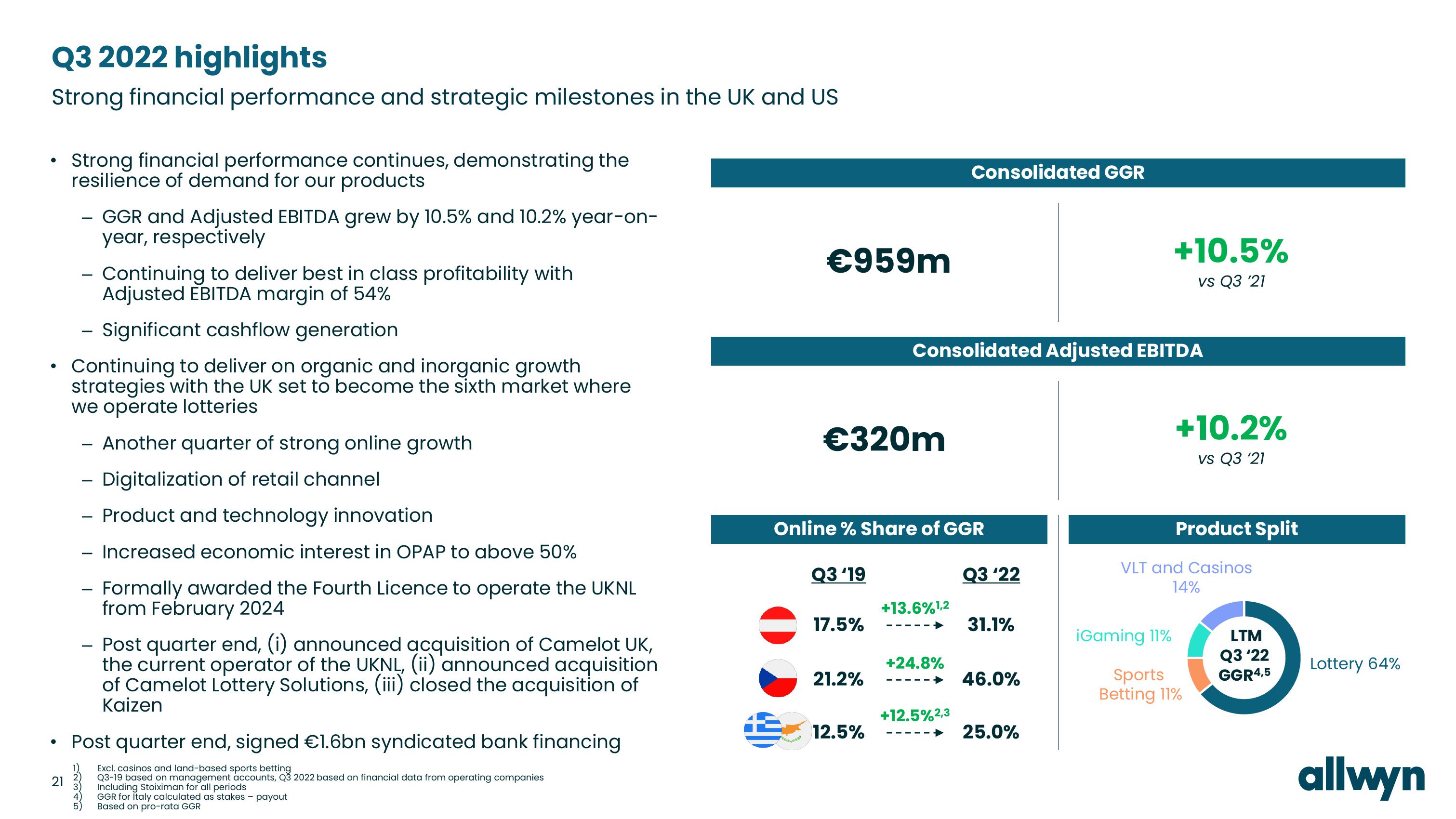

Strong financial performance and strategic milestones in the UK and US

●

●

21

Strong financial performance continues, demonstrating the

resilience of demand for our products

Continuing to deliver best in class profitability with

Adjusted EBITDA margin of 54%

- Significant cashflow generation

Continuing to deliver on organic and inorganic growth

strategies with the UK set to become the sixth market where

we operate lotteries

- Another quarter of strong online growth

Digitalization of retail channel

- GGR and Adjusted EBITDA grew by 10.5% and 10.2% year-on-

year, respectively

1)

5

Product and technology innovation

- Increased economic interest in OPAP to above 50%

-

Formally awarded the Fourth Licence to operate the UKNL

from February 2024

Post quarter end, signed €1.6bn syndicated bank financing

Excl. casinos and land-based sports betting

Q3-19 based on management accounts, Q3 2022 based on financial data from operating companies

- Post quarter end, (i) announced acquisition of Camelot UK,

the current operator of the UKNL, (ii) announced acquisition

of Camelot Lottery Solutions, (iii) closed the acquisition of

Kaizen

Including Stoiximan for all periods

GGR for Italy calculated as stakes payout

Based on pro-rata GGR

€959m

hesst

€320m

Online % Share of GGR

Q3 '19

17.5%

21.2%

12.5%

Consolidated Adjusted EBITDA

+13.6%¹,2

+24.8%

Consolidated GGR

→

+12.5%2,3

Q3 '22

31.1%

46.0%

25.0%

+10.5%

vs Q3 '21

iGaming 11%

+10.2%

vs Q3 '21

Product Split

VLT and Casinos

14%

Sports

Betting 11%

LTM

Q3'22

GGR4,5

Lottery 64%

allwynView entire presentation