Commercial Metals Company Investor Presentation Deck

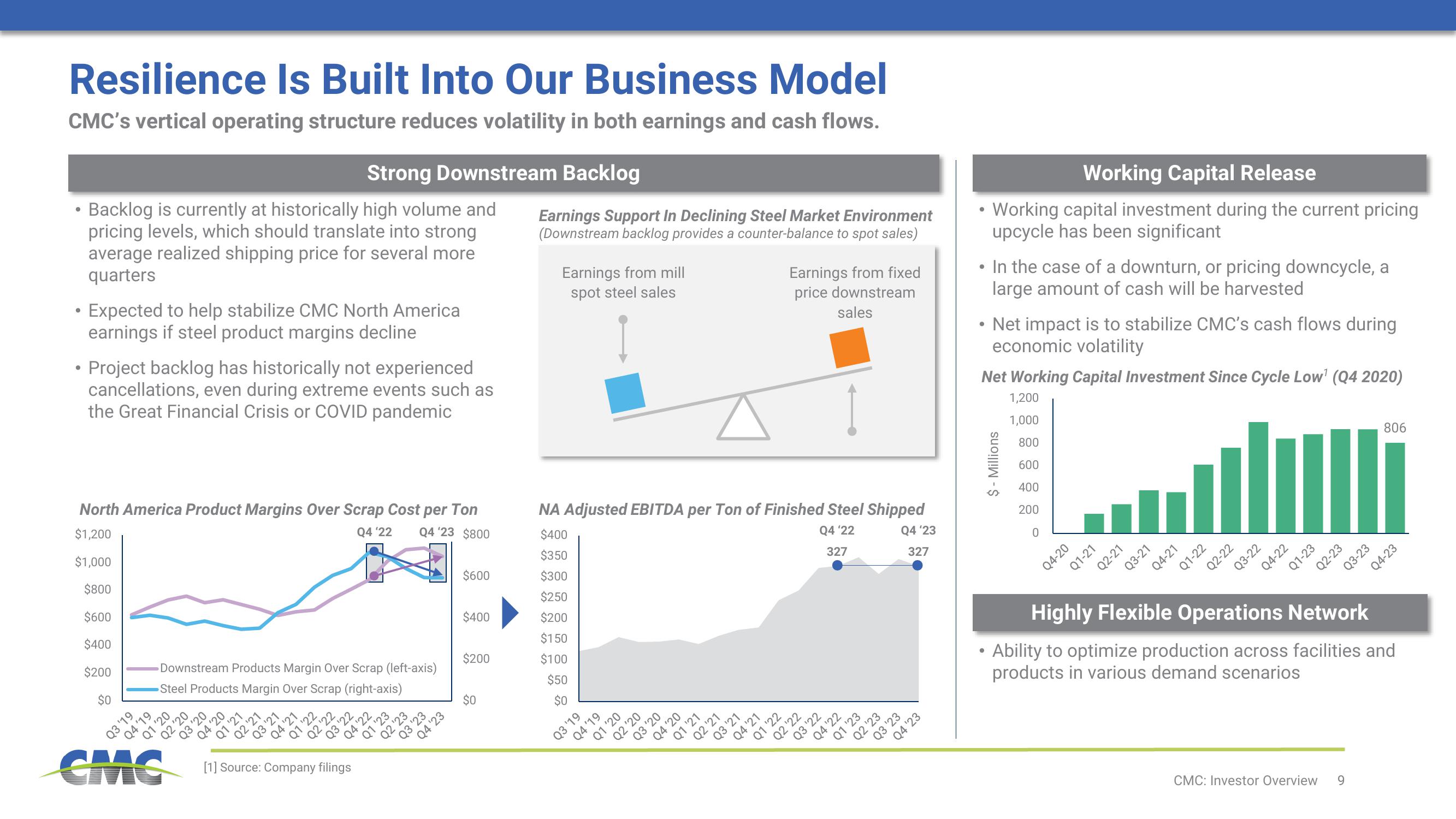

Resilience Is Built Into Our Business Model

CMC's vertical operating structure reduces volatility in both earnings and cash flows.

• Backlog is currently at historically high volume and

pricing levels, which should translate into strong

average realized shipping price for several more

quarters

●

Expected to help stabilize CMC North America

earnings if steel product margins decline

• Project backlog has historically not experienced

cancellations, even during extreme events such as

the Great Financial Crisis or COVID pandemic

North America Product Margins Over Scrap Cost per Ton

Q4 '22 Q4 '23 $800

$1,200

$1,000

$800

$600

$400

$200

$0

Q3 '19

Q4 '19

Downstream Products Margin Over Scrap (left-axis)

Steel Products Margin Over Scrap (right-axis)

Q1 '20

CMC

Q2 '20

Q3 '20

Strong Downstream Backlog

Q4 '20

'21

Q3 '21

¹22

Q4 '21

[1] Source: Company filings

'23

$600

$400

$200

$0

Earnings Support In Declining Steel Market Environment

(Downstream backlog provides a counter-balance to spot sales)

Earnings from mill

spot steel sales

NA Adjusted EBITDA per Ton of Finished Steel Shipped

$400

Q4 '23

Q4 '22

327

327

$350

$300

$250

$200

$150

$100

$50

$0

Q3 '19

Q4 '19

Q1 '20

Q2 '20

Q3 '20

Q4 '20

Q1 '21

Q2 '21

Q3 '21

Q4 '21

Earnings from fixed

price downstream

sales

Q1 '22

Q2 '22

Q3 '22

Q4 '22

Q1 '23

Q2 '23

Q3 '23

Q4 '23

Working Capital Release

• Working capital investment during the current pricing

upcycle has been significant

In the case of a downturn, or pricing downcycle, a

large amount of cash will be harvested

• Net impact is to stabilize CMC's cash flows during

economic volatility

Net Working Capital Investment Since Cycle Low¹ (Q4 2020)

1,200

1,000

800

600

400

200

0

●

$ - Millions

Q4-20

Q1-21

Q2-21

Q3-21

Q4-21

dou

Q1-22

Q2-22

Q3-22

Q4-22

Q1-23

Q2-23

CMC: Investor Overview

Q3-23

9

806

Highly

Flexible Operations Network

Ability to optimize production across facilities and

products in various demand scenarios

Q4-23View entire presentation