CorpAcq SPAC Presentation Deck

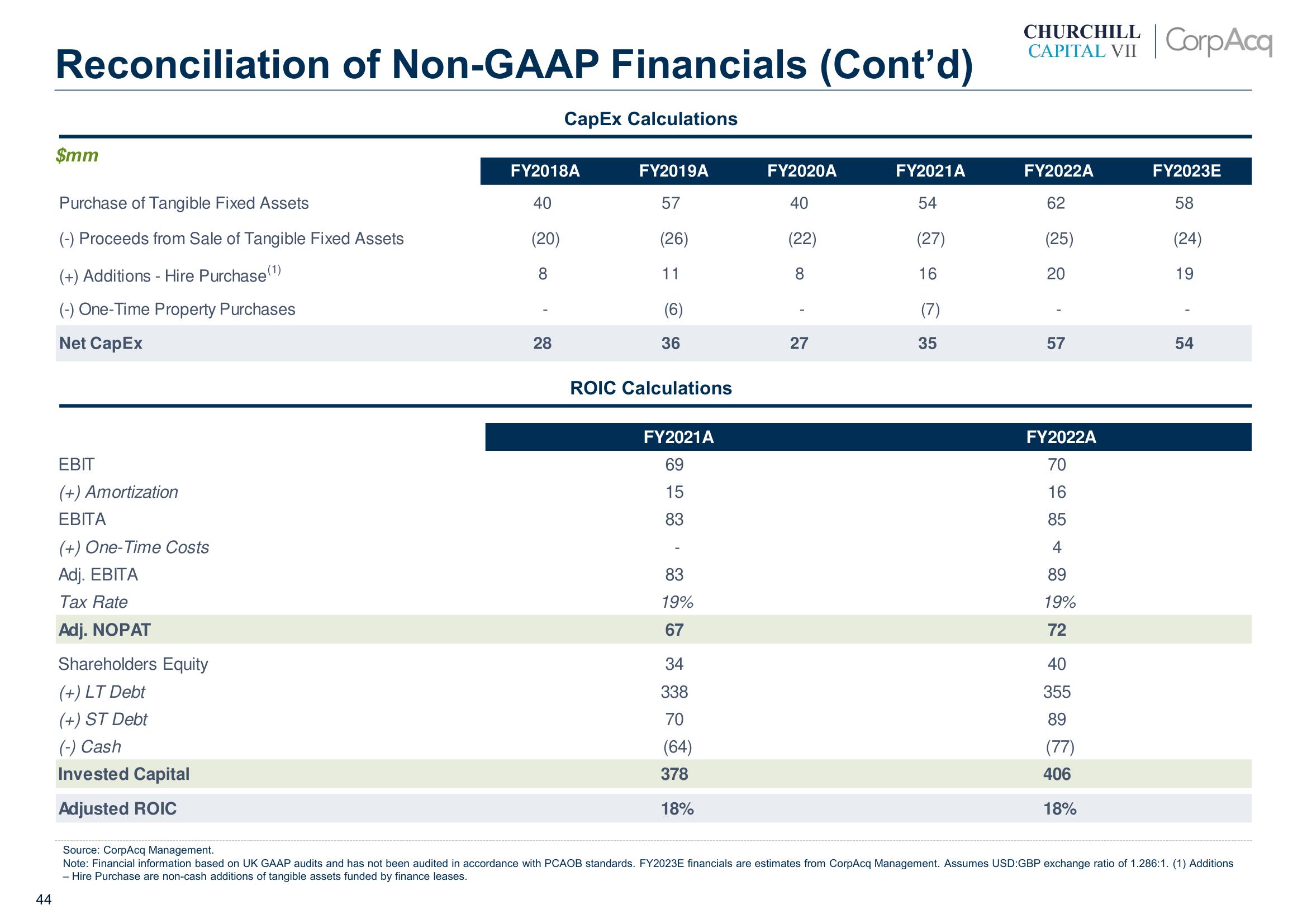

Reconciliation of Non-GAAP Financials (Cont'd)

CapEx Calculations

$mm

Purchase of Tangible Fixed Assets

(-) Proceeds from Sale of Tangible Fixed Assets

(+) Additions - Hire Purchase (1)

(-) One-Time Property Purchases

Net CapEx

EBIT

(+) Amortization

EBITA

(+) One-Time Costs

Adj. EBITA

Tax Rate

Adj. NOPAT

Shareholders Equity

(+) LT Debt

(+) ST Debt

(-) Cash

Invested Capital

Adjusted ROIC

FY2018A

40

(20)

8

28

FY2019A

57

(26)

11

(6)

36

ROIC Calculations

FY2021A

69

15

83

83

19%

67

34

338

70

(64)

378

18%

FY2020A

40

(22)

8

27

FY2021A

54

(27)

16

(7)

35

CHURCHILL

CAPITAL VII CorpAcq

FY2022A

62

(25)

20

57

FY2022A

70

16

85

4

89

19%

72

40

355

89

(77)

406

18%

FY2023E

58

(24)

19

54

Source: CorpAcq Management.

Note: Financial information based on UK GAAP audits and has not been audited in accordance with PCAOB standards. FY2023E financials are estimates from CorpAcq Management. Assumes USD:GBP exchange ratio of 1.286:1. (1) Additions

- Hire Purchase are non-cash additions of tangible assets funded by finance leases.

44View entire presentation