Zegna Investor Presentation Deck

3. The Thom Browne factor

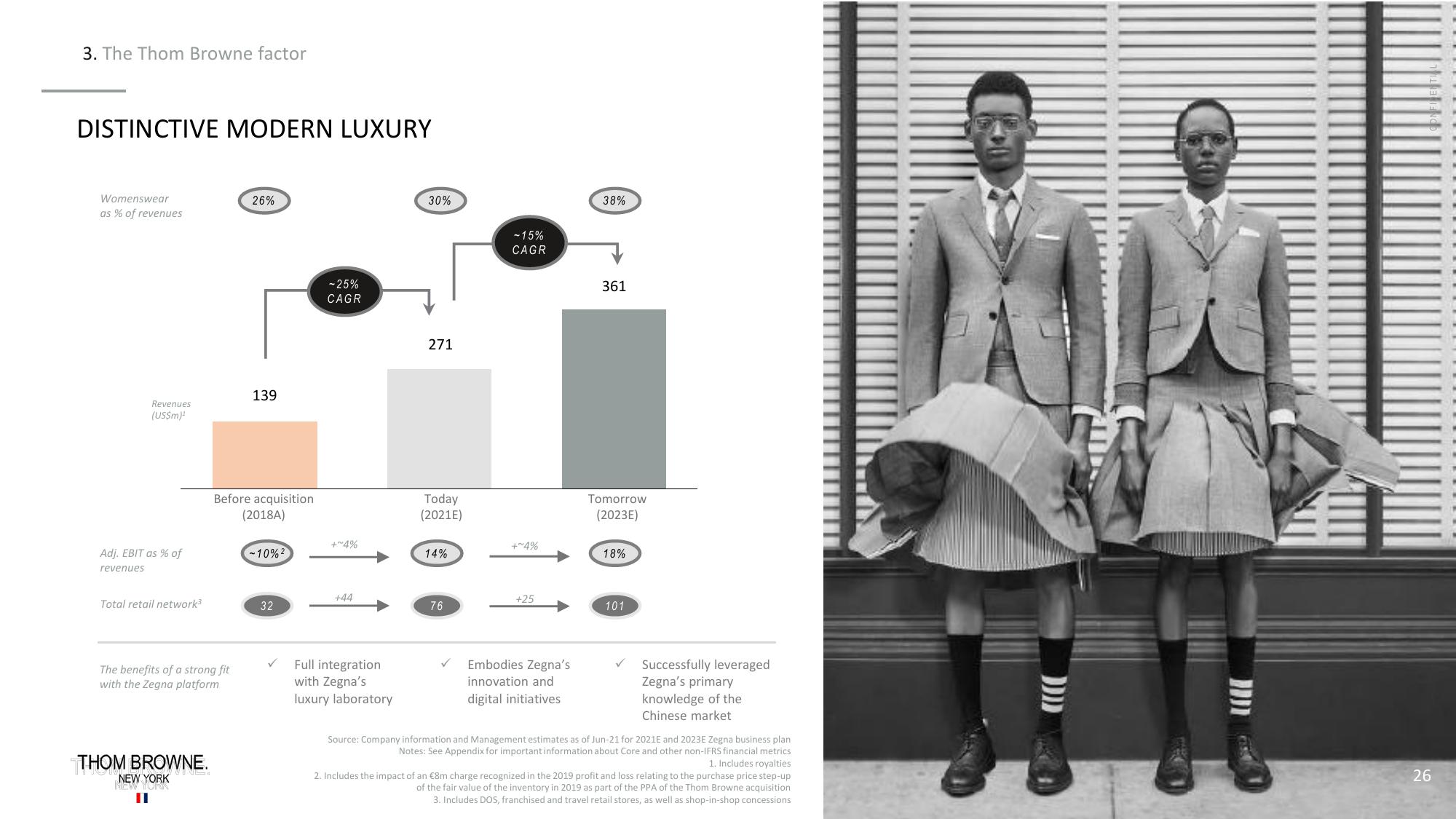

DISTINCTIVE MODERN LUXURY

Womenswear

as % of revenues

Revenues

(US$m)¹

Adj. EBIT as % of

revenues

Total retail network³

The benefits of a strong fit

with the Zegna platform

THOM BROWNE.

NEW YORK

NEW TURK

26%

139

Before acquisition

(2018A)

-10%²

32

✓

-25%

CAGR

+~4%

+44

Full integration

with Zegna's

luxury laboratory

30%

271

Today

(2021E)

14%

76

-15%

CAGR

+~4%

+25

Embodies Zegna's

innovation and

digital initiatives

38%

361

Tomorrow

(2023E)

18%

101

Successfully leveraged

Zegna's primary

knowledge of the

Chinese market

Source: Company information and Management estimates as of Jun-21 for 2021E and 2023E Zegna business plan

Notes: See Appendix for important information about Core and other non-IFRS financial metrics

1. Includes royalties

2. Includes the impact of an €8m charge recognized in the 2019 profit and loss relating to the purchase price step-up

of the fair value of the inventory in 2019 as part of the PPA of the Thom Browne acquisition

3. Includes DOS, franchised and travel retail stores, as well as shop-in-shop concessions

11

PE

4

26View entire presentation