Oatly IPO Presentation Deck

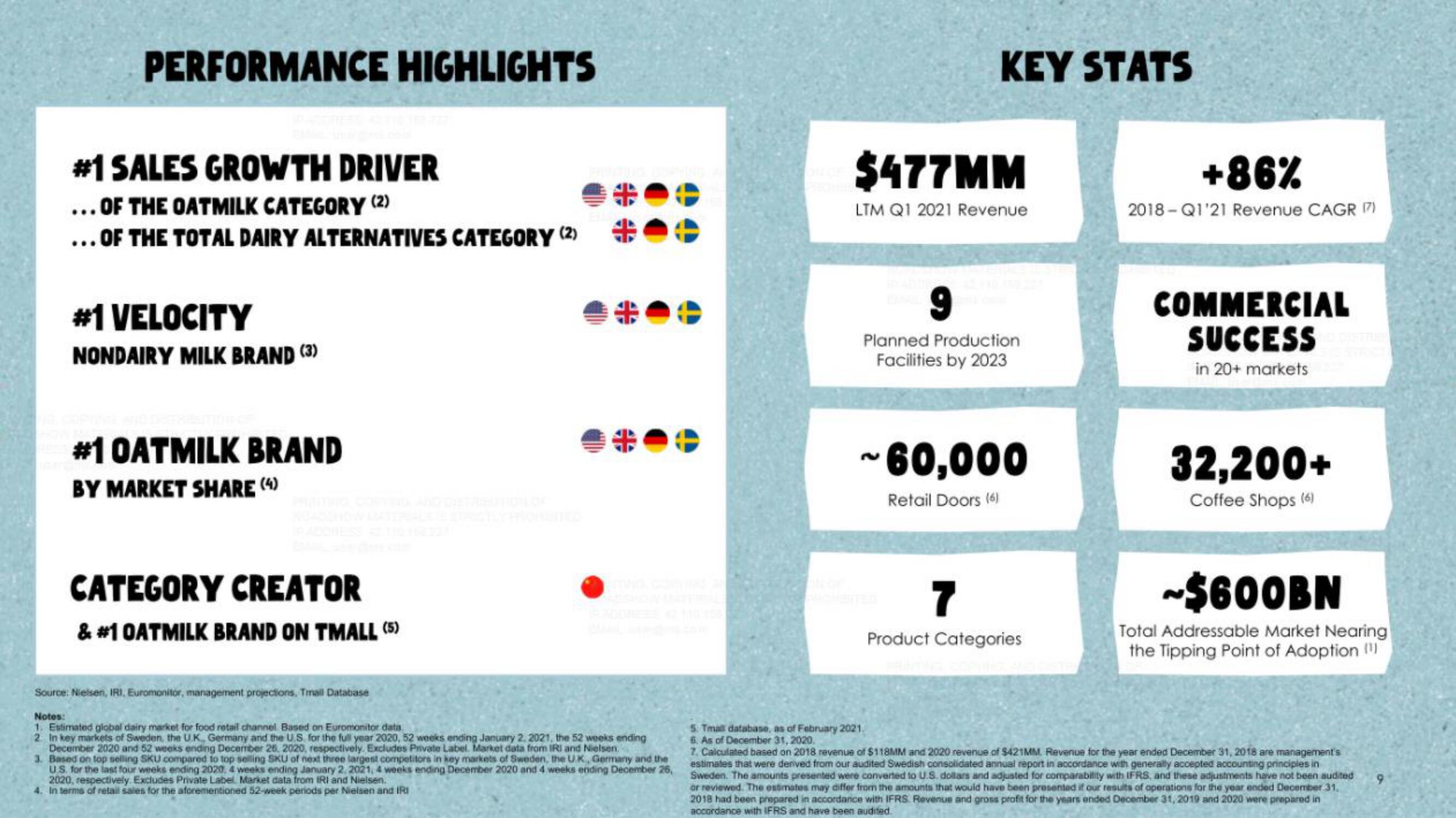

PERFORMANCE HIGHLIGHTS

#1 SALES GROWTH DRIVER

... OF THE OATMILK CATEGORY (2)

...OF THE TOTAL DAIRY ALTERNATIVES CATEGORY (2)

#1 VELOCITY

NONDAIRY MILK BRAND (3)

#1 OATMILK BRAND

BY MARKET SHARE (4)

CATEGORY CREATOR

OATMILK BRAND ON TMALL (5)

Source: Nielsen, IRI, Euromonitor, management projections, Tmall Database

Notes:

1. Estimated global dairy market for food retail channel Based on Euromonitor data

2. In key markets of Sweden, the U.K., Germany and the U.S. for the full year 2020, 52 weeks ending January 2, 2021, the 52 weeks ending

December 2020 and 52 weeks ending December 26, 2020, respectively. Excludes Private Label. Market data from IRI and Nielsen.

3. Based on top selling SKU compared to top selling SKU of next three largest competitors in key markets of Sweden, the UK, Germany and the

US for the last four weeks ending 2020, 4 weeks ending January 2, 2021, 4 weeks ending December 2020 and 4 weeks ending December 26,

2020, respectively. Excludes Private Label Market data from IRI and Nielsen.

4. In terms of retail sales for the aforementioned 52-week periods per Nielsen and IRI

KEY STATS

$477MM

LTM Q1 2021 Revenue

9

Planned Production

Facilities by 2023

~60,000

Retail Doors (6)

7

Product Categories

+86%

2018-Q1'21 Revenue CAGR (17)

COMMERCIAL

SUCCESS PETTE

in 20+ markets

32,200+

Coffee Shops (6)

~$600BN

Total Addressable Market Nearing

the Tipping Point of Adoption (¹)

5. Tmall database, as of February 2021.

6. As of December 31, 2020.

7. Calculated based on 2018 revenue of $118MM and 2020 revenue of $421MM. Revenue for the year ended December 31, 2018 are management's

estimates that were derived from our audited Swedish consolidated annual report in accordance with generally accepted accounting principles in

Sweden. The amounts presented were converted to U.S. dollars and adjusted for comparability with IFRS, and these adjustments have not been audited

or reviewed. The estimates may differ from the amounts that would have been presented if our results of operations for the year ended December 31,

2018 had been prepared in accordance with IFRS. Revenue and gross profit for the years ended December 31, 2019 and 2020 were prepared in

accordance with IFRS and have been auditedView entire presentation