Massachusetts Water Resources Authority (“MWRA”) Employees’ Retirement System

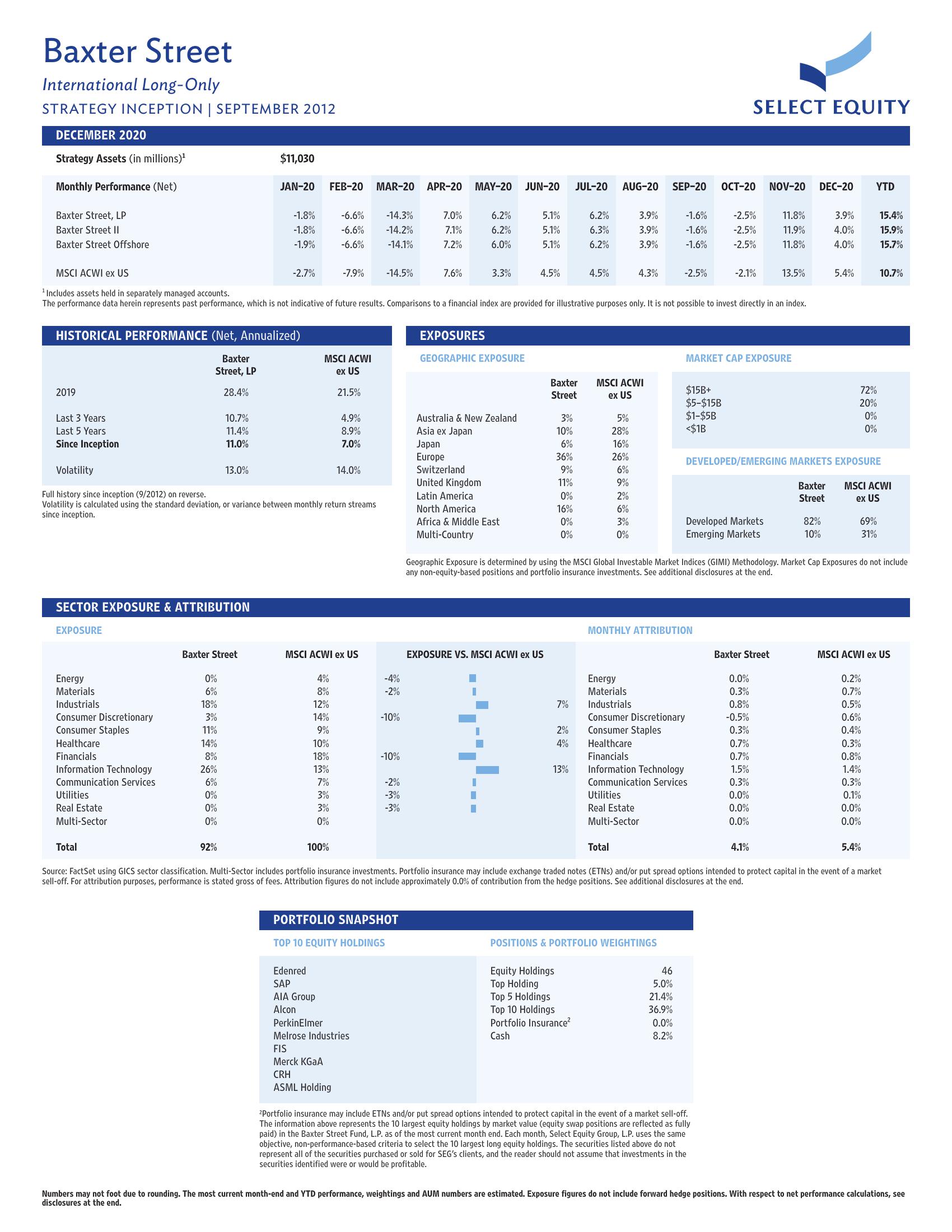

Baxter Street

International Long-Only

STRATEGY INCEPTION | SEPTEMBER 2012

DECEMBER 2020

Strategy Assets (in millions)¹

Monthly Performance (Net)

Baxter Street, LP

Baxter Street II

Baxter Street Offshore

2019

Last 3 Years

Last 5 Years

Since Inception

HISTORICAL PERFORMANCE (Net, Annualized)

Baxter

Street, LP

Energy

Materials

Industrials

Consumer Discretionary

Consumer Staples

Healthcare

Financials

Information Technology

Communication Services

SECTOR EXPOSURE & ATTRIBUTION

EXPOSURE

Utilities

Real Estate

Multi-Sector

Total

28.4%

0%

6%

18%

3%

11%

10.7%

11.4%

11.0%

14%

8%

26%

6%

0%

0%

0%

13.0%

Baxter Street

92%

$11,030

JAN-20

-1.8%

-1.8%

-1.9%

Volatility

Full history since inception (9/2012) on reverse.

Volatility is calculated using the standard deviation, or variance between monthly return streams

since inception.

MSCI ACWI ex US

¹ Includes assets held in separately managed accounts.

The performance data herein represents past performance, which is not indicative of future results. Comparisons to a financial index are provided for illustrative purposes only. It is not possible to invest directly in an index.

-2.7%

FEB-20 MAR-20 APR-20

-6.6% -14.3%

-6.6% -14.2%

-6.6% -14.1%

MSCI ACWI

ex US

4%

8%

12%

14%

9%

10%

18%

13%

7%

3%

3%

0%

100%

-7.9% -14.5%

Edenred

SAP

AIA Group

Alcon

21.5%

4.9%

8.9%

7.0%

MSCI ACWI ex US

14.0%

-4%

-2%

-10%

PerkinElmer

Melrose Industries

FIS

Merck KGaA

CRH

ASML Holding

-10%

-2%

-3%

-3%

PORTFOLIO SNAPSHOT

TOP 10 EQUITY HOLDINGS

7.0%

7.1%

7.2%

MAY-20 JUN-20

7.6%

6.2%

6.2%

6.0%

3.3%

EXPOSURES

GEOGRAPHIC EXPOSURE

Australia & New Zealand

Asia ex Japan

Japan

Europe

Switzerland

5.1%

5.1%

5.1%

United Kingdom

Latin America

North America

Africa & Middle East

Multi-Country

4.5%

EXPOSURE VS. MSCI ACWI ex US

Baxter

Street

3%

10%

6%

36%

9%

11%

0%

16%

0%

0%

7%

JUL-20 AUG-20 SEP-20

2%

4%

13%

6.2%

6.3%

6.2%

4.5%

Equity Holdings

Top Holding

Top 5 Holdings

Top 10 Holdings

Portfolio Insurance²

Cash

3.9%

3.9%

3.9%

MSCI ACWI

ex US

5%

28%

16%

26%

6%

9%

2%

6%

3%

0%

4.3%

Total

-1.6%

-1.6%

-1.6%

-2.5%

POSITIONS & PORTFOLIO WEIGHTINGS

Energy

Materials

Industrials

Consumer Discretionary

Consumer Staples

Healthcare

$15B+

$5-$15B

$1-$5B

<$1B

MONTHLY ATTRIBUTION

46

5.0%

21.4%

36.9%

0.0%

8.2%

OCT-20 NOV-20 DEC-20 YTD

Financials

Information Technology

Communication Services

Utilities

Real Estate

Multi-Sector

SELECT EQUITY

-2.5%

-2.5%

-2.5%

MARKET CAP EXPOSURE

-2.1%

Developed Markets

Emerging Markets

²Portfolio insurance may include ETNs and/or put spread options intended to protect capital in the event of a market sell-off.

The information above represents the 10 largest equity holdings by market value (equity swap positions are reflected as fully

paid) in the Baxter Street Fund, L.P. as of the most current month end. Each month, Select Equity Group, L.P. uses the same

objective, non-performance-based criteria to select the 10 largest long equity holdings. The securities listed above do not

represent all of the securities purchased or sold for SEG's clients, and the reader should not assume that investments in the

securities identified were or would be profitable.

Geographic Exposure is determined by using the MSCI Global Investable Market Indices (GIMI) Methodology. Market Cap Exposures do not include

any non-equity-based positions and portfolio insurance investments. See additional disclosures at the end.

11.8%

11.9%

11.8%

Baxter Street

0.0%

0.3%

0.8%

-0.5%

0.3%

0.7%

0.7%

1.5%

0.3%

0.0%

0.0%

0.0%

13.5%

DEVELOPED/EMERGING MARKETS EXPOSURE

4.1%

Baxter

Street

3.9%

4.0%

4.0%

82%

10%

5.4%

72%

20%

0%

0%

69%

31%

MSCI ACWI

ex US

Source: FactSet using GICS sector classification. Multi-Sector includes portfolio insurance investments. Portfolio insurance may include exchange traded notes (ETNS) and/or put spread options intended to protect capital in the event of a market

sell-off. For attribution purposes, performance is stated gross of fees. Attribution figures do not include approximately 0.0% of contribution from the hedge positions. See additional disclosures at the end.

15.4%

15.9%

15.7%

10.7%

0.2%

0.7%

0.5%

0.6%

0.4%

0.3%

0.8%

1.4%

MSCI ACWI ex US

0.3%

0.1%

0.0%

0.0%

5.4%

Numbers may not foot due to rounding. The most current month-end and YTD performance, weightings and AUM numbers are estimated. Exposure figures do not include forward hedge positions. With respect to net performance calculations, see

disclosures at the end.View entire presentation