Nikola SPAC Presentation Deck

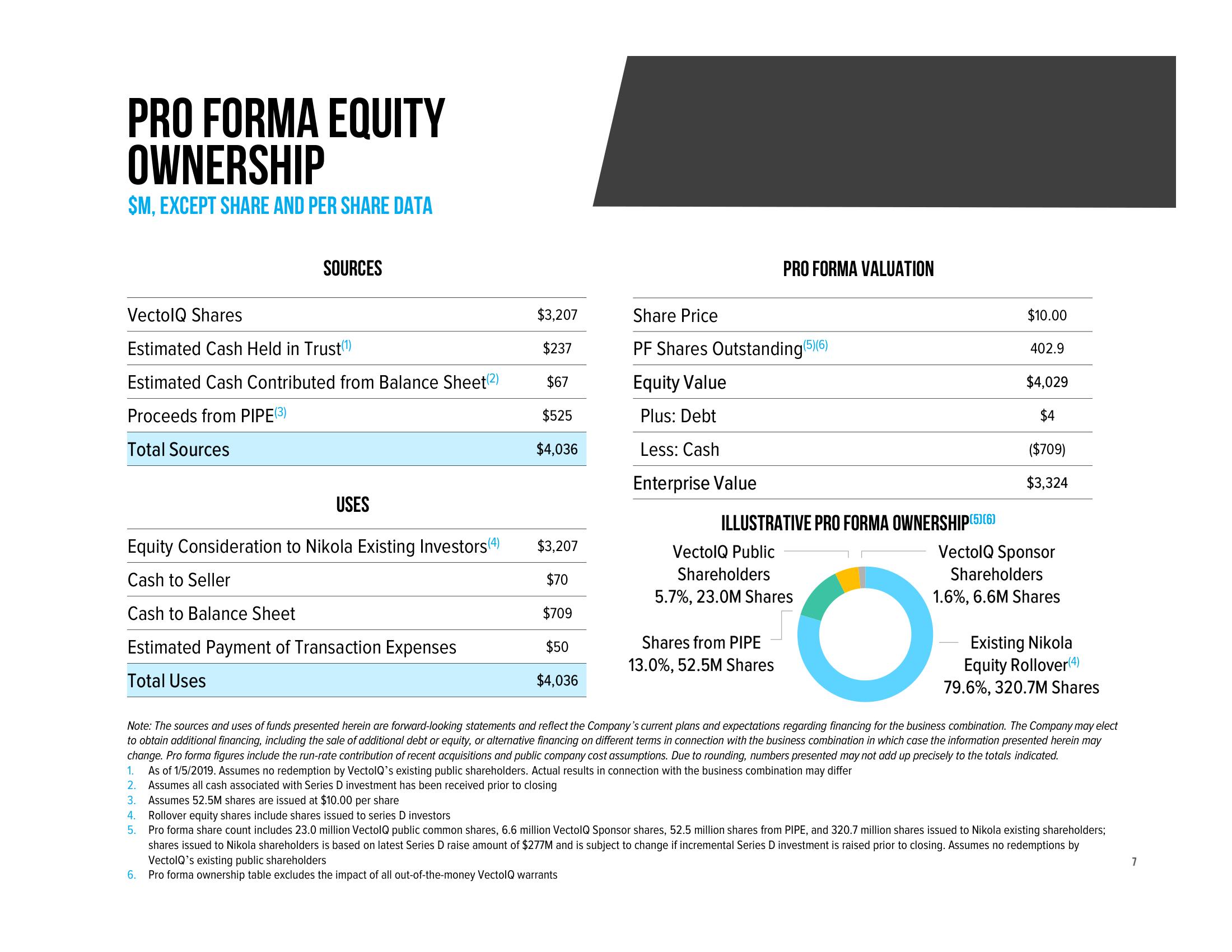

PRO FORMA EQUITY

OWNERSHIP

SM, EXCEPT SHARE AND PER SHARE DATA

SOURCES

VectolQ Shares

Estimated Cash Held in Trust(1)

Estimated Cash Contributed from Balance Sheet(2)

Proceeds from PIPE (3)

Total Sources

USES

Equity Consideration to Nikola Existing Investors(4)

Cash to Seller

Cash to Balance Sheet

Estimated Payment of Transaction Expenses

Total Uses

$3,207

$237

$67

$525

$4,036

$3,207

$70

$709

$50

$4,036

PRO FORMA VALUATION

Share Price

PF Shares Outstanding (5)(6)

Equity Value

Plus: Debt

Less: Cash

Enterprise Value

ILLUSTRATIVE PRO FORMA OWNERSHIP(5)(6)

VectolQ Public

Shareholders

5.7%, 23.0M Shares

Shares from PIPE

13.0%, 52.5M Shares

$10.00

402.9

$4,029

$4

($709)

$3,324

VectolQ Sponsor

Shareholders

1.6%, 6.6M Shares

O

Note: The sources and uses of funds presented herein are forward-looking statements and reflect the Company's current plans and expectations regarding financing for the business combination. The Company may elect

to obtain additional financing, including the sale of additional debt or equity, or alternative financing on different terms in connection with the business combination in which case the information presented herein may

change. Pro forma figures include the run-rate contribution of recent acquisitions and public company cost assumptions. Due to rounding, numbers presented may not add up precisely to the totals indicated.

1.

As of 1/5/2019. Assumes no redemption by VectolQ's existing public shareholders. Actual results in connection with the business combination may differ

2. Assumes all cash associated with Series D investment has been received prior to closing

3.

Assumes 52.5M shares are issued at $10.00 per share

4.

Rollover equity shares include shares issued to series D investors

5.

Pro forma share count includes 23.0 million VectolQ public common shares, 6.6 million VectolQ Sponsor shares, 52.5 million shares from PIPE, and 320.7 million shares issued to Nikola existing shareholders;

shares issued to Nikola shareholders is based on latest Series D raise amount of $277M and is subject to change if incremental Series D investment is raised prior to closing. Assumes no redemptions by

VectolQ's existing public shareholders

6.

Pro forma ownership table excludes the impact of all out-of-the-money VectolQ warrants

Existing Nikola

Equity Rollover (4)

79.6%, 320.7M Shares

7View entire presentation