Evercore Investment Banking Pitch Book

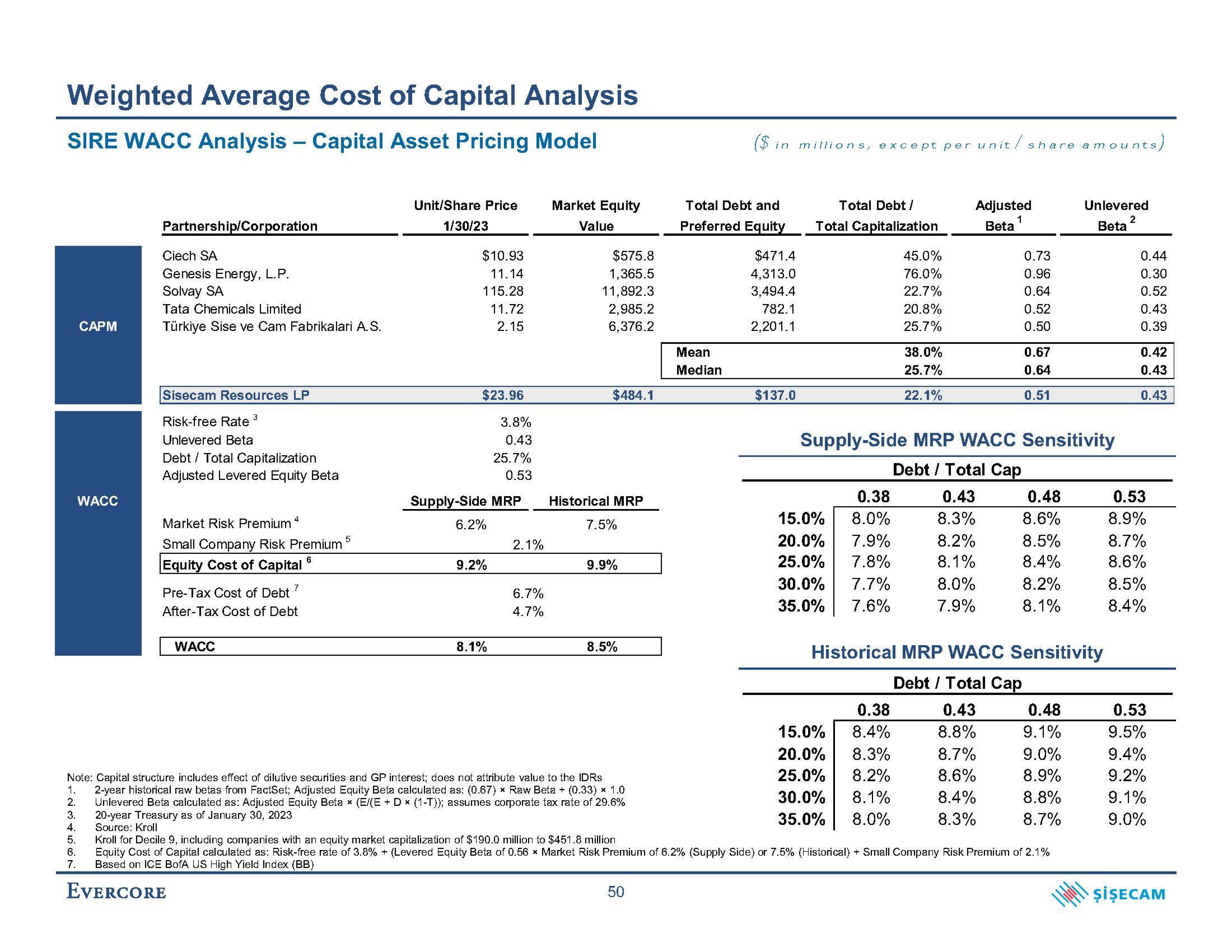

Weighted Average Cost of Capital Analysis

SIRE WACC Analysis - Capital Asset Pricing Model

CAPM

WACC

1.

2.

3.

4.

5.

6.

7.

Partnership/Corporation

Ciech SA

Genesis Energy, L.P.

Solvay SA

Tata Chemicals Limited

Türkiye Sise ve Cam Fabrikalari A.S.

Sisecam Resources LP

3

Risk-free Rate

Unlevered Beta

Debt Total Capitalization

Adjusted Levered Equity Beta

4

Market Risk Premium

Small Company Risk Premium

6

Equity Cost of Capital

Pre-Tax Cost of Debt?

After-Tax Cost of Debt

WACC

5

Unit/Share Price

1/30/23

$10.93

11.14

115.28

11.72

2.15

$23.96

Supply-Side MRP

6.2%

9.2%

3.8%

0.43

25.7%

0.53

8.1%

2.1%

6.7%

4.7%

Market Equity

Value

$575.8

1,365.5

11,892.3

2,985.2

6,376.2

$484.1

Historical MRP

7.5%

9.9%

8.5%

Note: Capital structure includes effect of dilutive securities and GP interest; does not attribute value to the IDRs

2-year historical raw betas from FactSet; Adjusted Equity Beta calculated as: (0.67) x Raw Beta + (0.33) × 1.0

Unlevered Beta calculated as: Adjusted Equity Beta x (E/(E + D x (1-T)); assumes corporate tax rate of 29.6%

20-year Treasury as of January 30, 2023

Source: Kroll

50

($ in millions, except per unit / share amounts,

Total Debt and

Preferred Equity

Mean

Median

$471.4

4,313.0

3,494.4

782.1

2,201.1

$137.0

Total Debt /

Total Capitalization

0.38

15.0%

8.0%

20.0% 7.9%

25.0% 7.8%

30.0% 7.7%

35.0% 7.6%

45.0%

76.0%

22.7%

20.8%

25.7%

38.0%

25.7%

22.1%

0.38

15.0% 8.4%

20.0% 8.3%

25.0% 8.2%

30.0% 8.1%

35.0% 8.0%

Adjusted

Beta

1

0.73

0.96

0.64

0.52

0.50

Supply-Side MRP WACC Sensitivity

Debt / Total Cap

0.43

8.3%

8.2%

8.1%

8.0%

7.9%

0.67

0.64

0.51

0.48

8.6%

8.5%

8.4%

8.2%

8.1%

Historical MRP WACC Sensitivity

Debt / Total Cap

0.43

8.8%

8.7%

8.6%

8.4%

8.3%

0.48

9.1%

Unlevered

Beta

2

9.0%

8.9%

8.8%

8.7%

Kroll for Decile 9, including companies with an equity market capitalization of $190.0 million to $451.8 million

Equity Cost of Capital calculated as: Risk-free rate of 3.8% + (Levered Equity Beta of 0.56 x Market Risk Premium of 6.2% (Supply Side) or 7.5% (Historical) + Small Company Risk Premium of 2.1%

Based on ICE BofA US High Yield Index (BB)

EVERCORE

0.44

0.30

0.52

0.43

0.39

0.42

0.43

0.43

0.53

8.9%

8.7%

8.6%

8.5%

8.4%

0.53

9.5%

9.4%

9.2%

9.1%

9.0%

ŞİŞECAMView entire presentation