Sonos Results Presentation Deck

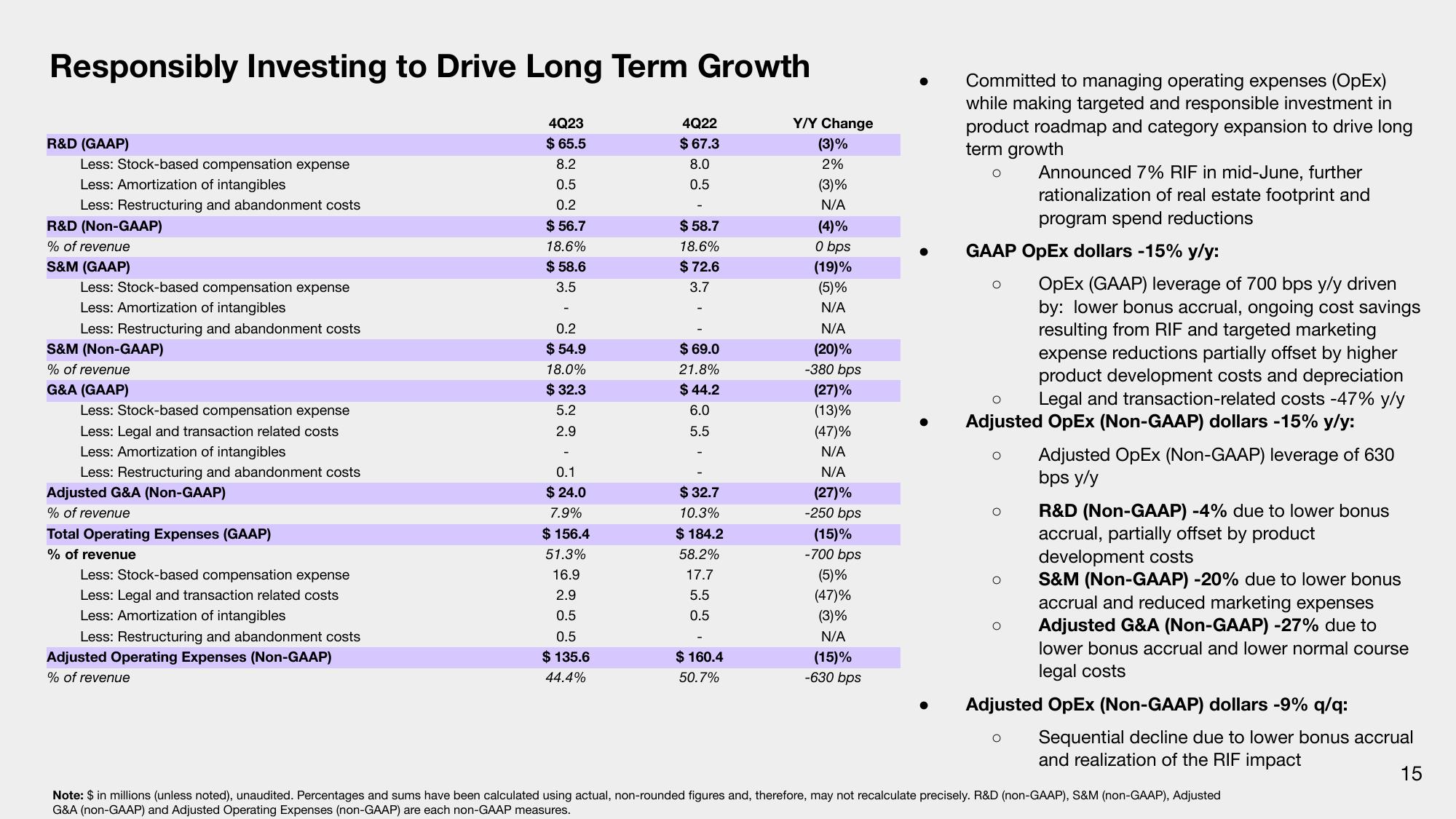

Responsibly Investing to Drive Long Term Growth

4Q23

$65.5

8.2

0.5

0.2

$56.7

18.6%

$ 58.6

3.5

R&D (GAAP)

Less: Stock-based compensation expense

Less: Amortization of intangibles

Less: Restructuring and abandonment costs

R&D (Non-GAAP)

% of revenue

S&M (GAAP)

Less: Stock-based compensation expense

Less: Amortization of intangibles

Less: Restructuring and abandonment costs

S&M (Non-GAAP)

% of revenue

G&A (GAAP)

Less: Stock-based compensation expense

Less: Legal and transaction related costs

Less: Amortization of intangibles

Less: Restructuring and abandonment costs

Adjusted G&A (Non-GAAP)

% of revenue

Total Operating Expenses (GAAP)

% of revenue

Less: Stock-based compensation expense

Less: Legal and transaction related costs

Less: Amortization of intangibles

Restructuring and abandonment costs

Adjusted Operating Expenses (Non-GAAP)

% of revenue

0.2

$ 54.9

18.0%

$32.3

5.2

2.9

0.1

$24.0

7.9%

$ 156.4

51.3%

16.9

2.9

0.5

0.5

$135.6

44.4%

4Q22

$67.3

8.0

0.5

$ 58.7

18.6%

$72.6

3.7

$69.0

21.8%

$44.2

6.0

5.5

$32.7

10.3%

$184.2

58.2%

17.7

5.5

0.5

$160.4

50.7%

Y/Y Change

(3)%

2%

(3)%

N/A

(4)%

0 bps

(19)%

(5)%

N/A

N/A

(20)%

-380 bps

(27)%

(13)%

(47)%

N/A

N/A

(27)%

-250 bps

(15)%

-700 bps

(5)%

(47)%

(3)%

N/A

(15)%

-630 bps

Committed to managing operating expenses (OpEx)

while making targeted and responsible investment in

product roadmap and category expansion to drive long

term growth

O

GAAP OpEx dollars -15% y/y:

OpEx (GAAP) leverage of 700 bps y/y driven

by: lower bonus accrual, ongoing cost savings

resulting from RIF and targeted marketing

expense reductions partially offset by higher

product development costs and depreciation

Legal and transaction-related costs -47% y/y

Adjusted OpEx (Non-GAAP) dollars -15% y/y:

O

O

O

O

O

Announced 7% RIF in mid-June, further

rationalization of real estate footprint and

program spend reductions

O

Adjusted OpEx (Non-GAAP) leverage of 630

bps y/y

R&D (Non-GAAP) -4% due to lower bonus

accrual, partially offset by product

development costs

S&M (Non-GAAP) -20% due to lower bonus

accrual and reduced marketing expenses

Adjusted G&A (Non-GAAP) -27% due to

lower bonus accrual and lower normal course

legal costs

Adjusted OpEx (Non-GAAP) dollars -9% q/q:

Sequential decline due to lower bonus accrual

and realization of the RIF impact

Note: $ in millions (unless noted), unaudited. Percentages and sums have been calculated using actual, non-rounded figures and, therefore, may not recalculate precisely. R&D (non-GAAP), S&M (non-GAAP), Adjusted

G&A (non-GAAP) and Adjusted Operating Expenses (non-GAAP) are each non-GAAP measures.

15View entire presentation