Evercore Investment Banking Pitch Book

Preliminary Financial Analysis

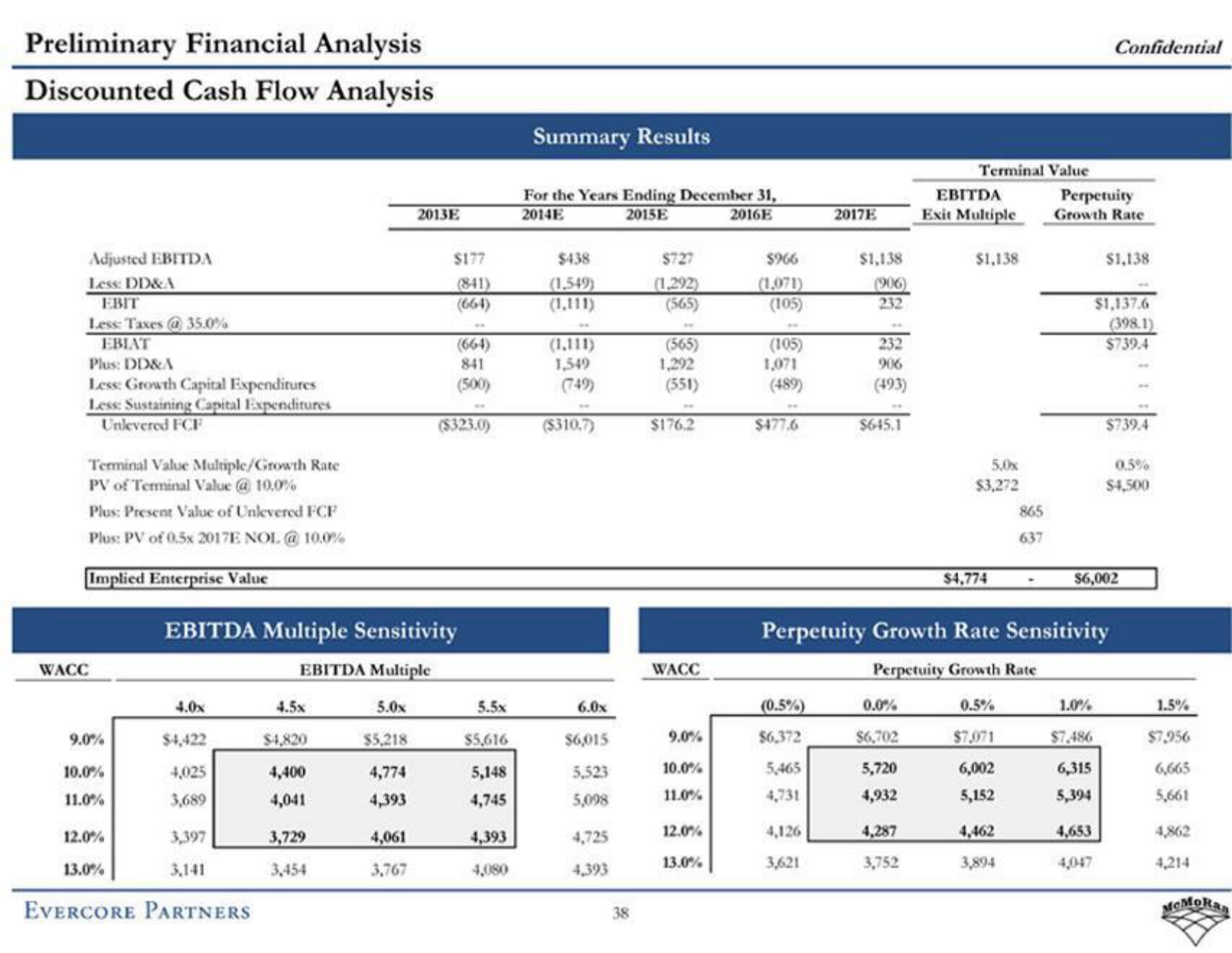

Discounted Cash Flow Analysis

Adjusted EBITDA

Less: DD&A

EBIT

Less: Taxes @ 35.0%

EBIAT

Plus: DD&A

Less: Growth Capital Expenditures

Less: Sustaining Capital Expenditures

Unlevered FCF

Terminal Value Multiple/Growth Rate

PV of Terminal Value @ 10.0%

Plus: Present Value of Unlevered FCF

Plus: PV of 0.5x 2017E NOL @ 10.0%

Implied Enterprise Value

WACC

9.0%

10.0%

11.0%

12.0%

13.0%

4.0x

$4,422

4,025

3,689

3,397

3,141

EVERCORE PARTNERS

EBITDA Multiple Sensitivity

EBITDA Multiple

5.0x

$5,218

4,774

4,393

4.5x

$4,820

4,400

4,041

3,729

3,454

2013E

4,061

3,767

$177

(841)

(664)

(664)

841

(500)

($323.0)

5.5x

$5,616

5,148

4,745

4,393

Summary Results

For the Years Ending December 31,

2014E

2015E

2016E

$438

(1,549)

(1,111)

(1,111)

1,549

(749)

($310.7)

6.0x

$6,015

5,523

5,098

4,725

4,393

38

$727

(1,292)

(565)

(565)

1,292

(551)

$176.2

WACC

9.0%

10.0%

11.0%

12.0%

13.0%

$966

(1,071)

(105)

(105)

1,071

(489)

$477.6

(0.5%)

$6,372

5,465

4,731

2017E

4,126

3,621

$1,138

(906)

232

232

906

(493)

$645.1

0.0%

$6,702

5,720

4,932

Terminal Value

4,287

3,752

EBITDA

Exit Multiple

$1,138

5,0x

$3,272

$4,774

865

637

4,462

3,894

Perpetuity

Growth Rate

Perpetuity Growth Rate Sensitivity

Perpetuity Growth Rate

0.5%

$7,071

6,002

5,152

Confidential

1.0%

$7.486

6,315

5,394

$1,138

4,653

4,047

$1,137.6

(398.1)

$739.4

$739.4

$6,002

0.5%

$4,500

1.5%

$7,956

6,665

5,661

4,862

4,214

McMoRanView entire presentation