Sonos Investor Presentation Deck

NEW: Diversified Channel Distribution

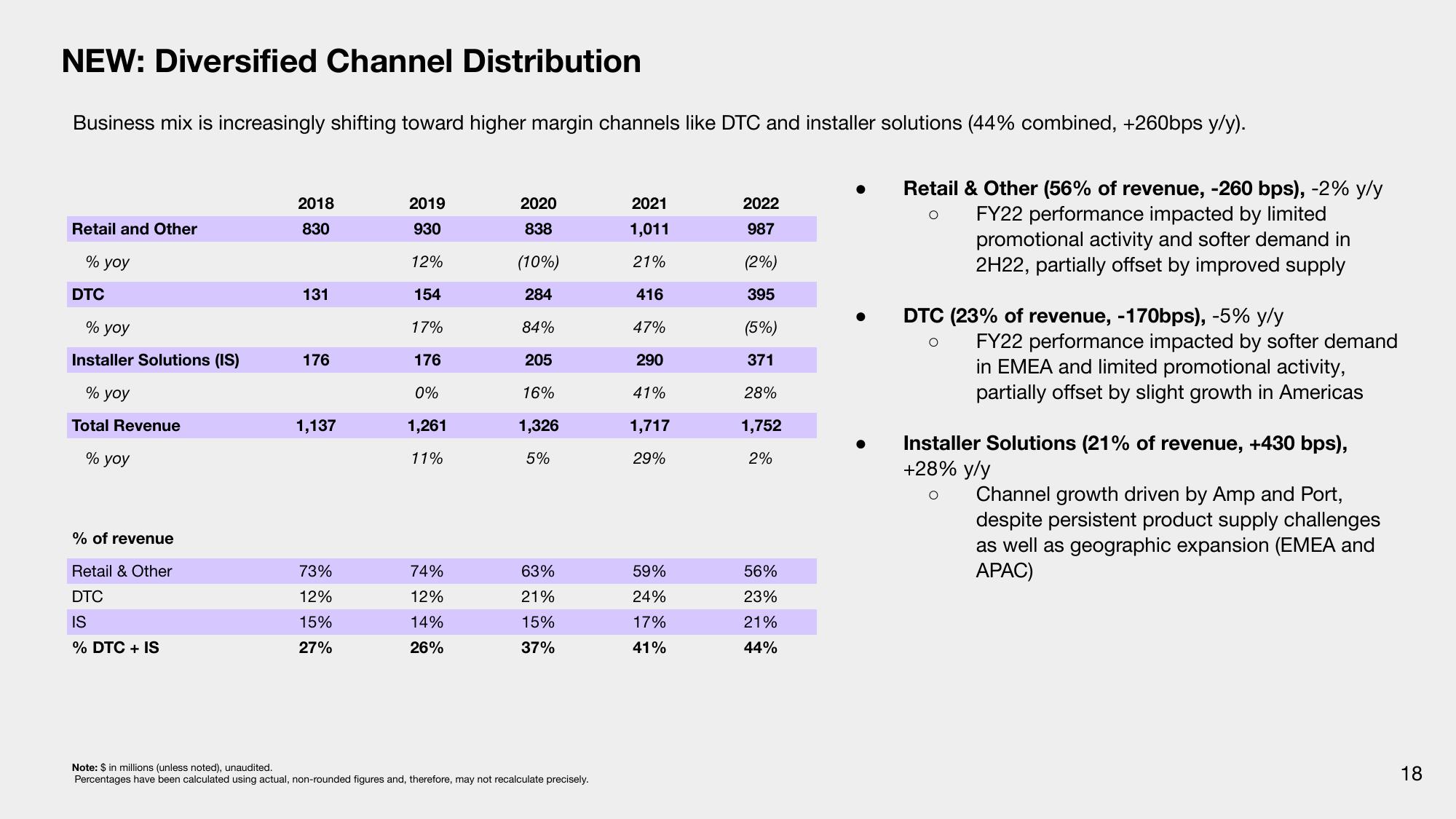

Business mix is increasingly shifting toward higher margin channels like DTC and installer solutions (44% combined, +260bps y/y).

Retail and Other

% yoy

DTC

% yoy

Installer Solutions (IS)

% yoy

Total Revenue

% yoy

% of revenue

Retail & Other

DTC

IS

% DTC + IS

2018

830

131

176

1,137

73%

12%

15%

27%

2019

930

12%

154

17%

176

0%

1,261

11%

74%

12%

14%

26%

2020

838

(10%)

284

84%

205

16%

1,326

5%

63%

21%

15%

37%

Note: $ in millions (unless noted), unaudited.

Percentages have been calculated using actual, non-rounded figures and, therefore, may not recalculate precisely.

2021

1,011

21%

416

47%

290

41%

1,717

29%

59%

24%

17%

41%

2022

987

(2%)

395

(5%)

371

28%

1,752

2%

56%

23%

21%

44%

● Retail & Other (56% of revenue, -260 bps), -2% y/y

FY22 performance impacted by limited

promotional activity and softer demand in

2H22, partially offset by improved supply

O

DTC (23% of revenue, -170bps), -5% y/y

FY22 performance impacted by softer demand

in EMEA and limited promotional activity,

partially offset by slight growth in Americas

Installer Solutions (21% of revenue, +430 bps),

+28% y/y

O

Channel growth driven by Amp and Port,

despite persistent product supply challenges

as well as geographic expansion (EMEA and

APAC)

18View entire presentation