Evercore Investment Banking Pitch Book

Process Considerations

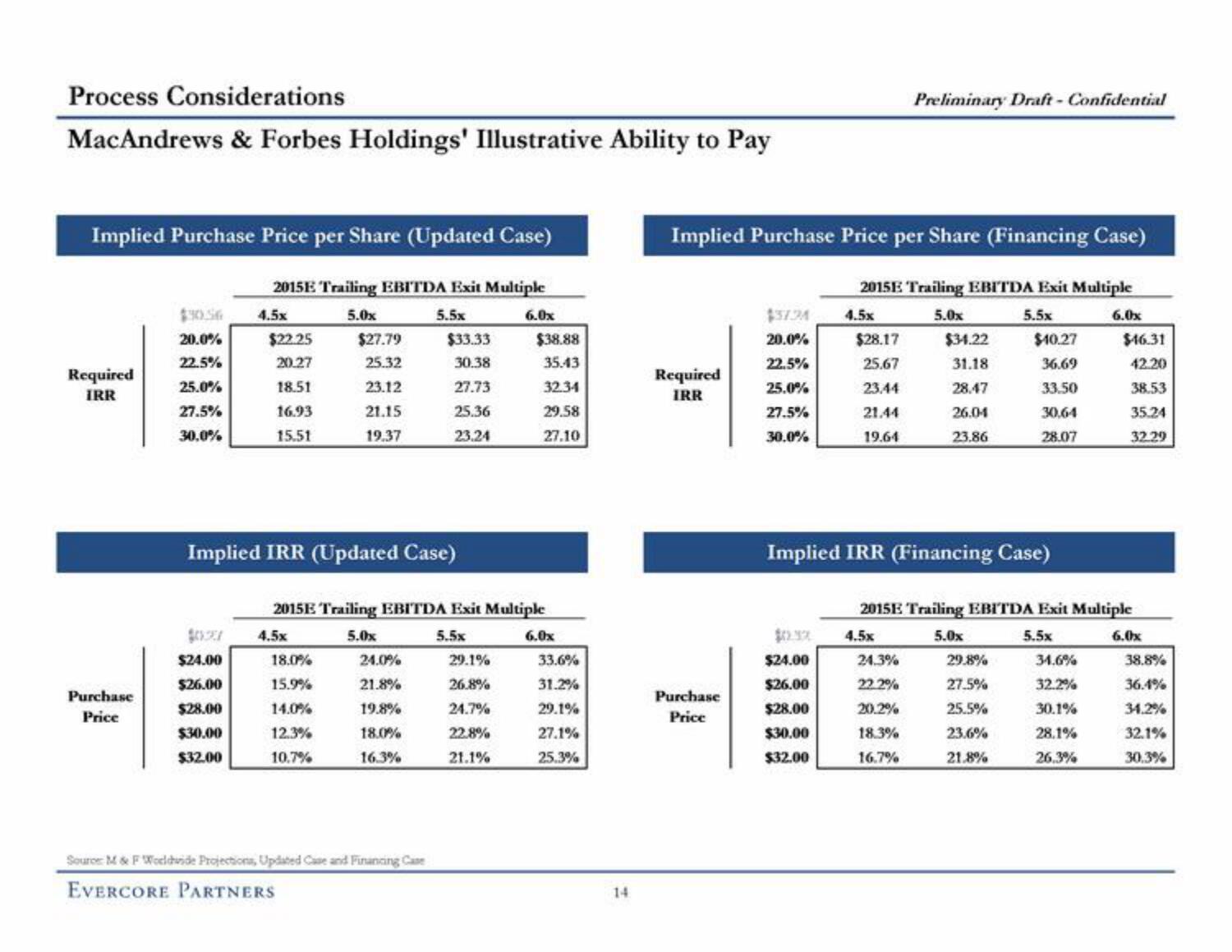

MacAndrews & Forbes Holdings' Illustrative Ability to Pay

Implied Purchase Price per Share (Updated Case)

Required

IRR

Purchase

Price

20.0%

22.5%

25.0%

27.5%

30.0%

2015E Trailing EBITDA Exit Multiple

5.0x

5.5x

$24.00

$26.00

$28.00

$30.00

$32.00

4.5x

$22.25

20.27

18.51

16.93

15.51

Implied IRR (Updated Case)

$27.79

25.32

23.12

21.15

19.37

4.5x

18.0%

15.9%

14.0%

12.3%

10.7%

$33.33

30.38

27.73

25.36

23.24

2015E Trailing EBITDA Exit Multiple

5.0x

5.5x

24.0%

21.8%

19.8%

18.0%

16.3%

Source: M & F Worldnde Projections, Updated Case and Financing Case

EVERCORE PARTNERS

6.0x

29.1%

26.8%

24.7%

22.8%

21.1%

$38.88

35.43

32.34

29.58

27.10

6.0x

33.6%

31.2%

29.1%

27.1%

25.3%

Implied Purchase Price per Share (Financing Case)

Required

IRR

Purchase

Price

$37.34

20.0%

22.5%

25.0%

27.5%

30.0%

$0.32

$24.00

$26.00

$28.00

$30.00

$32.00

Preliminary Draft - Confidential

2015E Trailing EBITDA Exit Multiple

5.5x

5.0x

$34.22

31.18

28.47

26.04

23.86

4.5x

$28.17

25.67

23.44

21.44

19.64

Implied IRR (Financing Case)

24.3%

22.2%

20.2%

18.3%

16.7%

$40.27

36.69

33.50

30.64

28.07

29.8%

27.5%

25.5%

23.6%

21.8%

2015E Trailing EBITDA Exit Multiple

4.5x

5.0x

5.5x

6.0x

34.6%

32.2%

30.1%

28.1%

26.3%

$46.31

42.20

38.53

35.24

32.29

6.0x

38.8%

36.4%

34.2%

32.1%

30.3%View entire presentation