Wallbox SPAC Presentation Deck

CONSOLIDATED FINANCIAL SUMMARY

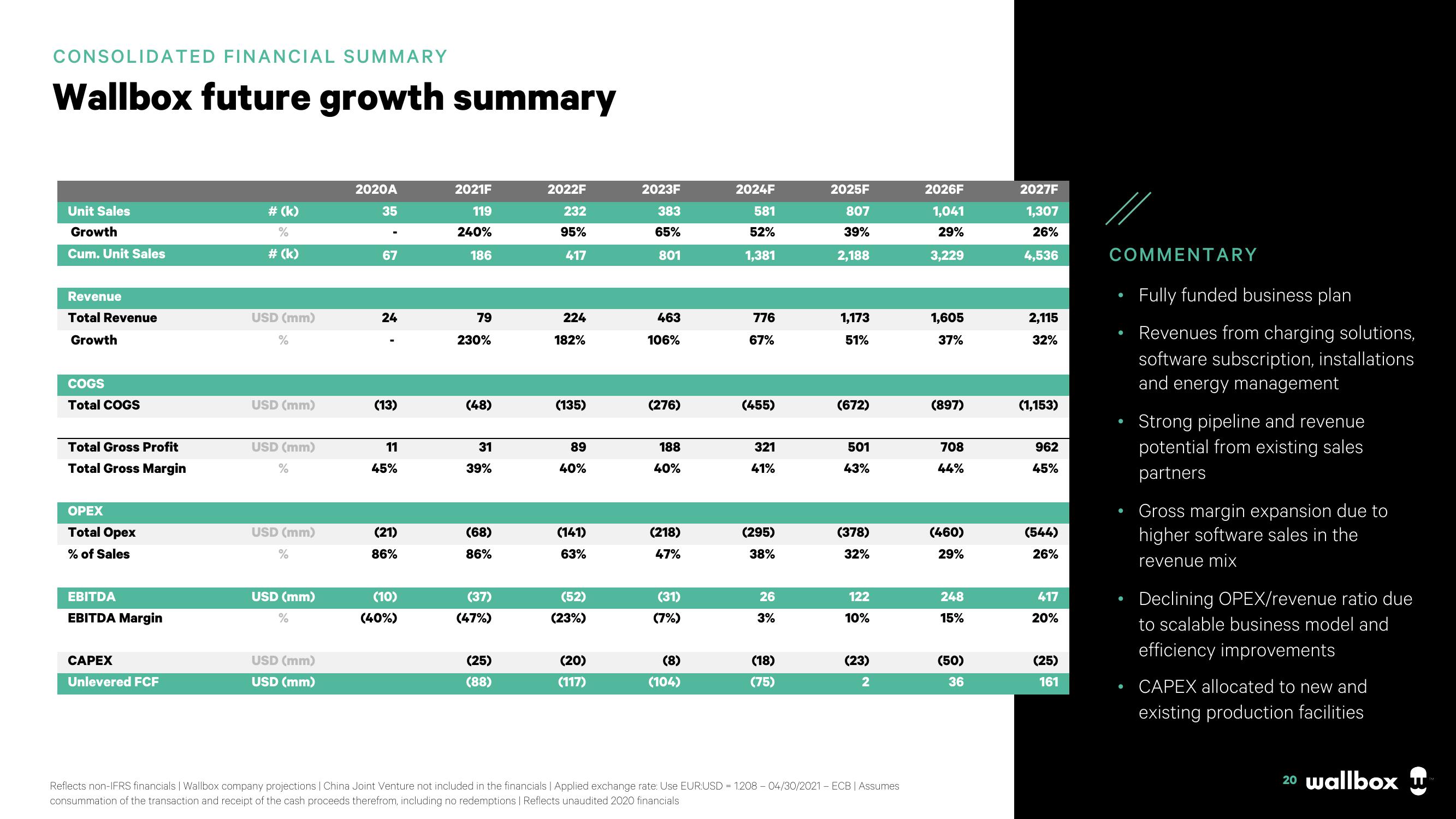

Wallbox future growth summary

Unit Sales

Growth

Cum. Unit Sales

Revenue

Total Revenue

Growth

COGS

Total COGS

Total Gross Profit

Total Gross Margin

OPEX

Total Opex

% of Sales

EBITDA

EBITDA Margin

CAPEX

Unlevered FCF

# (k)

%

# (k)

USD (mm)

%

USD (mm)

USD (mm)

%

USD (mm)

%

USD (mm)

%

USD (mm)

USD (mm)

2020A

35

67

24

(13)

11

45%

(21)

86%

(10)

(40%)

2021F

119

240%

186

79

230%

(48)

31

39%

(68)

86%

(37)

(47%)

(25)

(88)

2022F

232

95%

417

224

182%

(135)

89

40%

(141)

63%

(52)

(23%)

(20)

(117)

2023F

383

65%

801

463

106%

(276)

188

40%

(218)

47%

(31)

(7%)

(8)

(104)

2024F

581

52%

1,381

776

67%

(455)

321

41%

(295)

38%

26

3%

(18)

(75)

2025F

807

39%

2,188

1,173

51%

(672)

501

43%

(378)

32%

122

10%

(23)

2

Reflects non-IFRS financials | Wallbox company projections | China Joint Venture not included in the financials | Applied exchange rate: Use EUR:USD = 1.208 - 04/30/2021-ECB | Assumes

consummation of the transaction and receipt of the cash proceeds therefrom, including no redemptions | Reflects unaudited 2020 financials

2026F

1,041

29%

3,229

1,605

37%

(897)

708

44%

(460)

29%

248

15%

(50)

36

2027F

1,307

26%

4,536

2,115

32%

(1,153)

962

45%

(544)

26%

417

20%

(25)

161

COMMENTARY

●

Fully funded business plan

Revenues from charging solutions,

software subscription, installations

and energy management

Strong pipeline and revenue

potential from existing sales

partners

Gross margin expansion due to

higher software sales in the

revenue mix

Declining OPEX/revenue ratio due

to scalable business model and

efficiency improvements

CAPEX allocated to new and

existing production facilities

20 wallbox wView entire presentation