Tudor, Pickering, Holt & Co Investment Banking

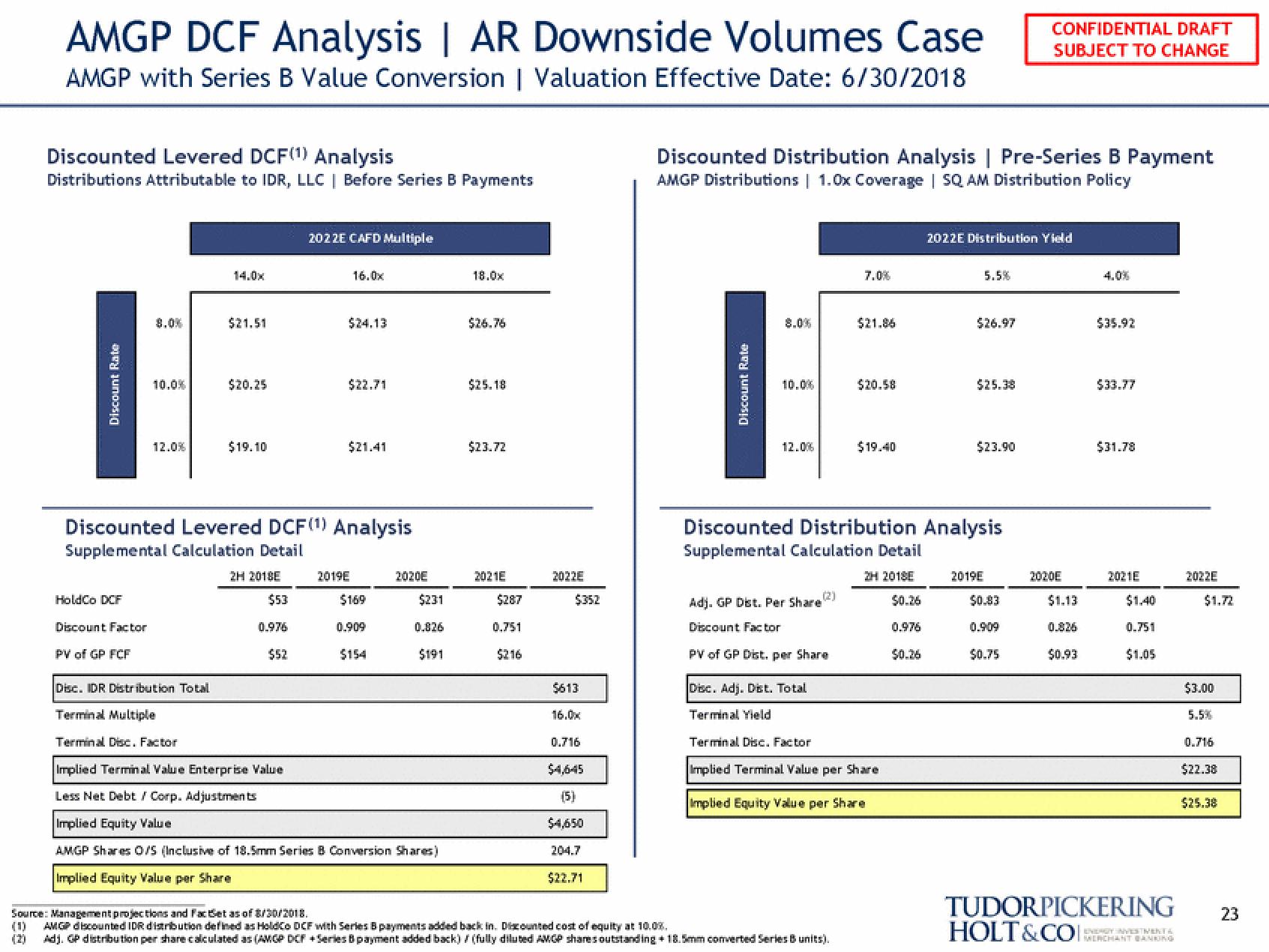

AMGP DCF Analysis | AR Downside Volumes Case

AMGP with Series B Value Conversion | Valuation Effective Date: 6/30/2018

Discounted Levered DCF(1) Analysis

Distributions Attributable to IDR, LLC | Before Series B Payments

Discount Rate

HoldCo DCF

Discount Factor

10.0%

PV of GP FCF

12.0%

14.0x

$21.51

$20.25

$19.10

2H 2018E

Discounted Levered DCF(1) Analysis

Supplemental Calculation Detail

$53

0.976

2022E CAFD Multiple

$52

16.0x

$24.13

$22.71

$21.41

2019E

$169

0.909

$154

2020E

$231

0.826

$191

Disc. IDR Distribution Total

Terminal Multiple

Terminal Disc. Factor

Implied Terminal Value Enterprise Value

Less Net Debt / Corp. Adjustments

Implied Equity Value

AMGP Shares 0/S (Inclusive of 18.5mm Series B Conversion Shares)

Implied Equity Value per Share

18.0x

$26.76

$25.18

$23.72

2021E

$287

0.751

$216

2022E

$352

$613

0.716

$4,645

(5)

$4,650

204.7

$22.71

Discounted Distribution Analysis | Pre-Series B Payment

AMGP Distributions | 1.0x Coverage | SQ AM Distribution Policy

Discount Rate

8.0%

10.0%

12.00

(2)

Adj. GP Dist. Per Share

Discount Factor

PV of GP Dist. per Share

7.0%

$21.86

Source: Management projections and FacBet as of 8/20/2018.

(1) AMGP discounted IDR distribution defined as HoldCo DCF with Series B payments added back in. Discounted cost of equity at 10.08.

Adj. GP distribution per share calculated as (AWGP DCF Series B payment added back) / (fully diluted AWGP shares outstanding + 18.5mm converted Series B units).

$20.58

$19.40

Disc. Adj. Dist. Total

Terminal Yield

Terminal Disc. Factor

Implied Terminal Value per Share

Implied Equity Value per Share

Discounted Distribution Analysis

Supplemental Calculation Detail

2H 2018E

50.26

0.976

50.26

2022E Distribution Yield

5.5%

$26.97

$25.38

$23.90

CONFIDENTIAL DRAFT

SUBJECT TO CHANGE

2019E

$0.83

0.909

$0.75

2020E

$1.13

0.826

$0.93

$35.92

$33.77

$31.78

2021E

$1,40

0.751

$1.05

TUDORPICKERING

HOLT&CO

MERCHANT BANKING

2022E

$1.72

$3.00

5.5%

0.716

$22.38

$25.38

23View entire presentation