Evercore Investment Banking Pitch Book

Preliminary Situation Assessment

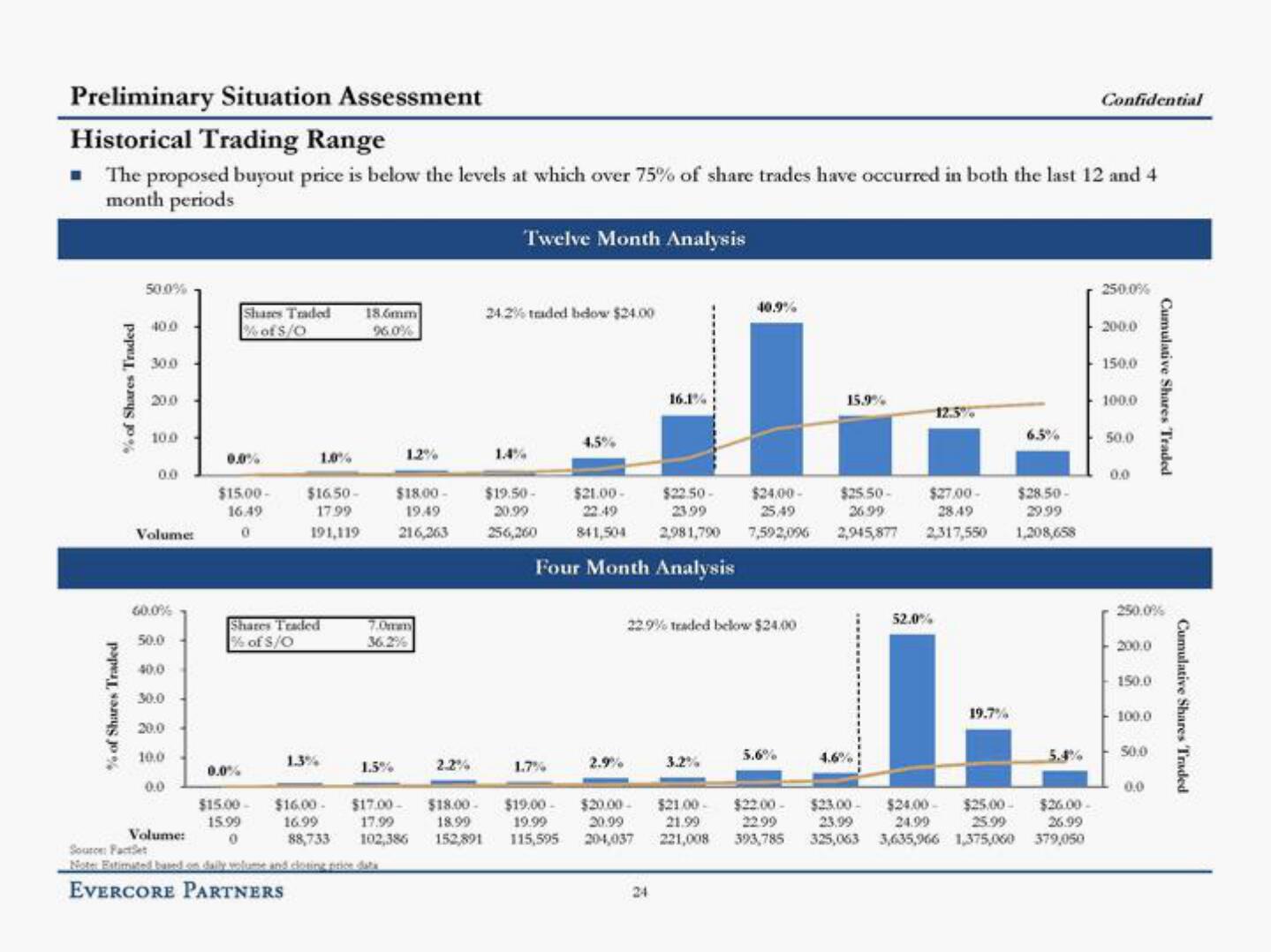

Historical Trading Range

■ The proposed buyout price is below the levels at which over 75% of share trades have occurred in both the last 12 and 4

month periods

Twelve Month Analysis

% of Shares Traded

% of Shares Traded

50.0%

40.0

30.0

20.0

10.0

0.0

Volume:

60.0%

50.0

40,0

30.0

20.0

10.0

0.0

Shares Traded

% of $/0

0.0%

$15.00-

16.49

0

0.0%

Shares Traded

% of $/O

$15.00-

15.99

0

1.0%

$16.50-

17.99

191,119

1.3%

$16.00-

16.99

18.6mm

96.0%

1.5%

1.2%

7.0mm

36.2%

$18.00-

19.49

216,263

Volume:

Source: FactSet

Note Estimated based on daily volume and cloting price data

EVERCORE PARTNERS

2.2%

24.2% traded below $24.00

1.4%

$19.50-

20.99

256,260

1.7%

$17.00- $18.00-

17.99 18.99

$19.00-

19.99

88,733 102,386 152,891 115,595

4.5%

Four Month Analysis

$21.00-

22.49

$22.50-

23.99

$24.00-

25.49

841,504 2,981,790 7,592,096

2.9%

16.1%

$20.00-

20.99

204,037

22.9% traded below $24.00

24

40.9%

3.2%

5.6%

15.9%

$25.50-

$27.00-

26.99

28.49

2,945,877 2,317,550

4.6%

12.5%

52.0%

19.7%

6.5%

$28.50-

29.99

1,208,658

$21.00- $22.00-

$23.00-

$24.00- $25.00- $26.00-

21.99

22.99

23.99

24.99 25.99 26.99

221,008 393,785 325,063 3,635,966 1,375,060 379,050

Confidential

250.0%

200.0

150,0

100.0

50.0

0.0

250.0%

200.0

150.0

100.0

50,0

Cumulative Shares Traded

0.0

Cumulative Shares TradedView entire presentation