Lazard Investor Presentation Deck

INVESTOR PRESENTATION

Seed Funds

Accelerators

Angel Investors

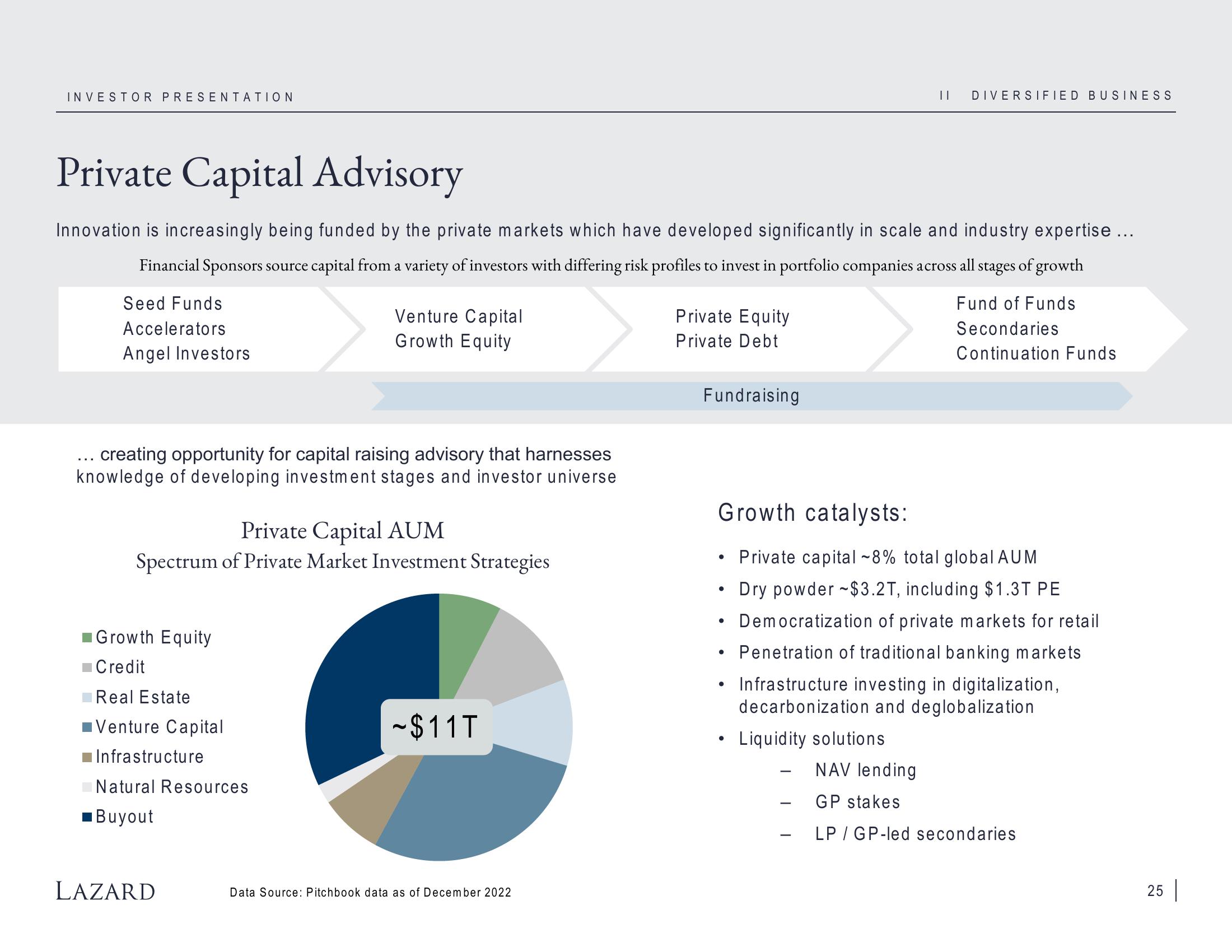

Private Capital Advisory

Innovation is increasingly being funded by the private markets which have developed significantly in scale and industry expertise ...

Financial Sponsors source capital from a variety of investors with differing risk profiles to invest in portfolio companies across all stages of growth

... creating opportunity for capital raising advisory that harnesses

knowledge of developing investment stages and investor universe

Private Capital AUM

Spectrum of Private Market Investment Strategies

Growth Equity

Credit

Real Estate

Venture Capital

Infrastructure

Natural Resources

Venture Capital

Growth Equity

■Buyout

LAZARD

~$11T

Data Source: Pitchbook data as of December 2022

Private Equity

Private Debt

Fundraising

●

||

●

DIVERSIFIED BUSINESS

Growth catalysts:

Private capital -8% total global AUM

Dry powder -$3.2T, including $1.3T PE

Democratization of private markets for retail

• Penetration of traditional banking markets

Infrastructure investing in digitalization,

decarbonization and deglobalization

• Liquidity solutions

Fund of Funds

Secondaries

Continuation Funds

NAV lending

GP stakes

LP / GP-led secondaries

25 |View entire presentation