Navitas SPAC Presentation Deck

Live Oak Partnership Provides de-SPAC Advantages

Live Oak is the Preferred

Merger Partner

LIVE OAK

ACQUISITION CORP ||

Generate a stable and long-term oriented shareholder base

▪ Live Oak maintains a network of direct investor relationships with

large institutional money managers, hedge funds, private equity and

family offices

▪ Live Oak II's IPO was specifically targeted to accounts who we believe

have a strong interest in maintaining ownership post-business

combination

Strategic advice and resources to assist with a successful

entry into the public markets

▪ Live Oak management and board have held C-level and leadership

positions within public companies, successful SPACs, and investment

managers

I Emphasis on maintaining a high level of credibility with investors as

the Company builds its public market profile

▪ Attract broader research coverage and maintain a high-profile

presence at Wall Street and industry conferences

Attract capital to fund future growth needs

▪ Deep capital markets experience, including two former CEOs of firms

that specialized in institutional capital raises for small- and mid-cap

companies

O Navitas Semiconductor 2021

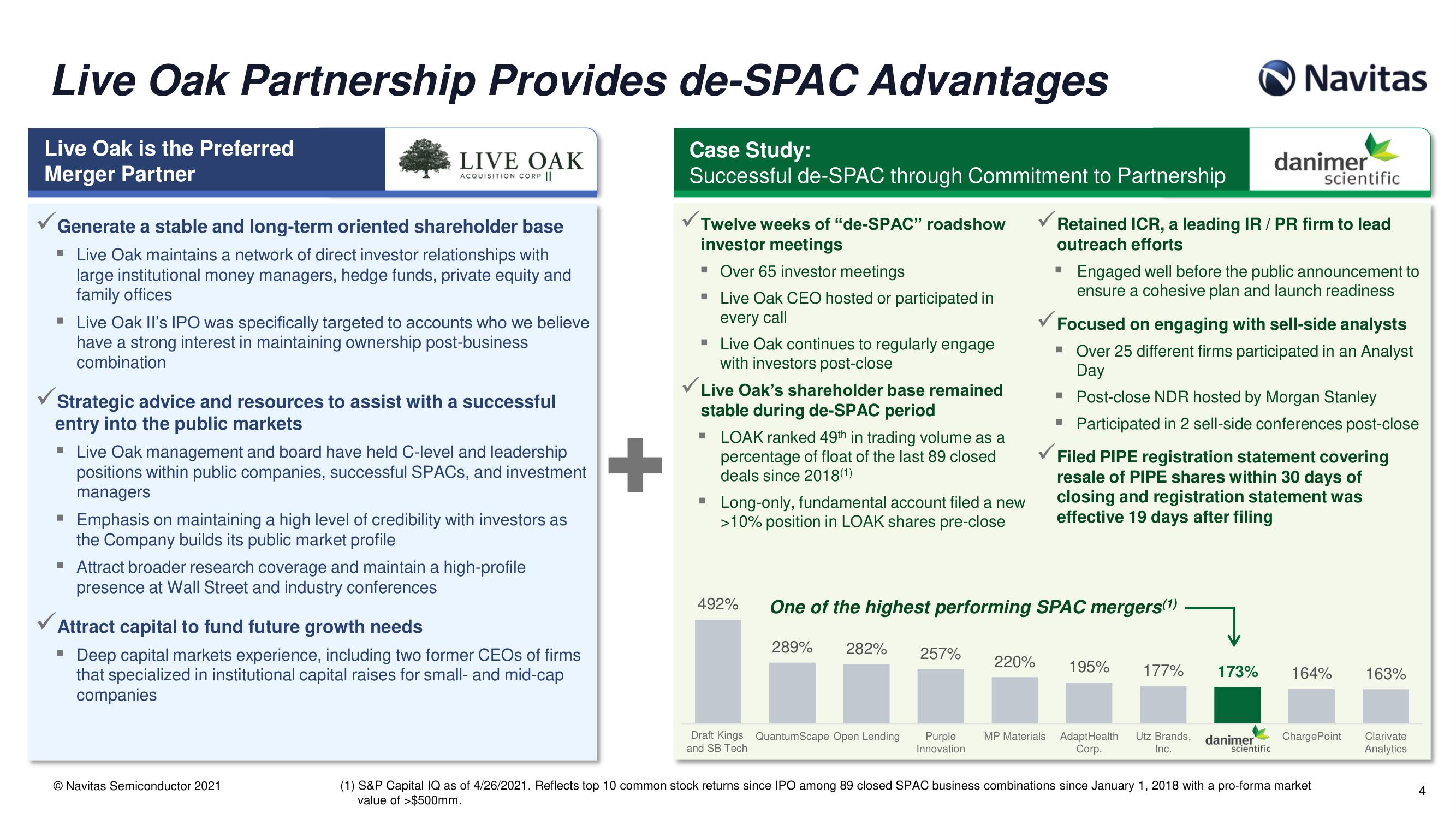

Case Study:

Successful de-SPAC through Commitment to Partnership

Twelve weeks of "de-SPAC" roadshow

investor meetings

■ Over 65 investor meetings

▪ Live Oak CEO hosted or participated in

every call

■ Live Oak continues to regularly engage

with investors post-close

Live Oak's shareholder base remained

stable during de-SPAC period

LOAK ranked 49th in trading volume as a

percentage of float of the last 89 closed

deals since 2018(1)

▪ Long-only, fundamental account filed a new

>10% position in LOAK shares pre-close

492%

289%

282%

Draft Kings QuantumScape Open Lending

and SB Tech

257%

Purple

Innovation

220%

■

One of the highest performing SPAC mergers(1)

Retained ICR, a leading IR / PR firm to lead

outreach efforts

■

■

Focused on engaging with sell-side analysts

Over 25 different firms participated in an Analyst

Day

■

Navitas

Engaged well before the public announcement to

ensure a cohesive plan and launch readiness

Post-close NDR hosted by Morgan Stanley

Participated in 2 sell-side conferences post-close

Filed PIPE registration statement covering

resale of PIPE shares within 30 days of

closing and registration statement was

effective 19 days after filing

danimer

195% 177%

MP Materials AdaptHealth Utz Brands,

Corp.

Inc.

scientific

danimer

scientific

173% 164%

ChargePoint

(1) S&P Capital IQ as of 4/26/2021. Reflects top 10 common stock returns since IPO among 89 closed SPAC business combinations since January 1, 2018 with a pro-forma market

value of $500mm.

163%

Clarivate

Analytics

4View entire presentation