Main Street Capital Investor Day Presentation Deck

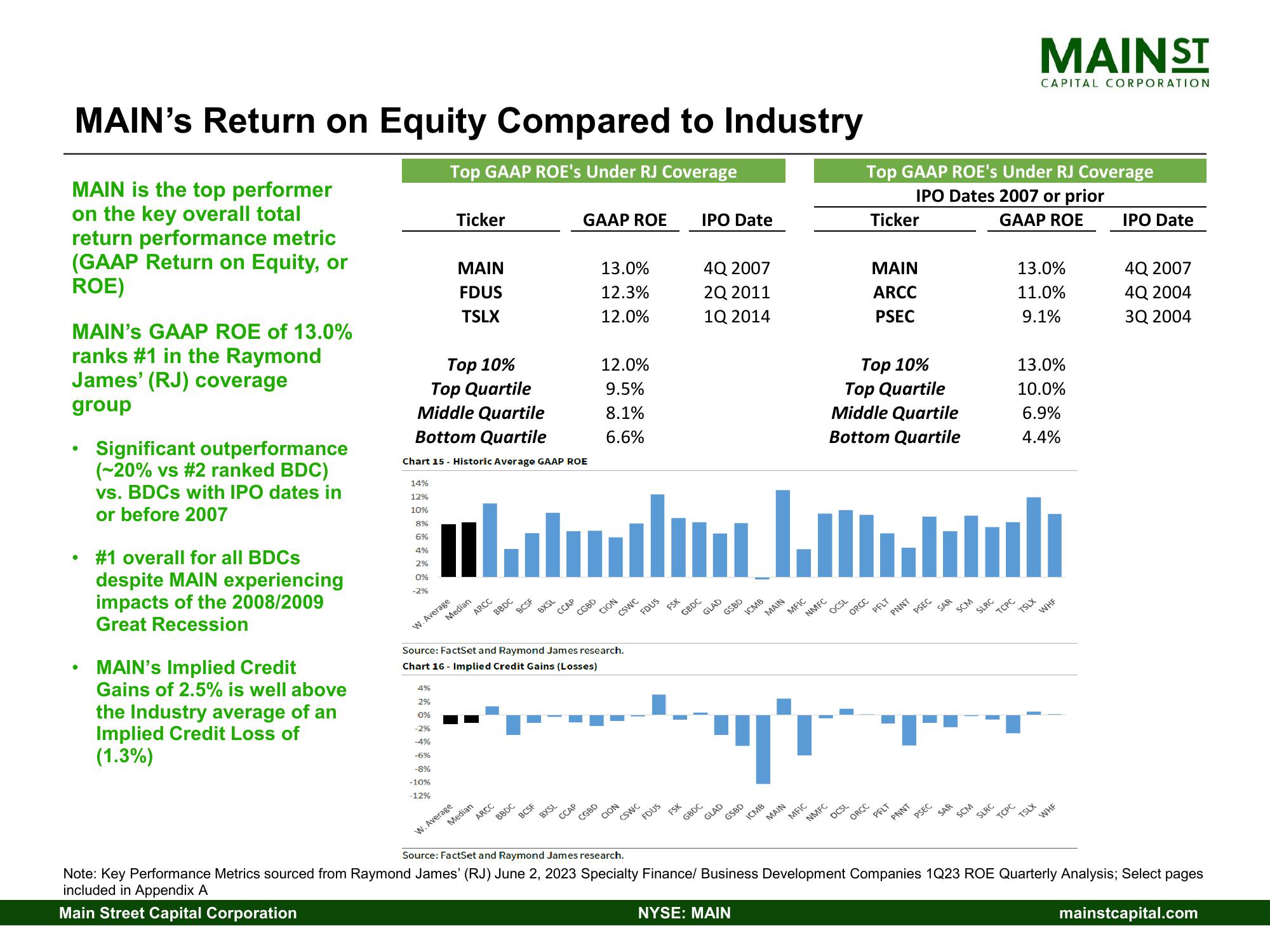

MAIN's Return on Equity Compared to Industry

Top GAAP ROE's Under RJ Coverage

MAIN is the top performer

on the key overall total

return performance metric

(GAAP Return on Equity, or

ROE)

MAIN'S GAAP ROE of 13.0%

ranks #1 in the Raymond

James' (RJ) coverage

group

●

●

Significant outperformance

(-20% vs #2 ranked BDC)

vs. BDCs with IPO dates in

or before 2007

#1 overall for all BDCs

despite MAIN experiencing

impacts of the 2008/2009

Great Recession

MAIN's Implied Credit

Gains of 2.5% is well above

the Industry average of an

Implied Credit Loss of

(1.3%)

14%

12%

10%

8%

6%

4%

2%

0%

-2%

Ticker

Top 10%

Top Quartile

Middle Quartile

Bottom Quartile

Chart 15 - Historic Average GAAP ROE

4%

2%

10%

MAIN

FDUS

TSLX

W. Average

-2%

-4%

-16%

-8%

-10%

-12%

Median

ARCC

BBDC

W. Average

Median

BCSF

ARCC

BBDC

BXSL

BCSF

............... ..............

LI

Im dali

Source: FactSet and Raymond James research.

Chart 16 - Implied Credit Gains (Losses)

GAAP ROE

CCAP

BXSL

CGBD

CCAP

13.0%

12.3%

12.0%

12.0%

9.5%

8.1%

6.6%

CION

CGBD

CSWC

CION

FDUS

FDUS

CSWC

FSK

IPO Date

4Q 2007

2Q 2011

1Q 2014

FSK

GBDC

GBDC

GLAD

GSBD

S

ICMB

GLAD

MAIN

ICMB

GSBD

MFIC

MFIC

MAIN

Top 10%

Top Quartile

Middle Quartile

Bottom Quartile

OCSL

NMFC

OCSL

NMFC

Top GAAP ROE's Under RJ Coverage

IPO Dates 2007 or prior

Ticker

GAAP ROE

ORCC

MAIN

ARCC

PSEC

PELT

ORCC

PNNT

PFLT

PSEC

PSEC

PNNT

SAR

SAR

SCM

SCM

SLRC

TCPC

SLRC

TCPC

MAINST

CAPITAL CORPORATION

13.0%

11.0%

9.1%

13.0%

10.0%

6.9%

4.4%

TSLX

TSLX

WHF

WHF

IPO Date

4Q 2007

4Q 2004

3Q 2004

Source: FactSet and Raymond James research.

Note: Key Performance Metrics sourced from Raymond James' (RJ) June 2, 2023 Specialty Finance/ Business Development Companies 1Q23 ROE Quarterly Analysis; Select pages

included in Appendix A

Main Street Capital Corporation

NYSE: MAIN

mainstcapital.comView entire presentation