MoneyLion Results Presentation Deck

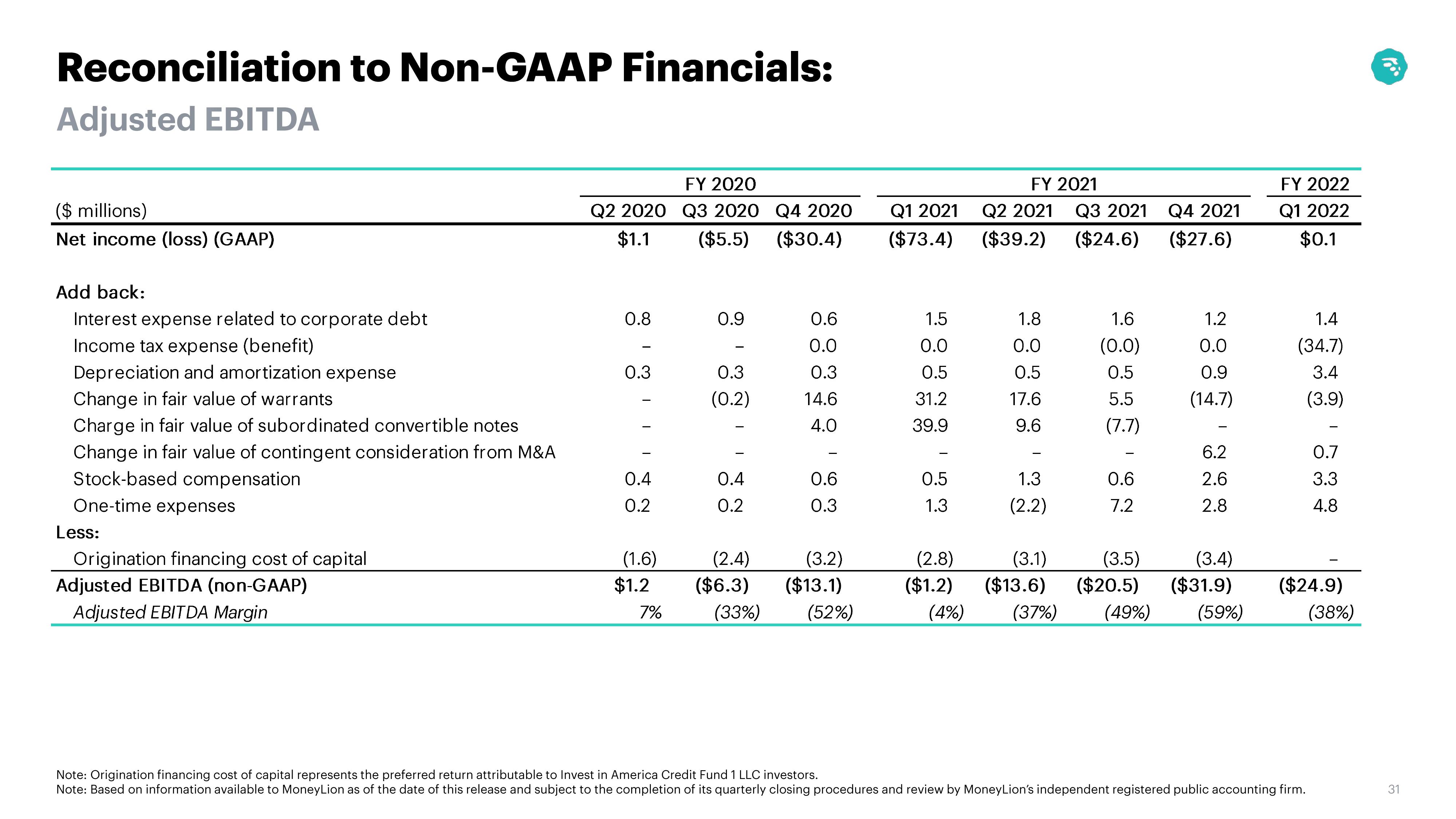

Reconciliation to Non-GAAP Financials:

Adjusted EBITDA

($ millions)

Net income (loss) (GAAP)

Add back:

Interest expense related to corporate debt

Income tax expense (benefit)

Depreciation and amortization expense

Change in fair value of warrants

Charge in fair value of subordinated convertible notes

Change in fair value of contingent consideration from M&A

Stock-based compensation

One-time expenses

Less:

Origination financing cost of capital

Adjusted EBITDA (non-GAAP)

Adjusted EBITDA Margin

Q2 2020

$1.1

0.8

0.3

0.4

0.2

(1.6)

$1.2

7%

FY 2020

Q3 2020 Q4 2020

($5.5) ($30.4)

0.9

0.3

(0.2)

0.4

0.2

0.6

0.0

0.3

14.6

4.0

0.6

0.3

(2.4) (3.2)

($6.3) ($13.1)

(33%)

(52%)

Q1 2021

($73.4)

1.5

0.0

0.5

31.2

39.9

0.5

1.3

FY 2021

Q2 2021

($39.2)

1.8

0.0

0.5

17.6

9.6

1.3

(2.2)

Q3 2021

($24.6)

1.6

(0.0)

0.5

5.5

(7.7)

0.6

7.2

Q4 2021

($27.6)

1.2

0.0

0.9

(14.7)

6.2

2.6

2.8

(3.5)

(3.4)

(2.8)

(3.1)

($1.2) ($13.6) ($20.5) ($31.9)

(4%) (37%) (49%) (59%)

FY 2022

Q1 2022

$0.1

1.4

(34.7)

3.4

(3.9)

0.7

3.3

4.8

($24.9)

(38%)

Note: Origination financing cost of capital represents the preferred return attributable to Invest in America Credit Fund 1 LLC investors.

Note: Based on information available to MoneyLion as of the date of this release and subject to the completion of its quarterly closing procedures and review by MoneyLion's independent registered public accounting firm.

31View entire presentation