Citi Investment Banking Pitch Book

Financing Alternatives Scorecard

22

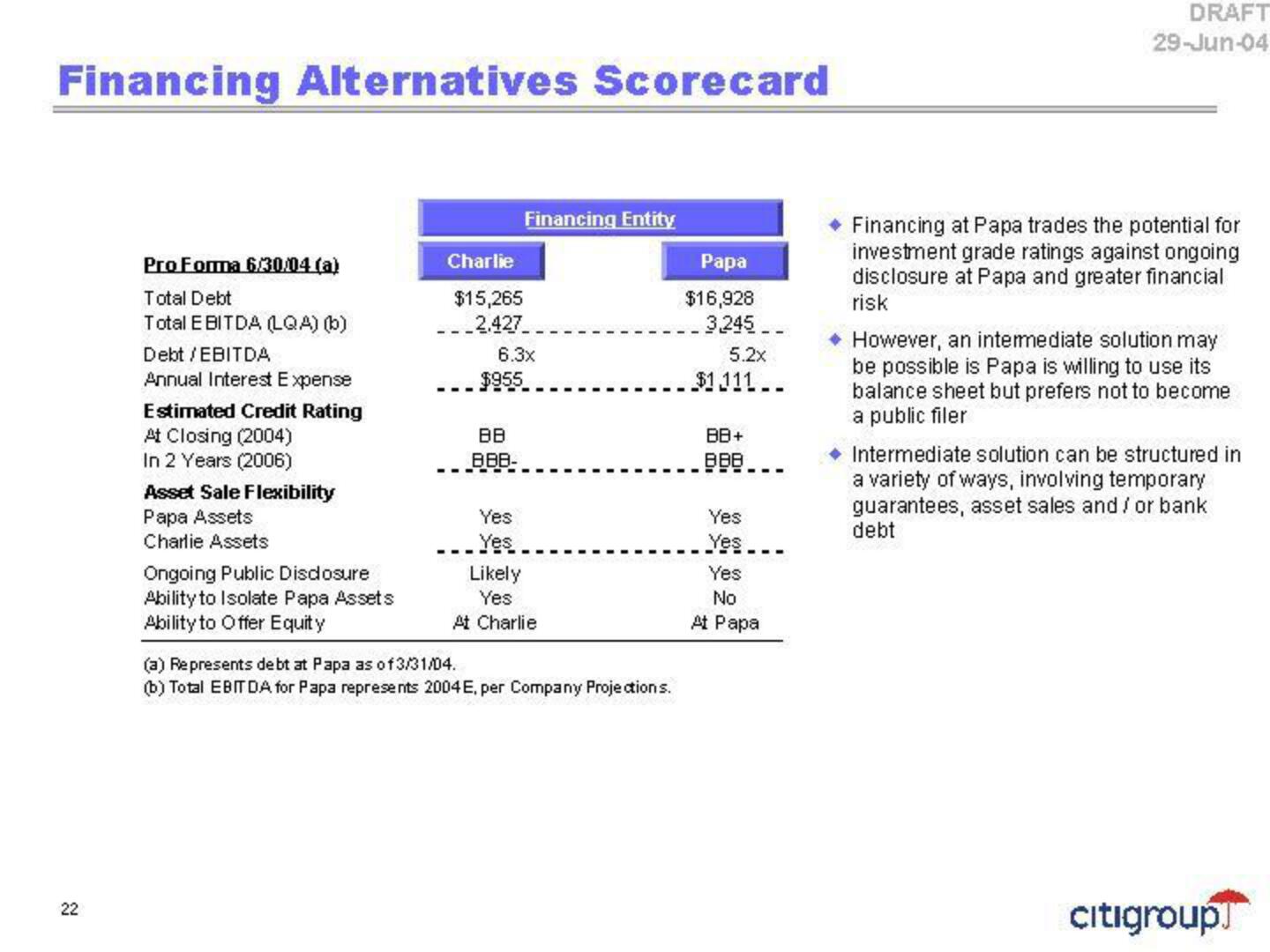

Pro Forma 6/30/04 (a)

Total Debt

Total EBITDA (LQA) (b)

Debt / EBITDA

Annual Interest Expense

Estimated Credit Rating

At Closing (2004)

In 2 Years (2006)

Asset Sale Flexibility

Papa Assets

Charlie Assets

Ongoing Public Disdosure

Ability to Isolate Papa Assets

Ability to Offer Equity

Charlie

$15,265

2.427

6.3x

$955

BB

888-

Financing Entity

Yes

Yes

Likely

Yes

At Charlie

(a) Represents debt at Papa as of 3/31/04.

(b) Total EBITDA for Papa represents 2004 E, per Company Projections.

Papa

$16,928

3,245

5.2x

$1111..

BB+

888

Yes

Yes

Yes

No

At Papa

DRAFT

29-Jun-04

◆ Financing at Papa trades the potential for

investment grade ratings against ongoing

disclosure at Papa and greater financial

risk

◆ However, an intermediate solution may

be possible is Papa is willing to use its

balance sheet but prefers not to become

a public filer

◆ Intermediate solution can be structured in

a variety of ways, involving temporary

guarantees, asset sales and / or bank

debt

Citigroup]View entire presentation