Pathward Financial Results Presentation Deck

LEGACY COMMUNITY BANK PORTFOLIO BREAKDOWN

AS OF DECEMBER 31, 2020 | SERVICED BY CENTRAL BANK

●

●

●

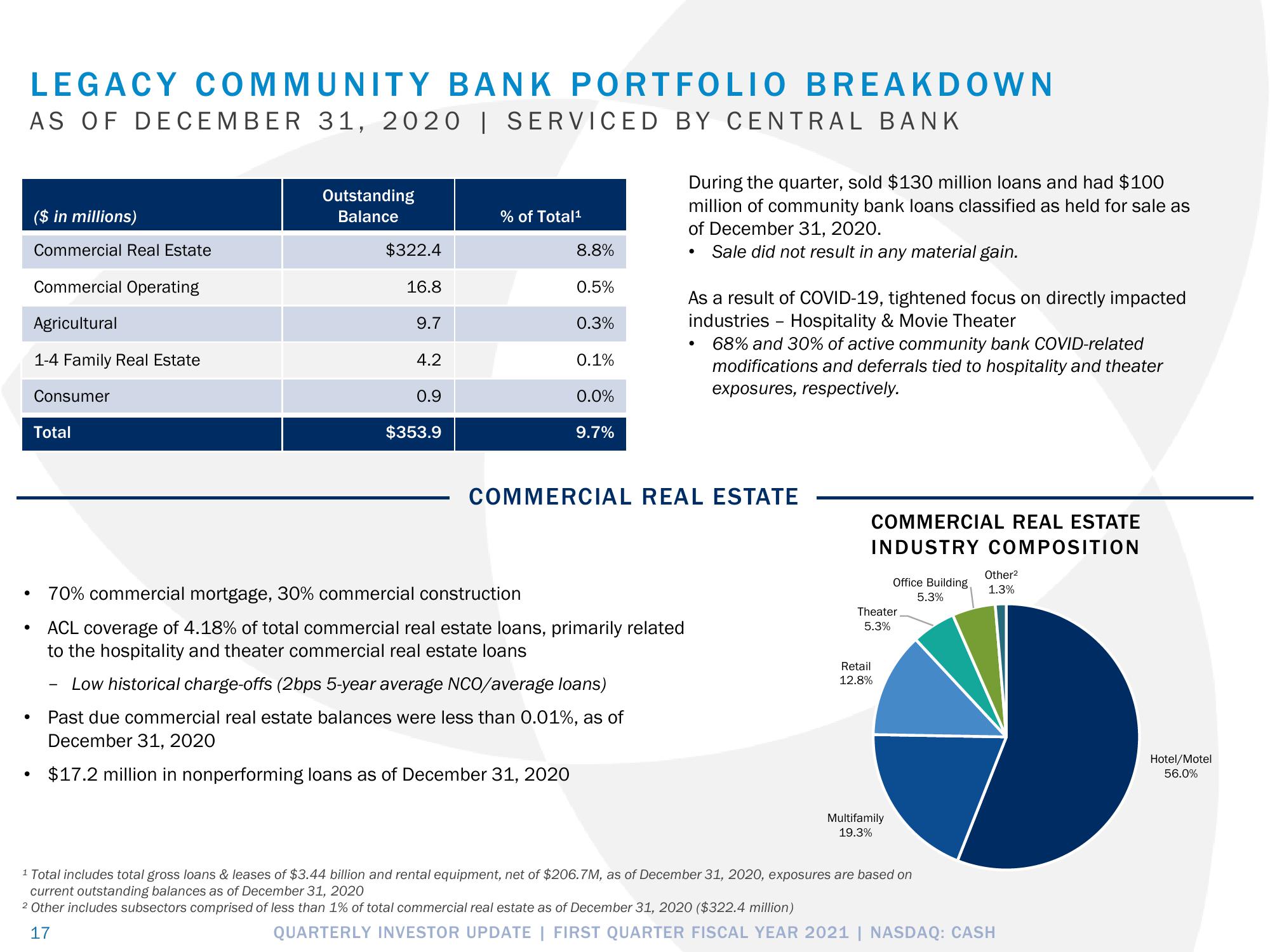

($ in millions)

Commercial Real Estate

Commercial Operating

Agricultural

1-4 Family Real Estate

Consumer

Total

Outstanding

Balance

$322.4

16.8

9.7

4.2

0.9

$353.9

% of Total¹

8.8%

0.5%

0.3%

0.1%

0.0%

9.7%

During the quarter, sold $130 million loans and had $100

million of community bank loans classified as held for sale as

of December 31, 2020.

Sale did not result in any material gain.

70% commercial mortgage, 30% commercial construction

ACL coverage of 4.18% of total commercial real estate loans, primarily related

to the hospitality and theater commercial real estate loans

Low historical charge-offs (2bps 5-year average NCO/average loans)

Past due commercial real estate balances were less than 0.01%, as of

December 31, 2020

$17.2 million in nonperforming loans as of December 31, 2020

As a result of COVID-19, tightened focus on directly impacted

industries - Hospitality & Movie Theater

68% and 30% of active community bank COVID-related

modifications and deferrals tied to hospitality and theater

exposures, respectively.

COMMERCIAL REAL ESTATE

COMMERCIAL REAL ESTATE

INDUSTRY COMPOSITION

Theater

5.3%

Retail

12.8%

Office Building,

5.3%

Multifamily

19.3%

1 Total includes total gross loans & leases of $3.44 billion and rental equipment, net of $206.7M, as of December 31, 2020, exposures are based on

current outstanding balances as of December 31, 2020

2 Other includes subsectors comprised of less than 1% of total commercial real estate as of December 31, 2020 ($322.4 million)

17

Other²

1.3%

QUARTERLY INVESTOR UPDATE | FIRST QUARTER FISCAL YEAR 2021 | NASDAQ: CASH

Hotel/Motel

56.0%View entire presentation