AT&T Investor Day Presentation Deck

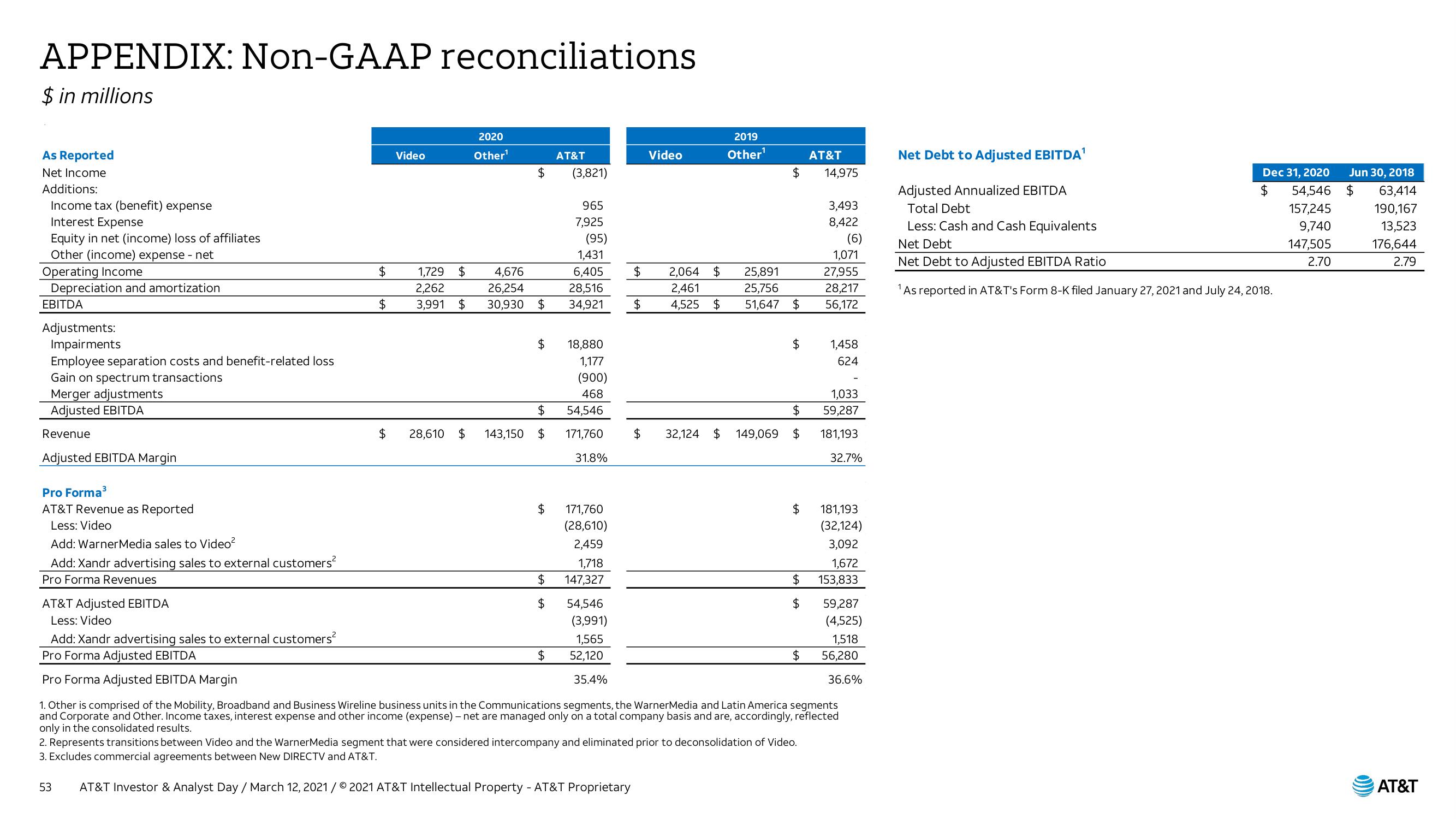

APPENDIX: Non-GAAP reconciliations

$ in millions

As Reported

Net Income

Additions:

Income tax (benefit) expense

Interest Expense

Equity in net (income) loss of affiliates

Other (income) expense - net

Operating Income

Depreciation and amortization

EBITDA

Adjustments:

Impairments

Employee separation costs and benefit-related loss

Gain on spectrum transactions

Merger adjustments

Adjusted EBITDA

Revenue

Adjusted EBITDA Margin

Pro Forma³

AT&T Revenue as Reported

Less: Video

Add: Warner Media sales to Video²

Add: Xandr advertising sales to external customers²

Pro Forma Revenues

AT&T Adjusted EBITDA

Less: Video

Add: Xandr advertising sales to external customers²

Pro Forma Adjusted EBITDA

Pro Forma Adjusted EBITDA Margin

$

$

Video

1,729 $

2,262

3,991 $

2020

Other¹

$

4,676

26,254

30,930 $

$

$

$ 28,610 $ 143,150 $

$

$

$

$

AT&T

(3,821)

965

7,925

(95)

1,431

6,405

28,516

34,921

18,880

1,177

(900)

468

54,546

171,760

31.8%

171,760

(28,610)

2,459

1,718

147,327

54,546

(3,991)

1,565

52,120

35.4%

$ 2,064 $

2,461

4,525 $

$

Video

$

32,124 $

2019

Other¹

AT&T

$ 14,975

25,891

25,756

51,647 $

$

$

149,069 $

$

$

$

$

3,493

8,422

2. Represents transitions between Video and the WarnerMedia segment that were considered intercompany and eliminated prior to deconsolidation of Video.

3. Excludes commercial agreements between New DIRECTV and AT&T.

53 AT&T Investor & Analyst Day / March 12, 2021 / 2021 AT&T Intellectual Property - AT&T Proprietary

(6)

1,071

27,955

28,217

56,172

1,458

624

1,033

59,287

181,193

32.7%

181,193

(32,124)

3,092

1,672

153,833

1. Other is comprised of the Mobility, Broadband and Business Wireline business units in the Communications segments, the WarnerMedia and Latin America segments

and Corporate and Other. Income taxes, interest expense and other income (expense) - net are managed only on a total company basis and are, accordingly, reflected

only in the consolidated results.

59,287

(4,525)

1,518

56,280

36.6%

Net Debt to Adjusted EBITDA¹

Adjusted Annualized EBITDA

Total Debt

Less: Cash and Cash Equivalents

$

Dec 31, 2020

54,546

157,245

9,740

147,505

2.70

Net Debt

Net Debt to Adjusted EBITDA Ratio

1 As reported in AT&T's Form 8-K filed January 27, 2021 and July 24, 2018.

Jun 30, 2018

$ 63,414

190,167

13,523

176,644

2.79

AT&TView entire presentation