HSBC Results Presentation Deck

Capital adequacy

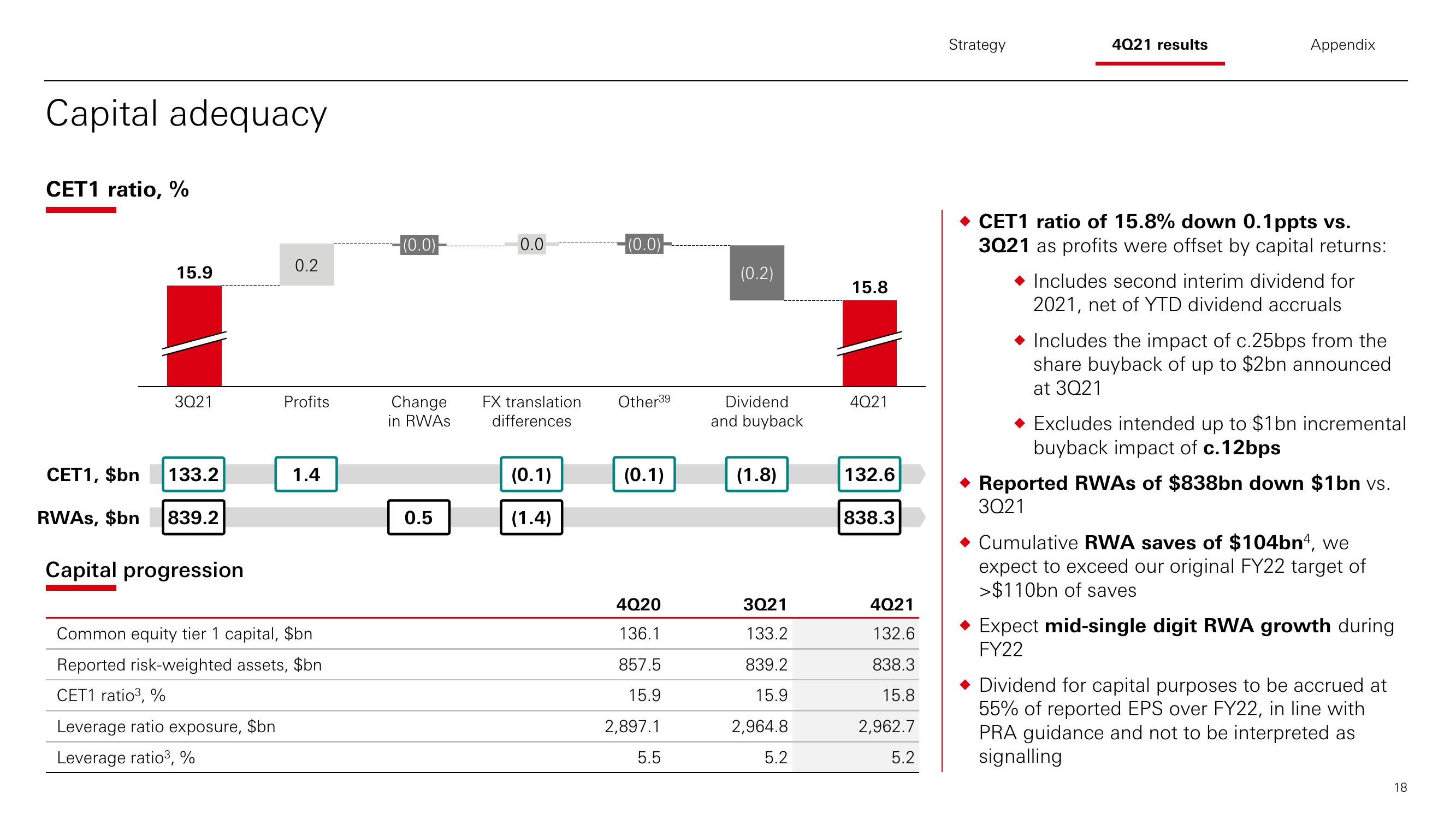

CET1 ratio, %

15.9

3Q21

CET1, $bn 133.2

RWAS, $bn 839.2

Capital progression

0.2

Profits

1.4

Common equity tier 1 capital, $bn

Reported risk-weighted assets, $bn

CET1 ratio³, %

Leverage ratio exposure, $bn

Leverage ratio³, %

(0.0)

0.0

Change FX translation

in RWAS differences

0.5

(0.1)

(1.4)

(0.0)

Other 39

(0.1)

4Q20

136.1

857.5

15.9

2,897.1

5.5

(0.2)

Dividend

and buyback

(1.8)

3Q21

133.2

839.2

15.9

2,964.8

5.2

15.8

4Q21

132.6

838.3

4Q21

132.6

838.3

15.8

2,962.7

5.2

Strategy

4021 results

Appendix

CET1 ratio of 15.8% down 0.1 ppts vs.

3021 as profits were offset by capital returns:

Includes second interim dividend for

2021, net of YTD dividend accruals

Includes the impact of c.25bps from the

share buyback of up to $2bn announced

at 3021

Excludes intended up to $1bn incremental

buyback impact of c.12bps

Reported RWAs of $838bn down $1bn vs.

3Q21

Cumulative RWA saves of $104bn4, we

expect to exceed our original FY22 target of

>$110bn of saves

Expect mid-single digit RWA growth during

FY22

Dividend for capital purposes to be accrued at

55% of reported EPS over FY22, in line with

PRA guidance and not to be interpreted as

signalling

18View entire presentation