Silicon Valley Bank Results Presentation Deck

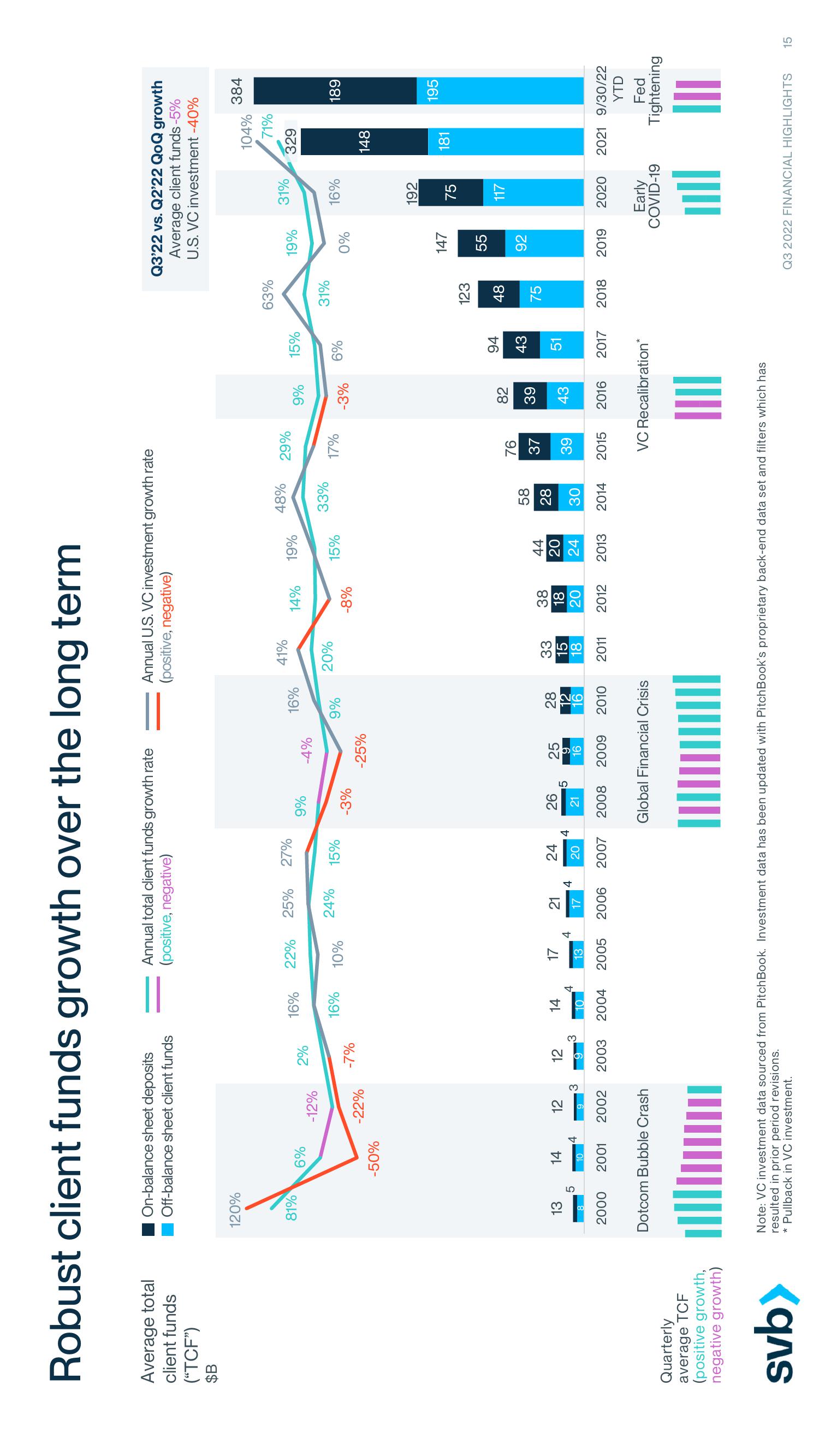

Robust client funds growth over the long term

On-balance sheet deposits

Off-balance sheet client funds

Annual total client funds growth rate

(positive, negative)

Average total

client funds

("TCF")

$B

Quarterly

average TCF

(positive growth,

negative growth)

svb>

120%

81%

13

5

2000

6%

-50%

14

10

-12%

4

-22%

12

3

12

9

10

2001 2002 2003 2004

2%

Dotcom Bubble Crash

-7%

16%

3

16%

14

22%

10%

25%

24%

17

4

13

2005 2006

21

17

4

27%

15%

24

20

2007

4

9%

-3%

26

21

-4%

5

-25%

28

12

16

2008 2009 2010

16%

25

9

16

9%

Annual U.S. VC investment growth rate

(positive, negative)

Global Financial Crisis

41%

20%

33

15

18

2011

14% 19%

-8%

38

18

20

2012

15%

44

20

24

2013

48%

33%

58

28

30

2014

29%

17%

76

37

39

9%

-3%

82

39

43

2015 2016

15%

Note: VC investment data sourced from Pitch Book. Investment data has been updated with PitchBook's proprietary back-end data set and filters which has

resulted in prior period revisions.

* Pullback in VC investment.

6%

94

43

51

VC Recalibration*

63%

31%

123

48

75

Q3'22 vs. Q2'22 QoQ growth

Average client funds -5%

U.S. VC investment -40%

19%

0%

147

55

92

2017 2018 2019

31%

16%

192

75

117

104%

71%

Early

COVID-19

329

148

181

384

189

195

2020 2021 9/30/22

YTD

Fed

Tightening

Q3 2022 FINANCIAL HIGHLIGHTS 15View entire presentation