Maersk Results Presentation Deck

A.P. Moller Maersk Group

- Interim Report 02 2015

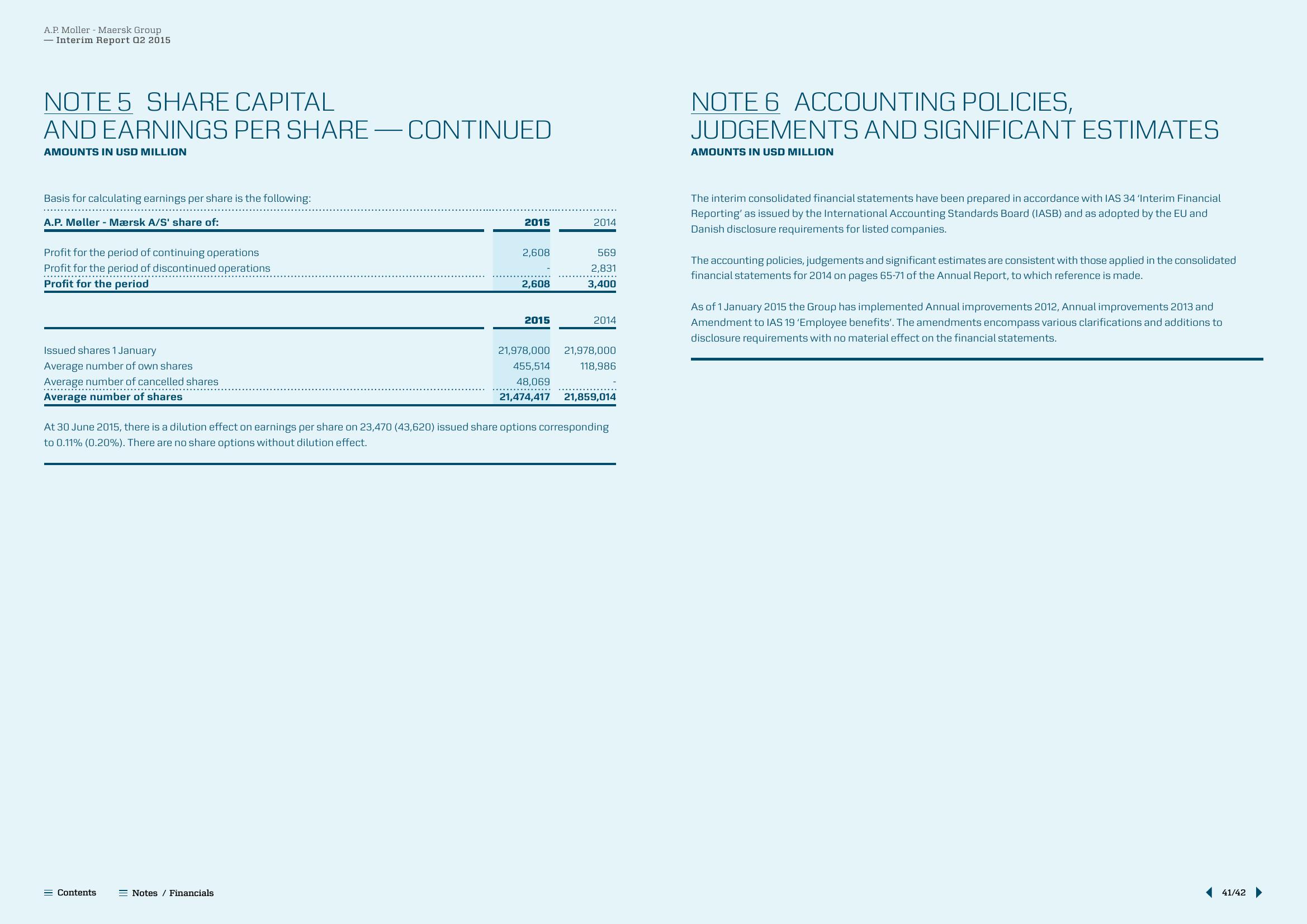

NOTE 5 SHARE CAPITAL

AND EARNINGS PER SHARE - CONTINUED

AMOUNTS IN USD MILLION

Basis for calculating earnings per share is the following:

A.P. Møller-Mærsk A/S' share of:

Profit for the period of continuing operations

Profit for the period of discontinued operations

Profit for the period

Issued shares 1 January

Average number of own shares.

Average number of cancelled shares

Average number of shares

= Contents

2015

Notes / Financials

2,608

2,608

2015

2014

569

2,831

3,400

2014

At 30 June 2015, there is a dilution effect on earnings per share on 23,470 (43,620) issued share options corresponding

to 0.11% (0.20%). There are no share options without dilution effect.

21,978,000 21,978,000

455,514

118,986

48,069

21,474,417 21,859,014

NOTE 6 ACCOUNTING POLICIES,

JUDGEMENTS AND SIGNIFICANT ESTIMATES

AMOUNTS IN USD MILLION

The interim consolidated financial statements have been prepared in accordance with IAS 34 'Interim Financial

Reporting' as issued by the International Accounting Standards Board (IASB) and as adopted by the EU and

Danish disclosure requirements for listed companies.

The accounting policies, judgements and significant estimates are consistent with those applied in the consolidated

financial statements for 2014 on pages 65-71 of the Annual Report, to which reference is made.

As of 1 January 2015 the Group has implemented Annual improvements 2012, Annual improvements 2013 and

Amendment to IAS 19 'Employee benefits'. The amendments encompass various clarifications and additions to

disclosure requirements with no material effect on the financial statements.

41/42 ▶View entire presentation