jetBlue Results Presentation Deck

Operating expense, operating

income (loss), adjusted operating

margin, pre-tax income (loss),

adjusted pre-tax margin, net

income (loss) and earnings (loss)

per share, excluding special

items and net gain (loss) on

investments (continued)

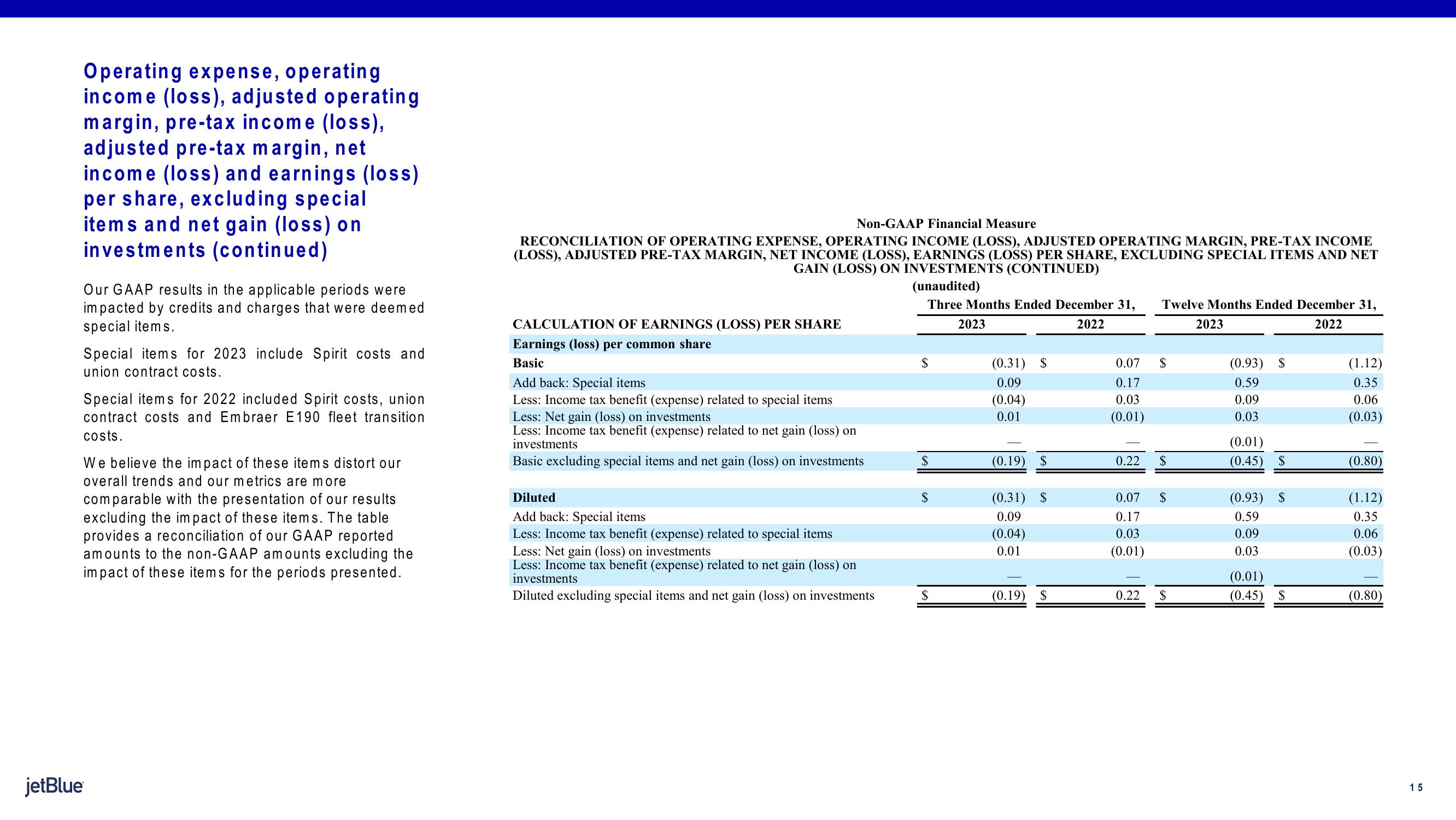

Our GAAP results in the applicable periods were

impacted by credits and charges that were deemed

special items.

Special items for 2023 include Spirit costs and

union contract costs.

jetBlue

Special items for 2022 included Spirit costs, union

contract costs and Embraer E190 fleet transition

costs.

We believe the impact of these items distort our

overall trends and our metrics are more

comparable with the presentation of our results

excluding the impact of these items. The table

provides a reconciliation of our GAAP reported

amounts to the non-GAAP amounts excluding the

impact of these items for the periods presented.

Non-GAAP Financial Measure

RECONCILIATION OF OPERATING EXPENSE, OPERATING INCOME (LOSS), ADJUSTED OPERATING MARGIN, PRE-TAX INCOME

(LOSS), ADJUSTED PRE-TAX MARGIN, NET INCOME (LOSS), EARNINGS (LOSS) PER SHARE, EXCLUDING SPECIAL ITEMS AND NET

GAIN (LOSS) ON INVESTMENTS (CONTINUED)

(unaudited)

Three Months Ended December 31,

2023

2022

CALCULATION OF EARNINGS (LOSS) PER SHARE

Earnings (loss) per common share

Basic

Add back: Special items

Less: Income tax benefit (expense) related to special items

Less: Net gain (loss) on investments

Less: Income tax benefit (expense) related to net gain (loss) on

investments

Basic excluding special items and net gain (loss) on investments

Diluted

Add back: Special items

Less: Income tax benefit (expense) related to special items

Less: Net gain (loss) on investments

Less: Income tax benefit (expense) related to net gain (loss) on

investments

Diluted excluding special items and net gain (loss) on investments

$

$

$

$

(0.31) $

0.09

(0.04)

0.01

(0.19) $

(0.31) $

0.09

(0.04)

0.01

(0.19) $

0.07

0.17

0.03

(0.01)

0.22

0.07

0.17

0.03

(0.01)

0.22

Twelve Months Ended December 31,

2022

$

$

$

$

2023

(0.93) $

0.59

0.09

0.03

(0.01)

(0.45) $

(0.93) $

0.59

0.09

0.03

(0.01)

(0.45)

$

(1.12)

0.35

0.06

(0.03)

(0.80)

(1.12)

0.35

0.06

(0.03)

(0.80)

15View entire presentation