Zegna Results Presentation Deck

Non-IFRS Financial Measures

Ermenegildo Ermenegildo Zegna Group

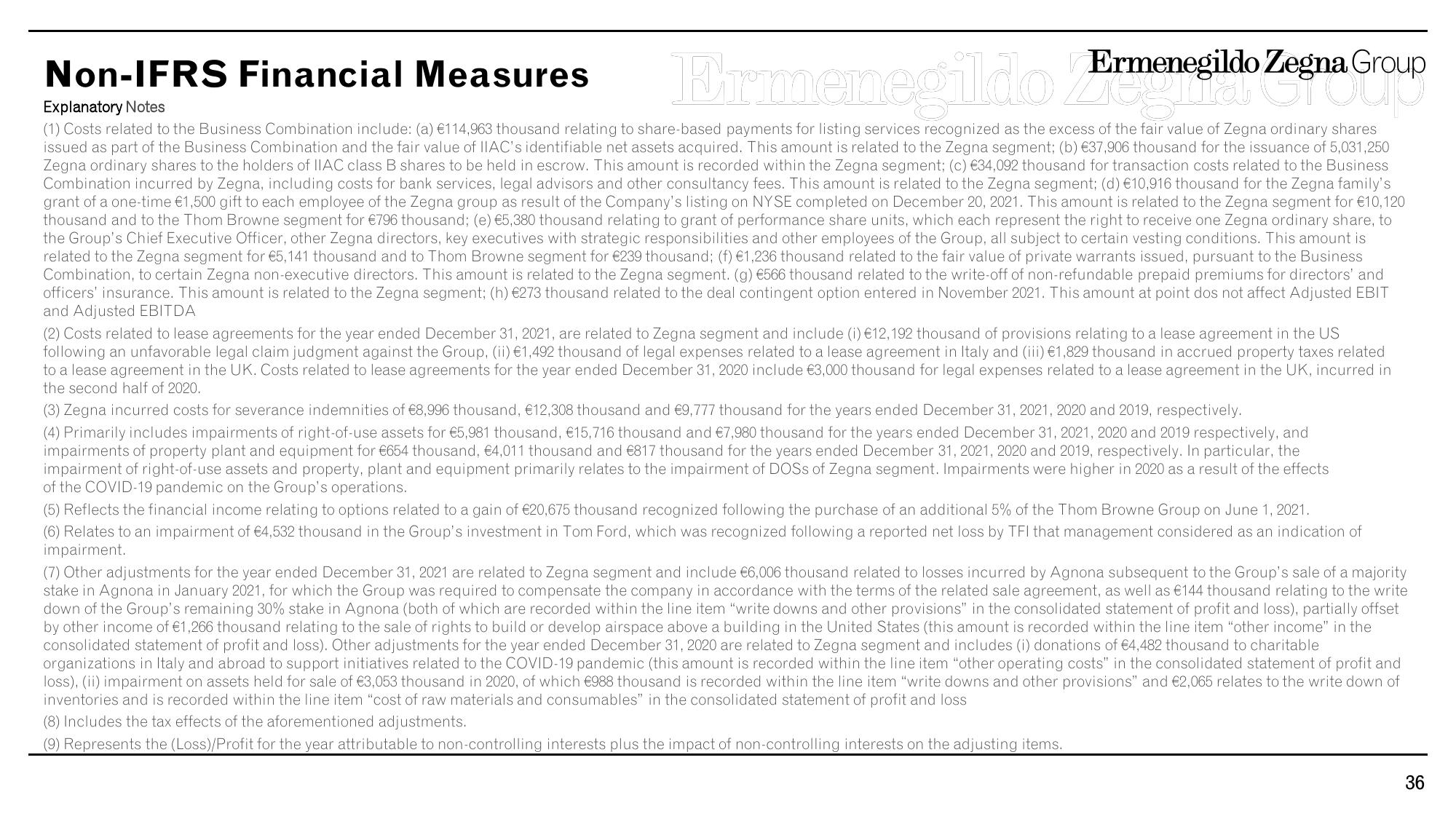

Explanatory Notes

(1) Costs related to the Business Combination include: (a) €114,963 thousand relating to share-based payments for listing services recognized as the excess of the fair value of Zegna ordinary shares

issued as part of the Business Combination and the fair value of IIAC's identifiable net assets acquired. This amount is related to the Zegna segment; (b) €37,906 thousand for the issuance of 5,031,250

Zegna ordinary shares to the holders of IIAC class B shares to be held in escrow. This amount is recorded within the Zegna segment; (c) €34,092 thousand for transaction costs related to the Business

Combination incurred by Zegna, including costs for bank services, legal advisors and other consultancy fees. This amount is related to the Zegna segment; (d) €10,916 thousand for the Zegna family's

grant of a one-time €1,500 gift to each employee of the Zegna group as result of the Company's listing on NYSE completed on December 20, 2021. This amount is related to the Zegna segment for €10,120

thousand and to the Thom Browne segment for €796 thousand; (e) €5,380 thousand relating to grant of performance share units, which each represent the right to receive one Zegna ordinary share, to

the Group's Chief Executive Officer, other Zegna directors, key executives with strategic responsibilities and other employees of the Group, all subject to certain vesting conditions. This amount is

related to the Zegna segment for €5,141 thousand and to Thom Browne segment for €239 thousand; (f) €1,236 thousand related to the fair value of private warrants issued, pursuant to the Business

Combination, to certain Zegna non-executive directors. This amount is related to the Zegna segment. (g) €566 thousand related to the write-off of non-refundable prepaid premiums for directors' and

officers' insurance. This amount is related to the Zegna segment; (h) €273 thousand related to the deal contingent option entered in November 2021. This amount at point dos not affect Adjusted EBIT

and Adjusted EBITDA

(2) Costs related to lease agreements for the year ended December 31, 2021, are related to Zegna segment and include (i) €12,192 thousand of provisions relating to a lease agreement in the US

following an unfavorable legal claim judgment against the Group, (ii) €1,492 thousand of legal expenses related to a lease agreement in Italy and (iii) €1,829 thousand in accrued property taxes related

to a lease agreement in the UK. Costs related to lease agreements for the year ended December 31, 2020 include €3,000 thousand for legal expenses related to a lease agreement in the UK, incurred in

the second half of 2020.

(3) Zegna incurred costs for severance indemnities of €8,996 thousand, €12,308 thousand and €9,777 thousand for the years ended December 31, 2021, 2020 and 2019, respectively.

(4) Primarily includes impairments of right-of-use assets for €5,981 thousand, €15,716 thousand and €7,980 thousand for the years ended December 31, 2021, 2020 and 2019 respectively, and

impairments of property plant and equipment for €654 thousand, €4,011 thousand and €817 thousand for the years ended December 31, 2021, 2020 and 2019, respectively. In particular, the

impairment of right-of-use assets and property, plant and equipment primarily relates to the impairment of DOSs of Zegna segment. Impairments were higher in 2020 as a result of the effects

of the COVID-19 pandemic on the Group's operations.

(5) Reflects the financial income relating to options related to a gain of €20,675 thousand recognized following the purchase of an additional 5% of the Thom Browne Group on June 1, 2021.

(6) Relates to an impairment of €4,532 thousand in the Group's investment in Tom Ford, which was recognized following a reported net loss by TFI that management considered as an indication of

impairment.

(7) Other adjustments for the year ended December 31, 2021 are related to Zegna segment and include €6,006 thousand related to losses incurred by Agnona subsequent to the Group's sale of a majority

stake in Agnona in January 2021, for which the Group was required to compensate the company in accordance with the terms of the related sale agreement, as well as €144 thousand relating to the write

down of the Group's remaining 30% stake in Agnona (both of which are recorded within the line item "write downs and other provisions" in the consolidated statement of profit and loss), partially offset

by other income of €1,266 thousand relating to the sale of rights to build or develop airspace above a building in the United States (this amount is recorded within the line item "other income" in the

consolidated statement of profit and loss). Other adjustments for the year ended December 31, 2020 are related to Zegna segment and includes (i) donations of €4,482 thousand to charitable

organizations in Italy and abroad to support initiatives related to the COVID-19 pandemic (this amount is recorded within the line item "other operating costs" in the consolidated statement of profit and

loss), (ii) impairment on assets held for sale of €3,053 thousand in 2020, of which €988 thousand is recorded within the line item "write downs and other provisions" and €2,065 relates to the write down of

inventories and is recorded within the line item "cost of raw materials and consumables" in the consolidated statement of profit and loss

(8) Includes the tax effects of the aforementioned adjustments.

(9) Represents the (Loss)/Profit for the year attributable to non-controlling interests plus the impact of non-controlling interests on the adjusting items.

36View entire presentation