Silicon Valley Bank Results Presentation Deck

Stable credit

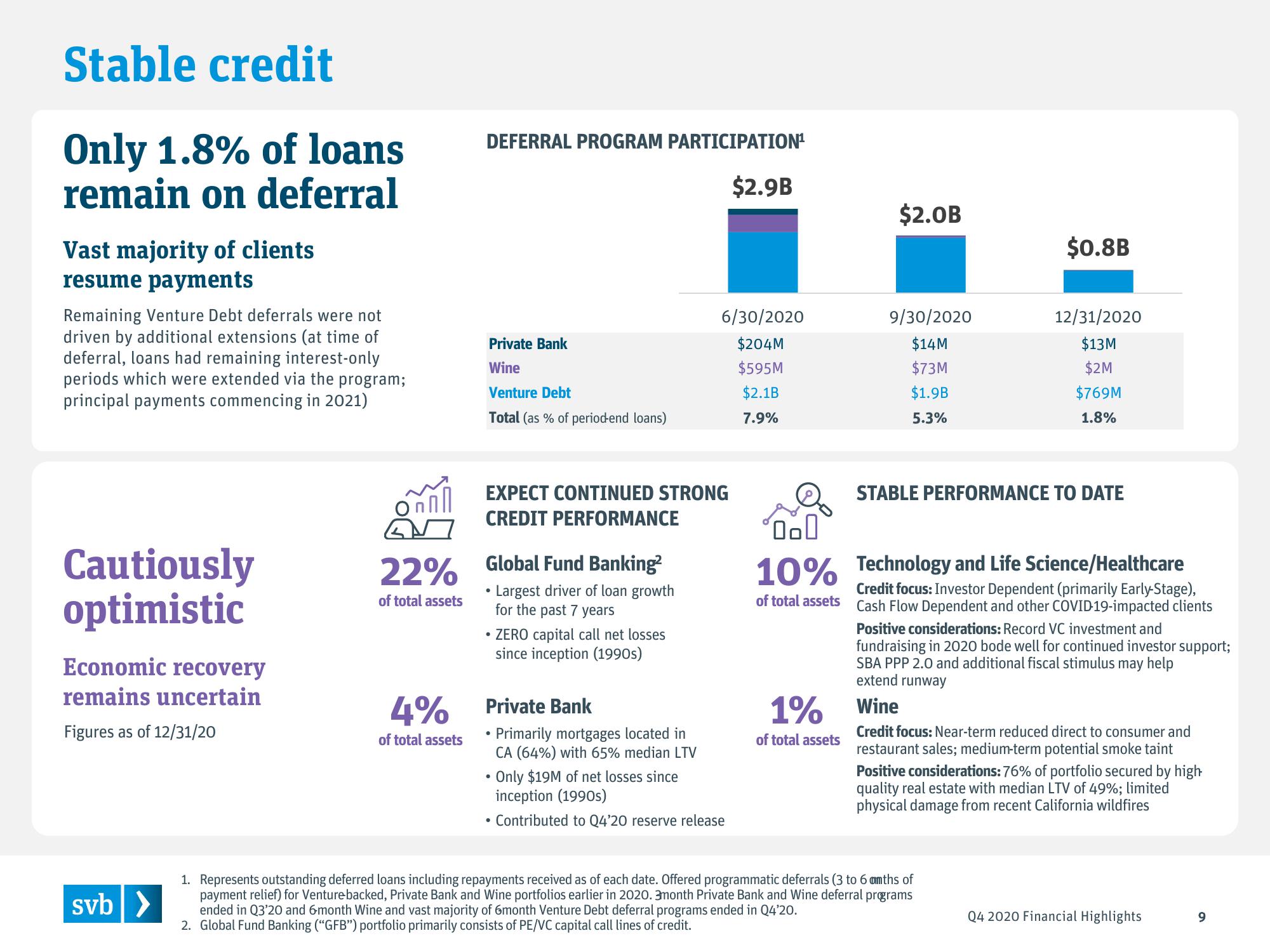

Only 1.8% of loans

remain on deferral

Vast majority of clients

resume payments

Remaining Venture Debt deferrals were not

driven by additional extensions (at time of

deferral, loans had remaining interest-only

periods which were extended via the program;

principal payments commencing in 2021)

Cautiously

optimistic

Economic recovery

remains uncertain

Figures as of 12/31/20

svb >

O

DEFERRAL PROGRAM PARTICIPATION¹

4%

of total assets

Private Bank

Wine

Venture Debt

Total (as % of period-end loans)

22% Global Fund Banking²

of total assets

• Largest driver of loan growth

for the past 7 years

EXPECT CONTINUED STRONG

CREDIT PERFORMANCE

• ZERO capital call net losses

since inception (1990s)

Private Bank

• Primarily mortgages located in

CA (64%) with 65% median LTV

6/30/2020

$204M

$595M

$2.1B

7.9%

$2.9B

• Only $19M of net losses since

inception (1990s)

• Contributed to Q4'20 reserve release

$2.0B

1%

of total assets

9/30/2020

$14M

$73M

$1.9B

5.3%

$0.8B

12/31/2020

$13M

$2M

$769M

1.8%

STABLE PERFORMANCE TO DATE

000

10% Technology and Life Science/Healthcare

Credit focus: Investor Dependent (primarily Early-Stage),

of total assets Cash Flow Dependent and other COVID-19-impacted clients

1. Represents outstanding deferred loans including repayments received as of each date. Offered programmatic deferrals (3 to 6 amths of

payment relief) for Venture backed, Private Bank and Wine portfolios earlier in 2020. 3month Private Bank and Wine deferral programs

ended in Q3'20 and 6-month Wine and vast majority of 6month Venture Debt deferral programs ended in Q4'20.

2. Global Fund Banking ("GFB") portfolio primarily consists of PE/VC capital call lines of credit.

Positive considerations: Record VC investment and

fundraising in 2020 bode well for continued investor support;

SBA PPP 2.0 and additional fiscal stimulus may help

extend runway

Wine

Credit focus: Near-term reduced direct to consumer and

restaurant sales; medium-term potential smoke taint

Positive considerations: 76% of portfolio secured by high

quality real estate with median LTV of 49%; limited

physical damage from recent California wildfires

Q4 2020 Financial Highlights

9View entire presentation