Grove SPAC Presentation Deck

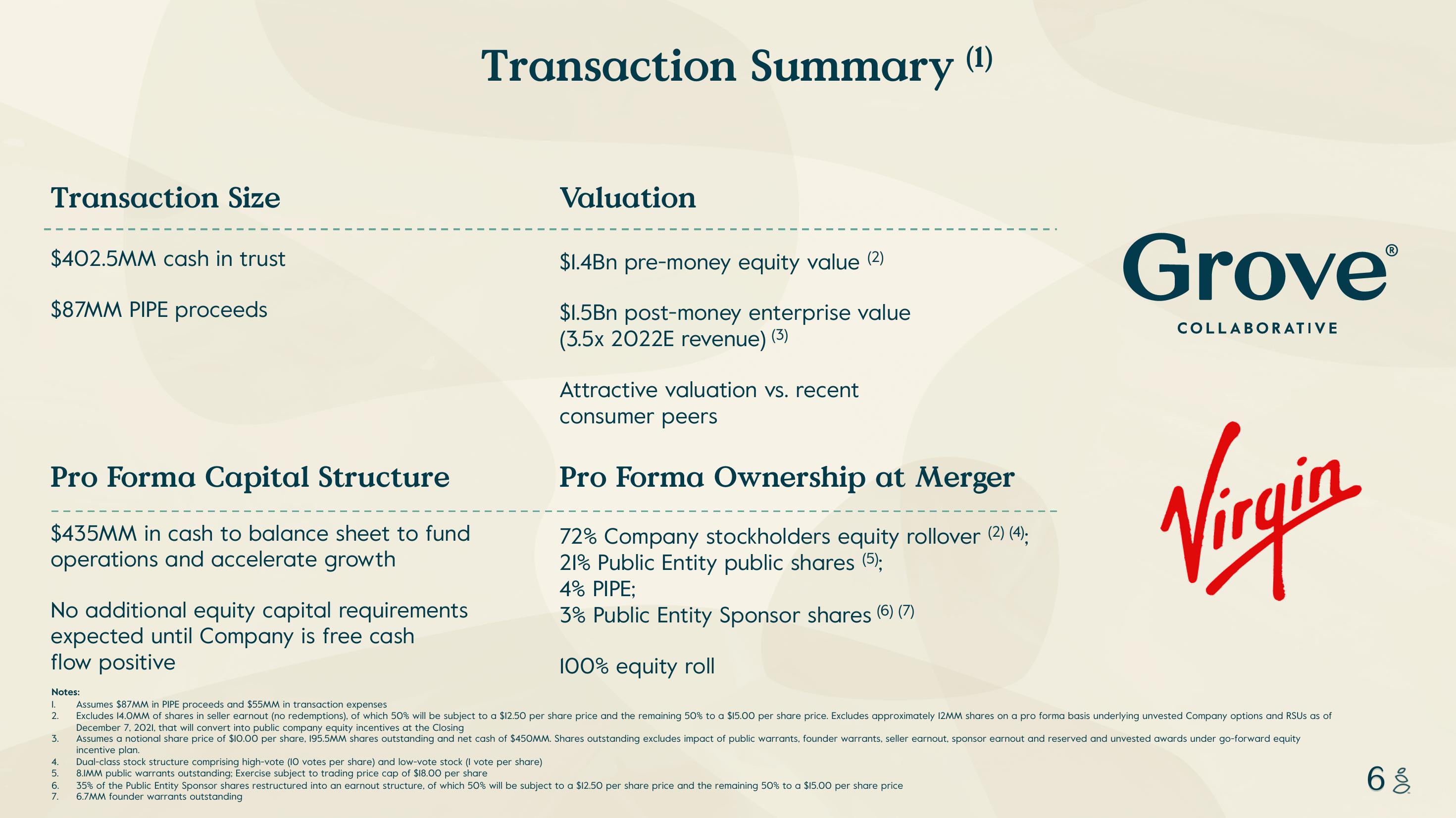

Transaction Size

$402.5MM cash in trust

$87MM PIPE proceeds

Pro Forma Capital Structure

$435MM in cash to balance sheet to fund

operations and accelerate growth

No additional equity capital requirements

expected until Company is free cash

flow positive

Notes:

I.

2.

Transaction Summary (¹)

4. Dual-class stock structure comprising high-vote (10 votes per share) and low-vote stock (I vote per share)

5. 8.IMM public warrants outstanding; Exercise subject to trading price cap of $18.00 per share

+567

Valuation

Pro Forma Ownership at Merger

72% Company stockholders equity rollover (2) (4);

21% Public Entity public shares (5);

4% PIPE:

3% Public Entity Sponsor shares (6) (7)

100% equity roll

Assumes $87MM in PIPE proceeds and $55MM in transaction expenses

Excludes 14.0MM of shares in seller earnout (no redemptions), of which 50% will be subject to a $12.50 per share price and the remaining 50% to a $15.00 per share price. Excludes approximately 12MM shares on a pro forma basis underlying unvested Company options and RSUS as of

December 7, 2021, that will convert into public company equity incentives at the Closing

3. Assumes a notional share price of $10.00 per share, 195.5MM shares outstanding and net cash of $450MM. Shares outstanding excludes impact of public warrants, founder warrants, seller earnout, sponsor earnout and reserved and unvested awards under go-forward equity

incentive plan.

6.

$1.4Bn pre-money equity value (2)

$1.5Bn post-money enterprise value

(3.5x 2022E revenue) (3)

Attractive valuation vs. recent

consumer peers

35% of the Public Entity Sponsor shares restructured into an earnout structure, of which 50% will be subject to a $12.50 per share price and the remaining 50% to a $15.00 per share price

7. 6.7MM founder warrants outstanding

Grove

COLLABORATIVE

Virgin

6 %View entire presentation