Zoominfo Results Presentation Deck

Q1 EARNINGS CALL > OVERVIEW

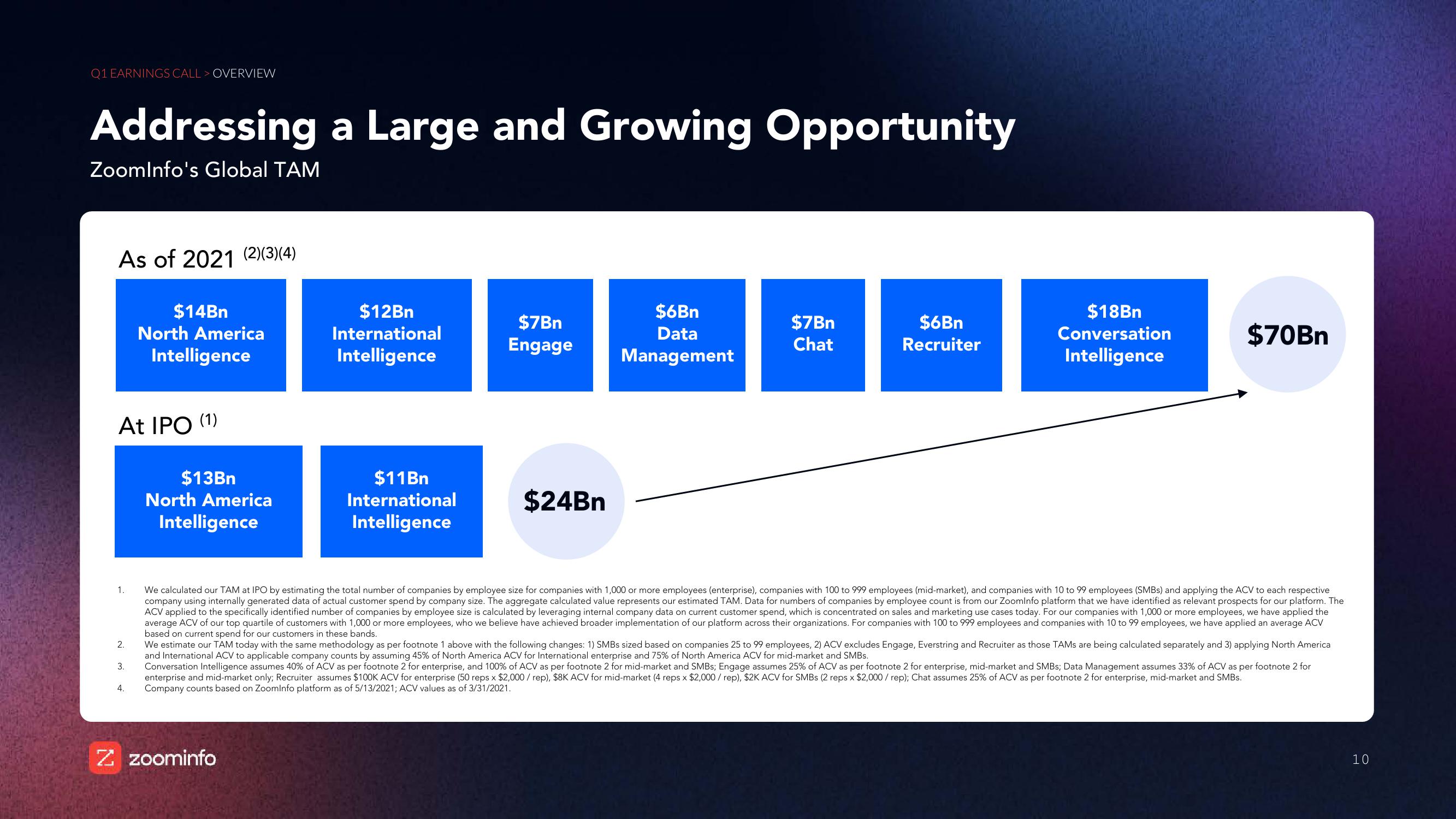

Addressing a Large and Growing Opportunity

ZoomInfo's Global TAM

As of 2021 (2)(3)(4)

At IPO (1)

1.

2.

3.

$14Bn

North America

Intelligence

4.

$13Bn

North America

Intelligence

$12Bn

International

Intelligence

$11Bn

International

Intelligence

Z zoominfo

$7Bn

Engage

$24Bn

$6Bn

Data

Management

$7Bn

Chat

$6Bn

Recruiter

$18Bn

Conversation

Intelligence

$70Bn

We calculated our TAM at IPO by estimating the total number of companies by employee size for companies with 1,000 or more employees (enterprise), companies with 100 to 999 employees (mid-market), and companies with 10 to 99 employees (SMBs) and applying the ACV to each respective

company using internally generated data of actual customer spend by company size. The aggregate calculated value represents our estimated TAM. Data for numbers of companies by employee count is from our ZoomInfo platform that we have identified as relevant prospects for our platform. The

ACV applied to the specifically identified number of companies by employee size is calculated by leveraging internal company data on current customer spend, which is concentrated on sales and marketing use cases today. For our companies with 1,000 or more employees, we have applied the

average ACV of our top quartile of customers with 1,000 or more employees, who we believe have achieved broader implementation of our platform across their organizations. For companies with 100 to 999 employees and companies with 10 to 99 employees, we have applied an average ACV

based on current spend for our customers in these bands.

We estimate our TAM today with the same methodology as per footnote 1 above with the following changes: 1) SMBs sized based on companies 25 to 99 employees, 2) ACV excludes Engage, Everstring and Recruiter as those TAMs are being calculated separately and 3) applying North America

and International ACV to applicable company counts by assuming 45% of North America ACV for International enterprise and 75% of North America ACV for mid-market and SMBs.

Conversation Intelligence assumes 40% of ACV as per footnote 2 for enterprise, and 100% of ACV as per footnote 2 for mid-market and SMBs; Engage assumes 25% of ACV as per footnote 2 for enterprise, mid-market and SMBs; Data Management assumes 33% of ACV as per footnote 2 for

enterprise and mid-market only; Recruiter assumes $100K ACV for enterprise (50 reps x $2,000/ rep), $8K ACV for mid-market (4 reps x $2,000/ rep), $2K ACV for SMBS (2 reps x $2,000/ rep); Chat assumes 25% of ACV as per footnote 2 for enterprise, mid-market and SMBs.

Company counts based on ZoomInfo platform as of 5/13/2021; ACV values as of 3/31/2021.

10View entire presentation