VinFast Investor Presentation Deck

V

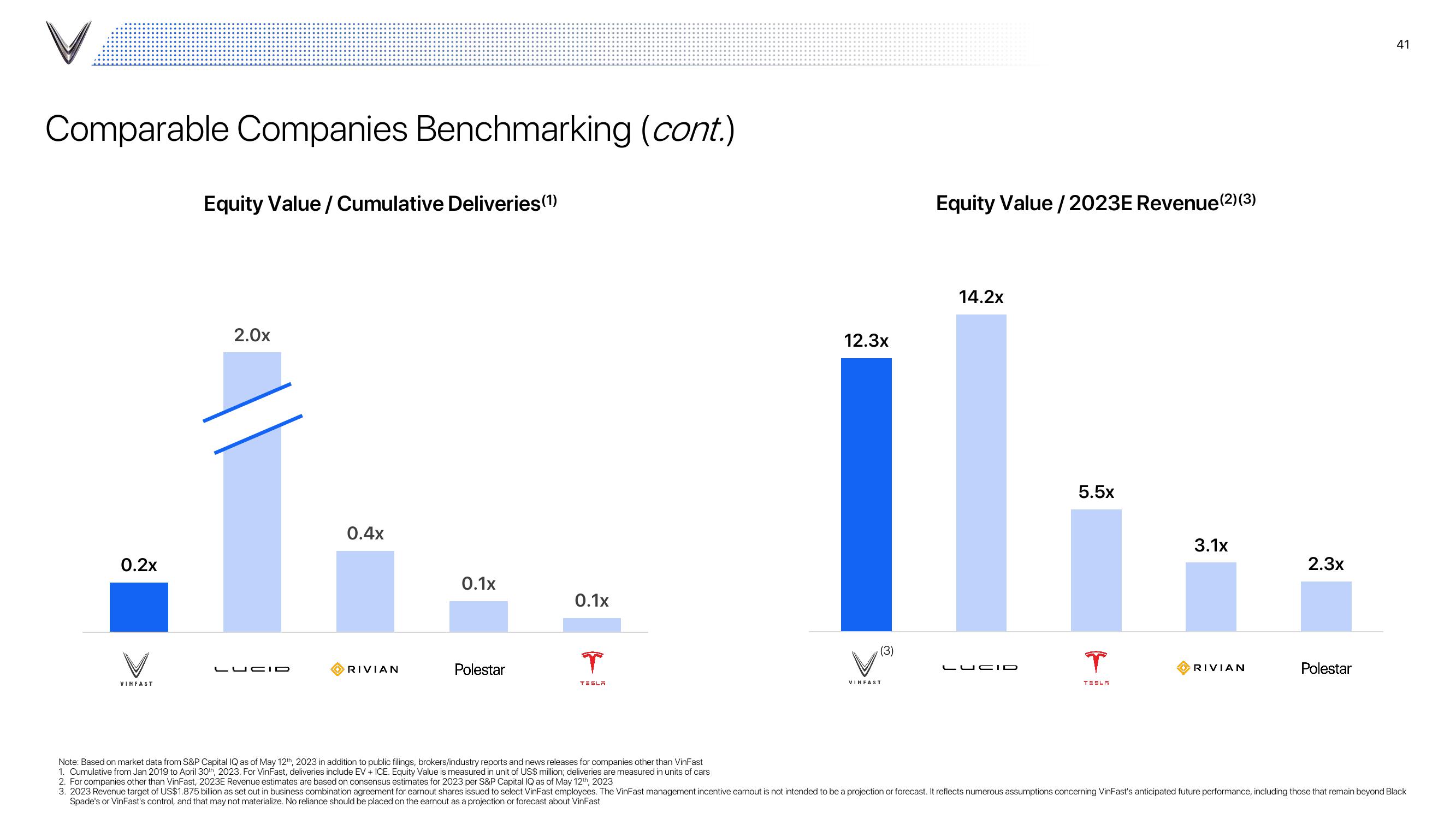

Comparable Companies Benchmarking (cont.)

0.2x

VINFAST

Equity Value / Cumulative Deliveries (1)

2.0x

LUCID

0.4x

RIVIAN

0.1x

Polestar

0.1x

T

TESLA

12.3x

1

(3)

Equity Value/2023E Revenue (2) (3)

VINFAST

14.2x

LUCID

5.5x

T

TESLA

3.1x

RIVIAN

2.3x

Polestar

41

Note: Based on market data from S&P Capital IQ as of May 12th, 2023 in addition to public filings, brokers/industry reports and news releases for companies other than VinFast

1. Cumulative from Jan 2019 to April 30th, 2023. For VinFast, deliveries include EV + ICE. Equity Value is measured in unit of US$ million; deliveries are measured in units of cars

2. For companies other than VinFast, 2023E Revenue estimates are based on consensus estimates for 2023 per S&P Capital IQ as of May 12th, 2023

3. 2023 Revenue target of US$1.875 billion as set out in business combination agreement for earnout shares issued to select VinFast employees. The VinFast management incentive earnout is not intended to be a projection or forecast. It reflects numerous assumptions concerning VinFast's anticipated future performance, including those that remain beyond Black

Spade's or VinFast's control, and that may not materialize. No reliance should be placed on the earnout as a projection or forecast about VinFastView entire presentation